EsteartículotambiénestáestáestreeNespañol.

In the aftermath of yesterday's Bitcoin Crash, the market participants are carefully investigating whether the major cryptocurrencies with market capitalization may rebound or are facing another decrease. In a post shared in X on February 4, the on -eaer analysis data provider LOOKONCHAIN provided five important indicators on traders and investors to evaluate the current location of bitcoin. 。

“The price of bitcoin experienced a big crash yesterday! Will it continue to rise or fall from above? Let's use five indicators to see if BTC is now peak.” Lookonchain is written.

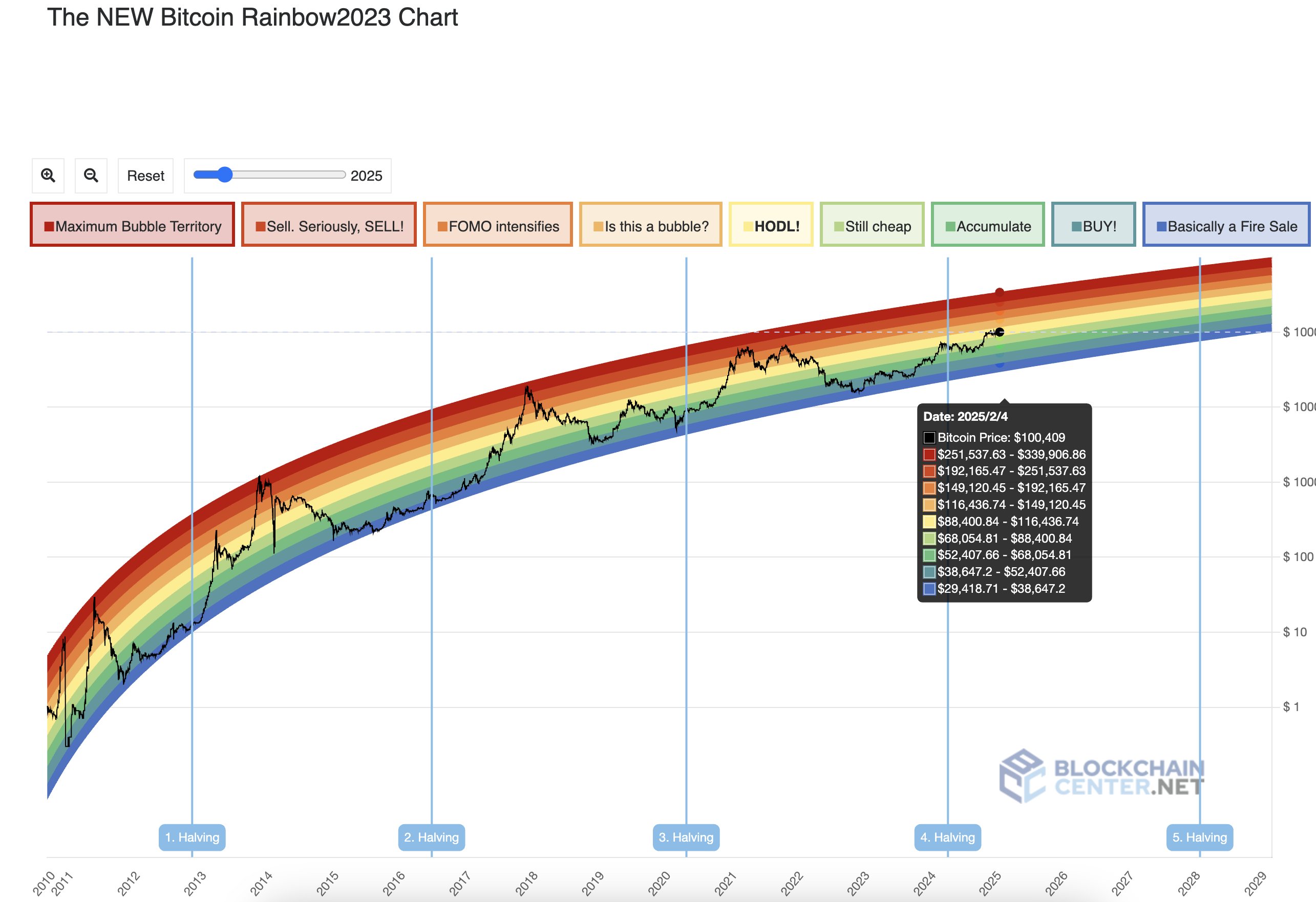

# 1 Bitcoin Rainbow Chart

LookonChain describes it as a “long -term evaluation tool that uses logarithmic growth curves to predict the potential future price direction of BTC.” Rainbow chart is often adopted to evaluate Bitcoin underestimating, overestimated, or approaching the key turning point. 。 “The new Bitcoin Rainbow2023 chart indicates that BTC can be retained, and BTC exceeds this cycle of $ 250,000.”

