Bitcoin prices were reduced to $ 91,500, triggered a large number of encryption calculation in the entire top Defi protocol, such as AAVE and Compound.

After reaching the peak of about $ 106,000 on Friday, Bitcoin.cwp-COIN-CHART SVG Pass {Strokewid: 0.65! }

price

24 hours volume

?

->

Price 7D

Before extending the loss on the weekend, I fell on the entire NY session on that day. Bitcoin has fallen further on Monday and drops to $ 91,500 due to the claim that major market manufacturers could operate market operations.

However, the unexpected rush of the early time on February 3 was included as the price steadily recovered and defeated $ 101,000 before reaction to the spot rate. In this wave -like price action, billions of leverage long positions have been settled in Binance, OKX, and bybit.

Currently, it is clear that leverage long and 100 times the speculation is not the only culprit. According to SantimeNT, Fallout has extended to lend beyond transactions, and AAVE, compound, and other Defi protocols must sell collateral to protect the lender. Their decision was shaken Defi into the core, causing the sale of AAVE, INJ ECTIVE, and even a top -time product, such as compounds.

The bitcoin price crash has defeated more than $ 2.2 billion at a large liquidation event.

From the BTCUSDT chart to a decline from January 31 to February 3, BTC lost 10 % and pushed the loss from the highest in history to about 16 %. At the time of writing, the price is stable, but the coins remain less than $ 100,000.

(BTCUSDT)

Over the past three days, the market, which has been tied to the range of appearance, has led to the liquidation of a permanent futures market.

According to Coinglass, a leverage position of more than $ 481 million in the past 24 hours has been closed. Most of these were leveraged, betting on Bitcoin and Ethereum, betting on rally.

(sauce)

As of February 3, this figure exceeded $ 2.2 billion. In other words, many speculators have been washed away and excessive leverage has been erased.

The same liquidation has been extended to a rental protocol like AAVE or compound. In these platforms, users can rent a loan using WBTC, ETH, or other supported assets as collateral.

To borrow, you have to deposit a larger collateral than the loan amount. For example, to get a $ 1,000 loan with USDT, you need to lock more than $ 1,500 to cover volatility.

If the price continues to rise, the borrower is a type of leverage, as you do not need to worry about liquidation. Only after the price has started cooling, the borrower can consider repaying the loan so that the protocol does not liquidate the collateral.

WBTC liquidation related to AAVE and complex disorder

This was exactly what happened on February 3, when the price was fully tank.

Users who filmed a loan at the WBTC, StableCoin, which tracks BTC prices, lost their assets with AAVE and compounds after automatically clearing these coins.

According to Santiment, WBTC of $ 782,000 or more has been settled for the highest AAVE V2 since August 1, 2024.

