Coinbase has developed the latest Crypto report. This study was conducted by IPSOS. Observe how the cipher and blockchain technology are found in Argentina, Kenya, the Philippines and Switzerland, and how they affect the lives of these countries.

In most parts, this study is based on a survey of 4,000 adults (no age rate specified) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of coin -based coins. The purpose of the country is to give a prospect of society that live under significantly different socio -economic conditions in various regions in the world (these countries belong to the same continent, and the Philippines is based in the archipelago. is).

The similarities in these countries are the government systems that rotate mainly in Christian population and Republican models. Nevertheless, the countries have surprisingly different areas, maps on maps, historical experiences, culture, language, climate, and economic conditions.

However, coin bass outlines the same similarity between Argentina, Kenya, the Philippines and Switzerland. According to the exchange team, the residents of these countries need to improve their local financial systems. More than that, the inhabitants of the polls are regarded as a tool that can enhance life from the viewpoint of financial wealth, and generally give freedom and independence from the viewpoint of financial wealth.

The economic state of these countries

The report begins with statistics in each country indicating that less than half of respondents believe that their current financial direction is better than the previous generation. However, fewer people believe that it will be worse than Argentina and the Philippine parents.

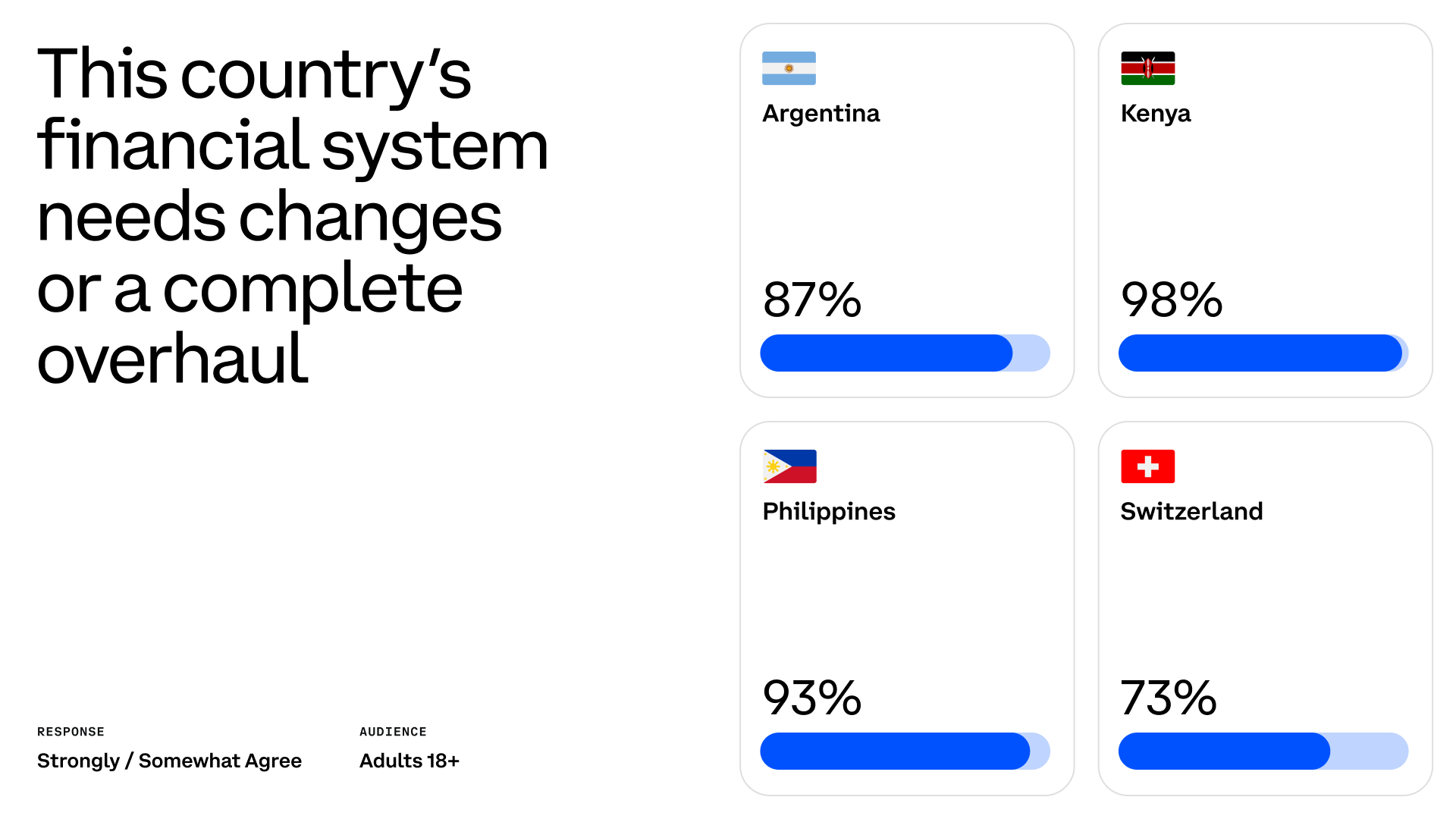

In Kenya and Switzerland, people have not approved the current financial politics in contrast to the past few years, while Argentina and the Philippines dislike both the current efforts and previous efforts, and the recent is a little. It is no exaggeration to say that you believe. Good than before. Respondents in all of these countries agree that they need to completely change or overhaul their local financial systems. They call their own financial systems “slow”, “expensive”, and “unstable.” They also quoted the lack of innovation as one of the problems.

