Important points

- The SEC has its first deadline to rule on Grayscale's proposal to convert Solana Trust into an ETF.

- Several companies, including VanEck and Bitwise, are awaiting an SEC decision on their Solana ETF proposal.

Share this article

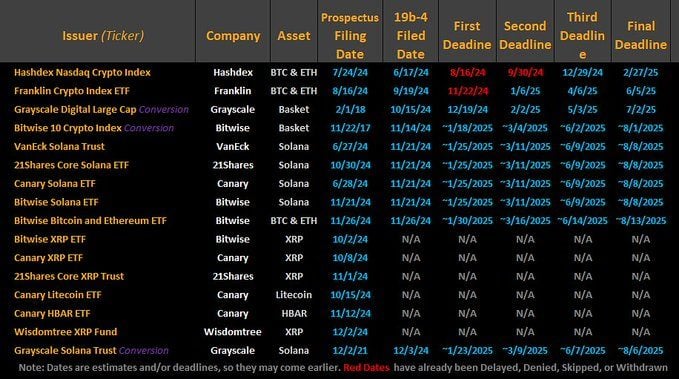

Today marks the first deadline for the U.S. SEC to issue a decision on Grayscale's application to convert Solana Trust (GSOL) into an ETF. The Solana ETF, proposed by VanEck, 21Shares, Canary Capital and Bitwise, is looking forward to a regulatory decision on January 25th.

On December 4, NYSE Arca proposed listing GSOL stock as the Spot Solana ETP. The trust, which was established in April 2023, had 7,221,835 shares outstanding as of January 21.

The deadline comes after Gary Gensler steps down as SEC chairman. Under Gensler, the SEC's Enforcement Division has filed numerous lawsuits against crypto companies, including cases targeting Binance and Coinbase, and the regulator has filed numerous lawsuits against crypto companies, including those targeting Binance and Coinbase. classified digital assets as securities.

The enforcement division's stance makes it difficult for other parts of the SEC to consider Solana's commodity ETFs, said James Seifert, a Bloomberg ETF analyst.

“Due to SEC precedent, the timeline could be extended to 2026,” Seifert said in a recent interview with Blockworks Macro. “The SEC's Enforcement Division refers to Solana as a security, which precludes other SEC divisions from analyzing Solana as a commodity ETF wrapper.”

Regulatory hurdles must be resolved for the Solana ETF to be approved. ETF analysts have suggested that the appointment of crypto advocate Paul Atkins as SEC chairman could facilitate this change.

However, Atkins' approval process is expected to take several months. The SEC currently operates with three commissioners, including Mark Ueda, who was appointed acting chairman following the recent leadership changes by President Trump, Hester Peirce, and Caroline Crenshaw.

A change in SEC leadership could change the regulatory landscape, according to Sol Strategies CEO Leah Wald, but some believe that Paul Atkins (if confirmed) and Solana There is speculation that it could have a positive impact on future decisions regarding ETF applications, but an immediate green light is unlikely.

“I think it will take a significant amount of time for the SOL ETF to be approved,” he said in an earlier statement, adding that it could take more than a year for regulators to understand Solana's unique properties. Ta.

Last July, VanEck and 21Shares filed 19b-4 forms with the SEC for their respective Solana ETFs, beginning the regulatory review process. Later that year, Canary Capital and Bitwise joined the race.

According to Matthew Sigel, head of digital asset research at VanEck, Solana works similarly to other digital instruments such as Bitcoin and Ethereum.

Solana and XRP are seen as strong candidates for the next wave of spot crypto ETFs, but continued legal issues have led ETF analysts to believe that Litecoin-related ETFs will be released under the Trump administration. It is “most likely” that it will be launched first.

The CFTC considers Litecoin to be a commodity in its lawsuit against KuCoin.

Share this article