Related reading

The chart suggests a long -term trajectory of bullish, but its predictions are based on a historic price pattern and may not explain an unexpected market event. Nevertheless, LOOKONCHAIN data shows the view that bitcoin has not reached cycle peak yet.

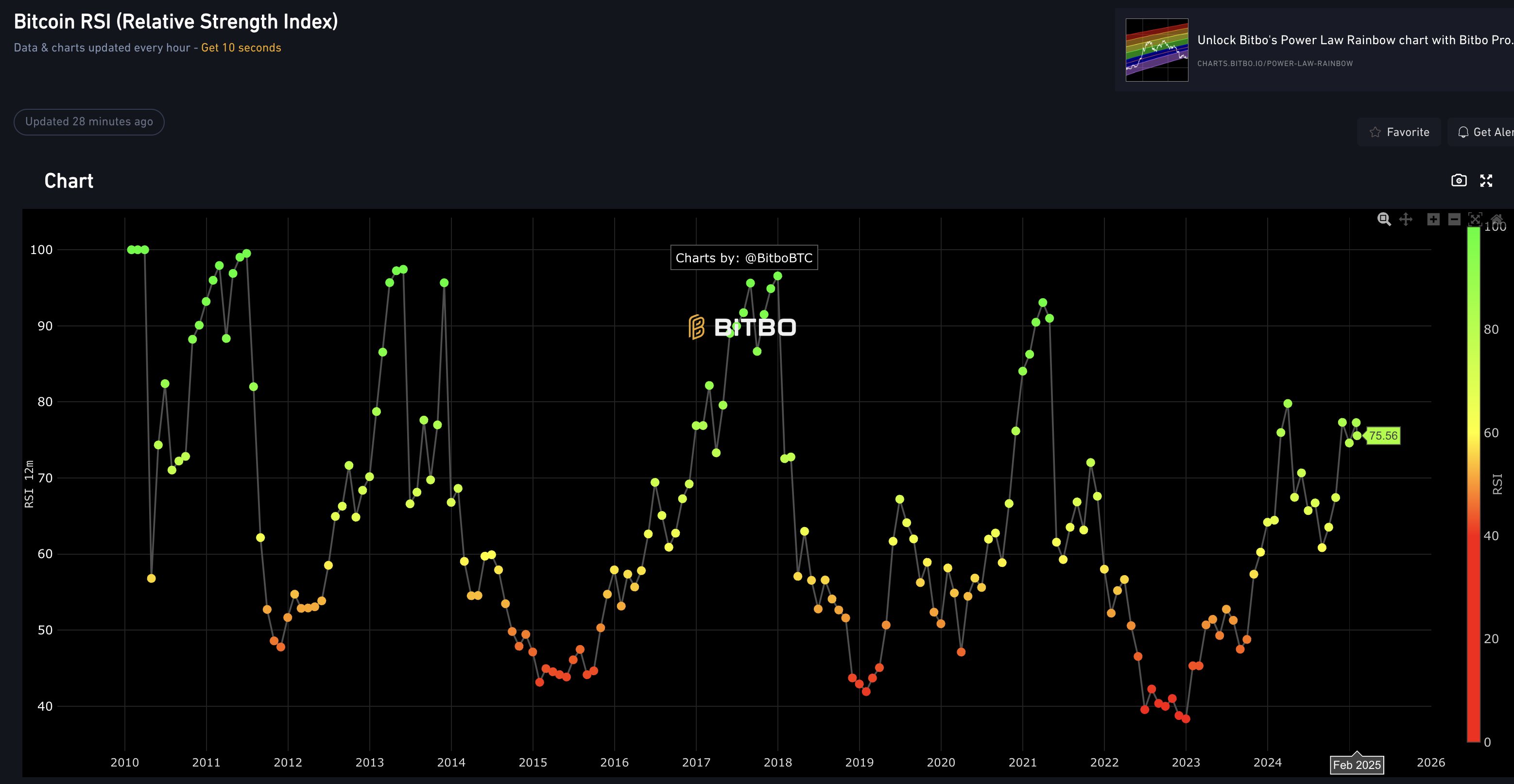

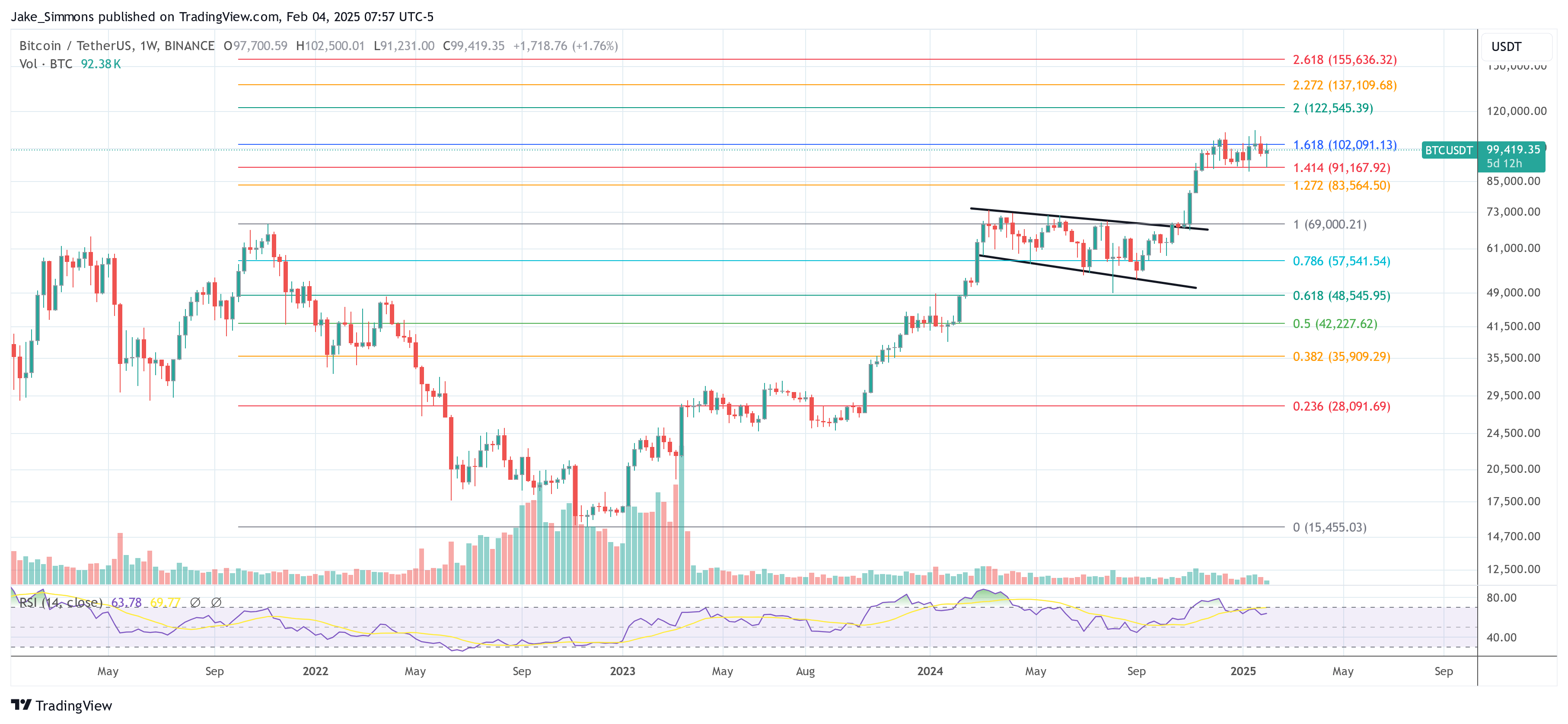

# 2 Relative strength index (RSI)

RSI is a technical indicator that measures recent price changes and evaluates the conditions for excessively buying or selling. “≥70: BTC is over -acquired and may decrease quickly. ≤30: BTC is sold too much and may increase quickly. The current RSI is 75.56, and the previous RSI. Compared to the data, BTC seems to have peaked yet. “

RSI reading values of more than 70 can usually be concerned that corrections may be paid. However, LOOKONCHAIN's observation emphasizes that despite the high RSI, the history data does not necessarily confirm the decisive market.