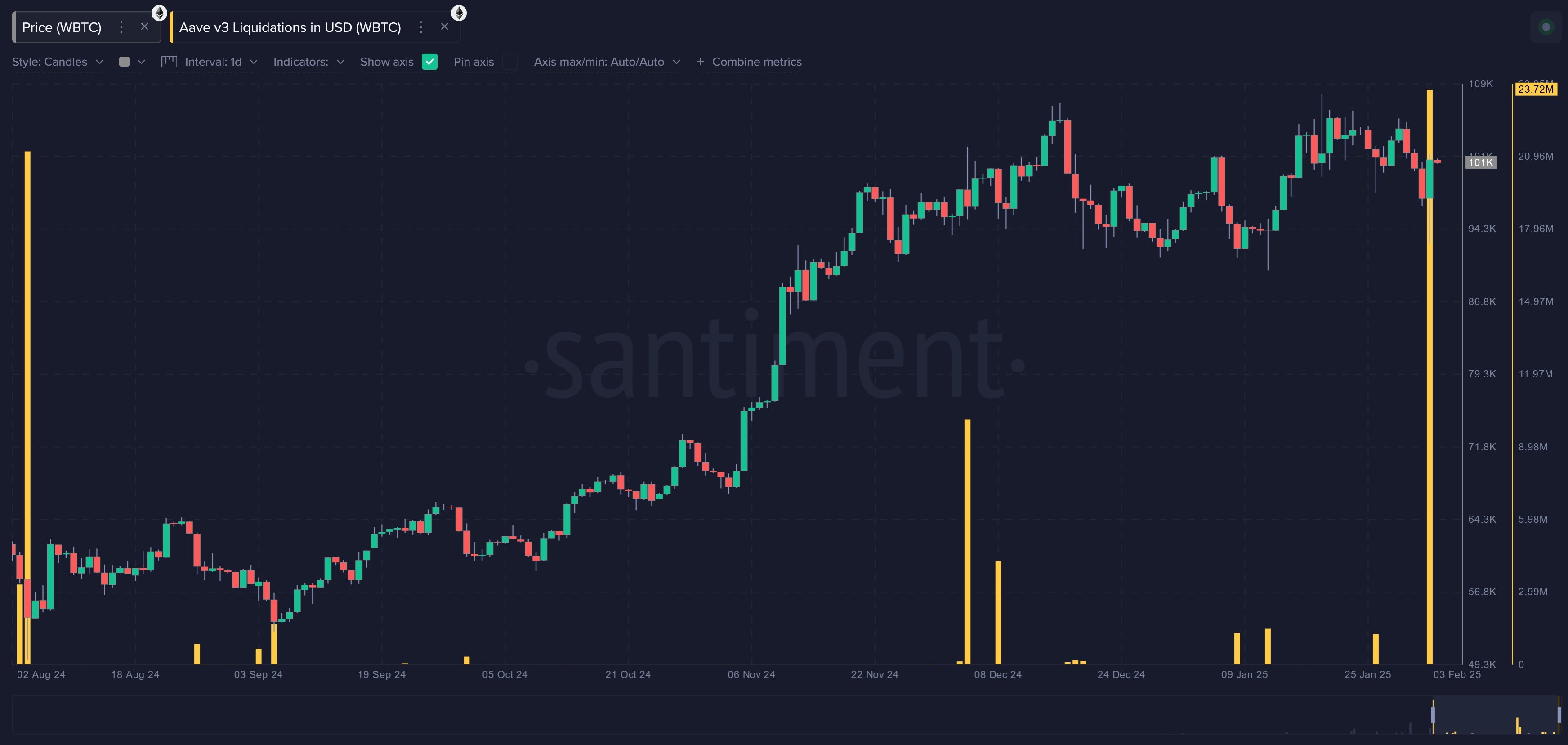

AAVE V3, known for its risk management and risk enhancements, sold over $ 23.7 million WBTC. This is the best liquidation day so far.

(sauce)

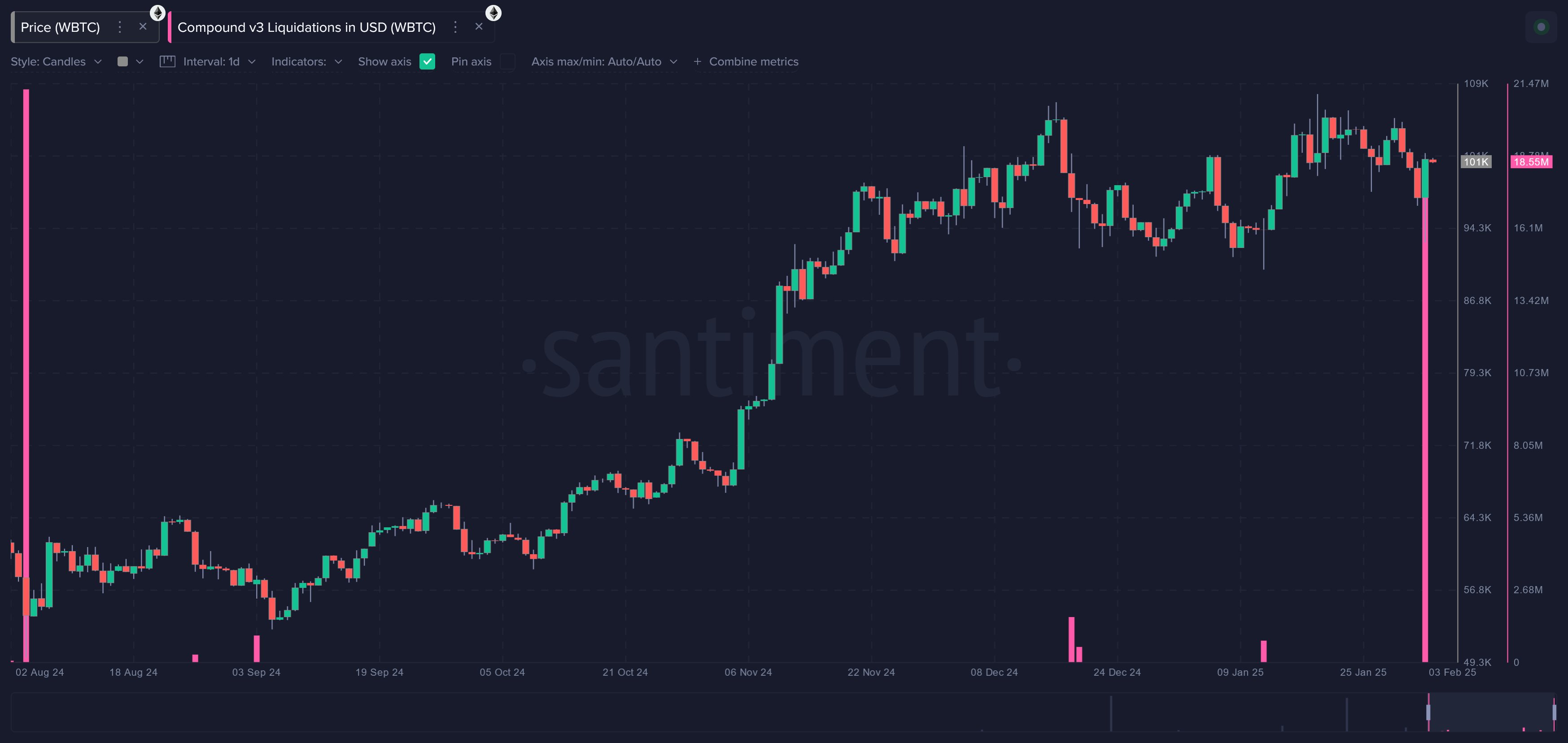

On the other hand, the borrower of the compound did not spare. When the price crashed to $ 91,500, WBTC, which exceeded $ 467,000, was forcibly closed. The compound V3 had to sell more than $ 18.5 million WBTC collateral to protect the lender and stabilize the protocol.

(sauce)

According to Defillama, if Sanity is resumed after the Delaveraging event, the total value of AAVE and COMPOUND (TVL) will be $ 16.8 billion and $ 2.3 billion, respectively.

(sauce)

On average, assets under control have been reduced by nearly 8 % from last week.

Exploration: FTX victim despair: Do you free free of FTX victims as your parents call the president?

For the latest market update, please participate in this 99 -bitcoins news.

The trigger of a postcoin decreased to $ 91,500 was first appeared in 99bitcoins.