The encryption market decreased on February 1 after targeting China, Mexico and Canada with long -term imported taxes that were threatened long -term. Bitcoin prices fell by 5 %, spreading to Altcoins.

On February 1, the United States imposed 25 % of the imports from Canada and Mexico and 10 % to Chinese products, further complicing the current trade war.

As a result, Bitcoin (BTC) has experienced a significant decrease in the sale of the entire market over the past 24 hours ending on February 3. Cryptocurrency decreased by more than 5 %, reaching the lowest price of $ 91,200 before rebounding at this time.

Despite this recovery, the BTC has been about 13 % below the highest $ 109,000 in history, and the transaction volume has increased by more than 200 %, suggesting considerable sales pressure or market panic.

In addition, the overall global codemic market capitalization decreased by nearly 12 % during the same period, and settled to $ 3.15 trillion.

It is noteworthy that Bitcoin and other altcoins have risen significantly following President Donald Trump's inauguration ceremony on January 20. However, since its peak, recent developments, including new tariff policies, have contributed to dramatic decreases in market emotions and asset value.

Considering Bitcoin's recent price crash, Altcoins had a cascade effect. In the past 24 hours, Etherneum (ETH) was nearly 20 %, Ripple (XRP) was 22 %, SOLANA (SOL) decreased by more than 15 %.

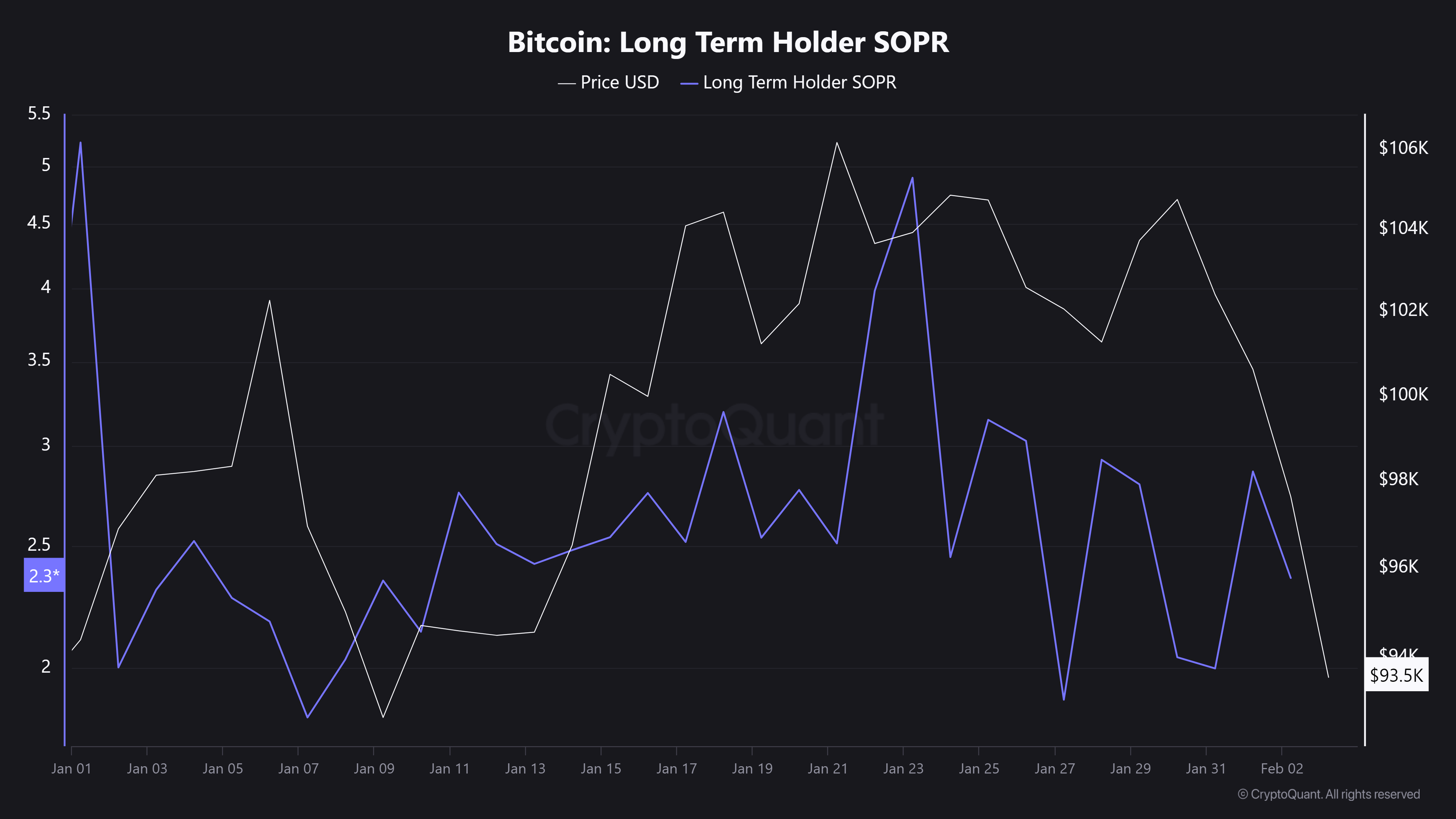

As the price decline, the rise in transactions often indicates strong sales pressure or market panic because more traders broadcast assets. This pattern suggests that Bitcoin: Long -term holder SOPR charts, which are sold at a lower profit than the purchase price or at a lower profit than the year. I am.

Such actions often show surrender among long -term holders. This is a common phenomenon in the trends and corrections of the bear market. Experts, including BitMex's CEO Arthur Hayes, have even warned that the “financial crisis” could be on the horizon.