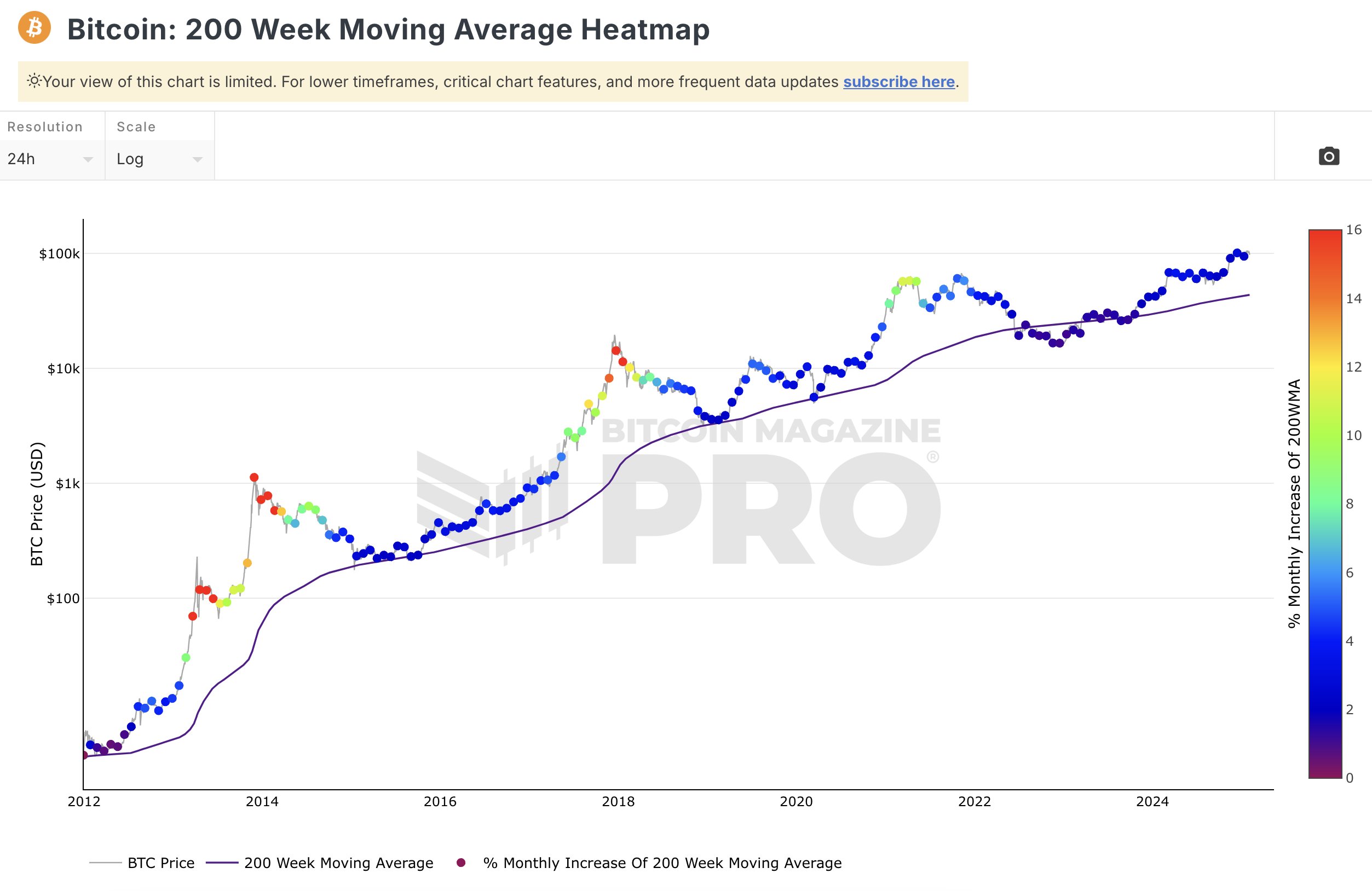

# 3 200 weeks moving average (200W mA) heat map

Traders often refer to 200W MA as basic support or resistance level. The heatmap variations charate with a wider amount of exercise and potential metal points over multiple years. “The 200 -week moving average heat map indicates that the current price range is blue, which means that it has not reached the top of the price yet, so it has come to hold it and purchase it.”

Related reading

Reading “blue” on the heat map means that the market does not display the peak signal observed in the previous cycle. Some consider this to be more potential, but given the uncertainty of the macro economy, others remain cautious.