The survey revealed the four main concerns of the respondents specified in the survey. It is too much effort to reduce fairness (discrimination), concentrate, decline the value of domestic currency, and save enough money and money.

The distribution of concerns varies from country to country, and Kenya and the Philippines are most important in concentration, discrimination, and wage slavery. Switzerland is cautious about the government's dependence on banks, but is most concerned about many of these issues. Argentine has the biggest trust in financial institutions and a problem with saving money.

Cryptography as a relief measure

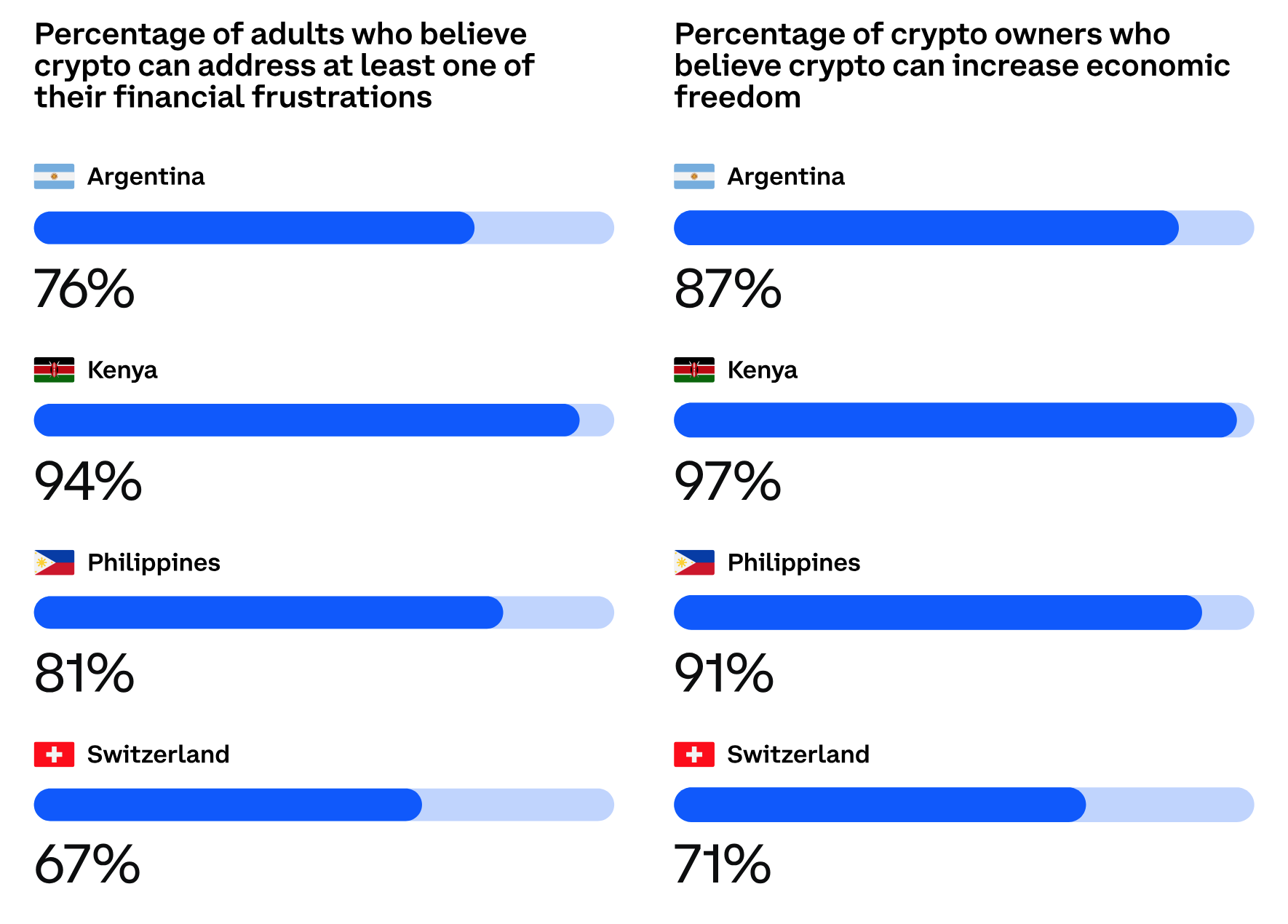

Most people voted by Ipsos for research want to be in charge of their financial status and gain more freedom and control of their money. Seven in seven respondents consider cryptocurrency and blockchain as a way to achieve these goals. More than that, both the encryption owner and the person who do not have a cipher agree that digital currencies can gain more freedom and help control wealth.

Switzerland is not more interested in encryption than respondents in other countries. However, more than 70 % of Switzerland's cryptographic owners believe that cipher will provide more control and freedom. Less than half of the Swiss subjects, which are not encrypted, believe they need it.

The adoption of a wider blockchain is considered a preferred factor that can improve local financial systems and individual wealth. Most of the respondents believe that blockchain promotes innovation and promotes individual financial control. Respondents want blockchain to make the system faster and easier to access.

In all opinion polls, Switzerland is presented with lower numbers. This reflects low expectations related to bitcoin and blockchain and low levels of financial status.

This study may find that there is a strong connection between the national economic direction and the level of the cryptocurrency and the level of blockchain support. Switzerland and Argentina residents are not very interested in their current financial state, and not much in cipher than Kenya and the Philippines. Probably, not only Kenya, but also Africa, which is hardly accessible to bank services, but is one of the reasons for having a smartphone, usually, cryptocurrency and blockchain base. It is considered to be the propulsion force of the large amount of solutions. Instead of a traditional bank.