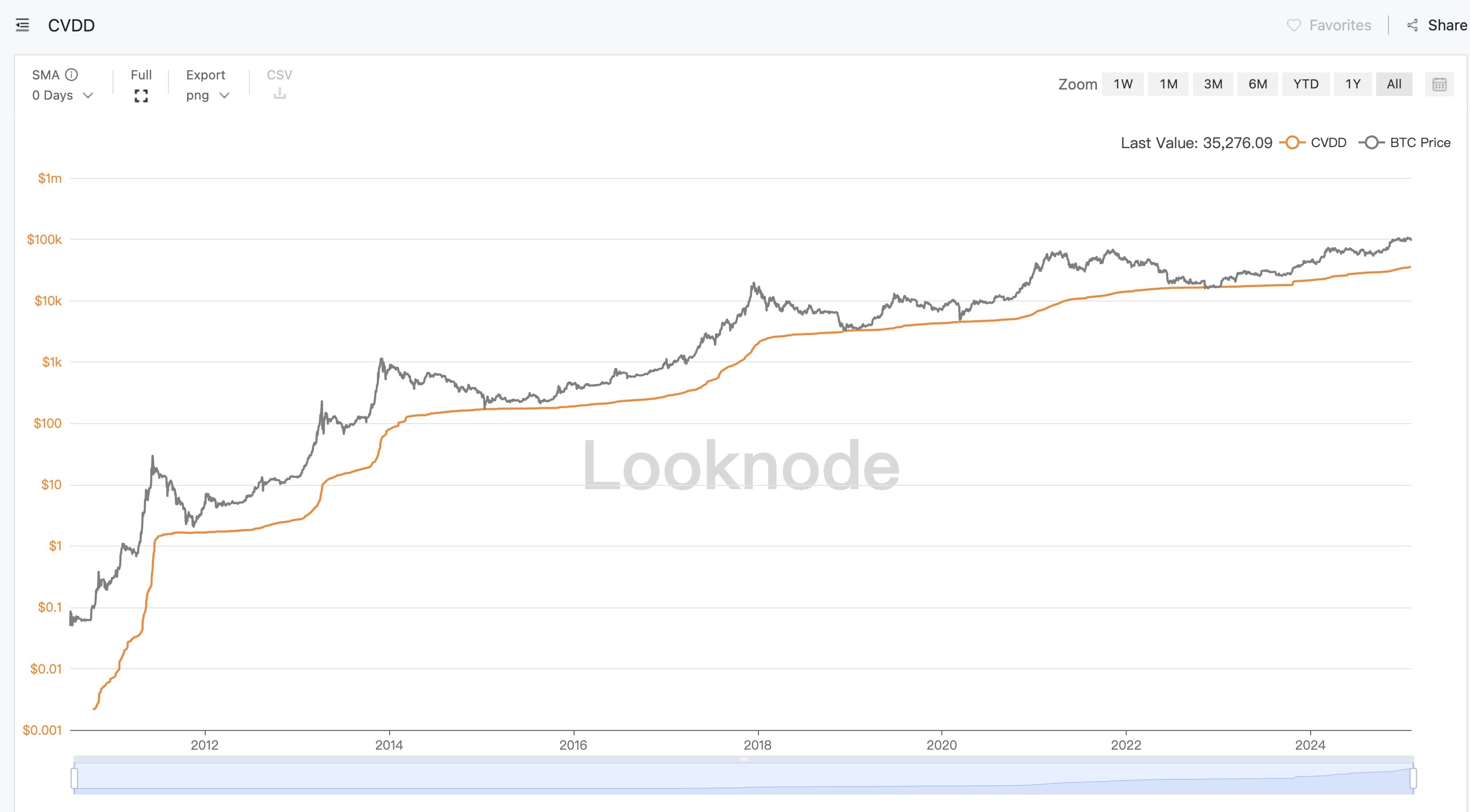

# 4 Cumulative coins of bitcoin have been destroyed (CVDD)

The destroyed coin Days is a long -standing on -fin metric that focuses on the period when BTC remains on a specific wallet before moving. The CVDD aims to identify this data over time and identify points that can underestimate or overestimate bitcoin. “If the price of the BTC touches the green line, the $ BTC price is underestimated, which is a good purchase opportunity. The current CVDD seems to have reached the top of $ BTC yet.”

According to LookonChain, the position of this metric means that the market has not encountered the highest conditions that have been observed historically, and suggests the possibility of further upward momentum.

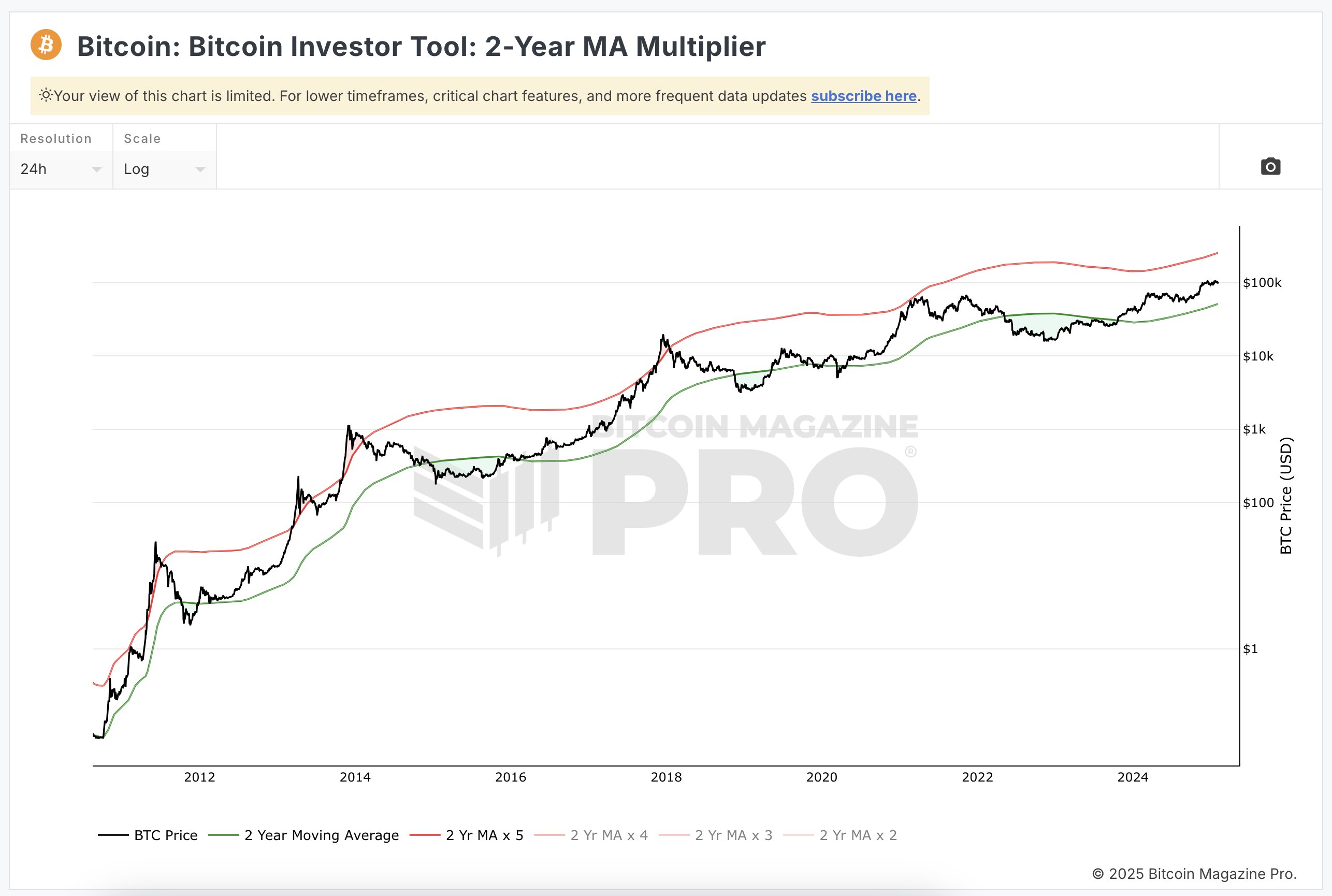

# 5 2 years MA multiplier

The average migration for two years is a widely referenced model that compares the current price of bitcoin with the two -year moving average. “The MA multiplier for two years indicates that the price of $ BTC is in the middle of the red and green lines. It does not touch the red line and the market has not reached the top yet.”

Historically, the price of bitcoin, which approaches or exceeds the red line at the top, is often the same as cycle peak. Bitcoin remains in the mid -range position, suggesting that the data may not be realized yet, which does not eliminate further volatility risks.

Overall, LOOKONCHAIN's analysis pointed out that these five indicators may not find the top of the current market cycle of Bitcoin.

At the time of press, the BTC was traded for $ 99,419.

Special image created in Dall.e, chart of TradingView.com