Bitcoin price movements are always subject to discussion between investors and analysts. Many people are wondering if Bitcoin has already peaked in this bullshicle due to recent retraces. In this article, we examine data and metric on chains to evaluate the location of the Bitcoin market and the potential future movement.

For detailed complete analysis, see the original where the price of bitcoin has already peaked. Complete video presentation available on YouTube channel of Bitcoin Magazine Pro.

Bitcoin's current market performance

Bitcoin has recently faced a recession of the highest to 10 % of history, leading to concerns about the end of the bullish market. However, the historic trend suggests that such a correction is normal and normal. Usually, Bitcoin experiences 20 % to 40 % pullbacks before reaching the final cycle peak.

Analysis of on -eye metric

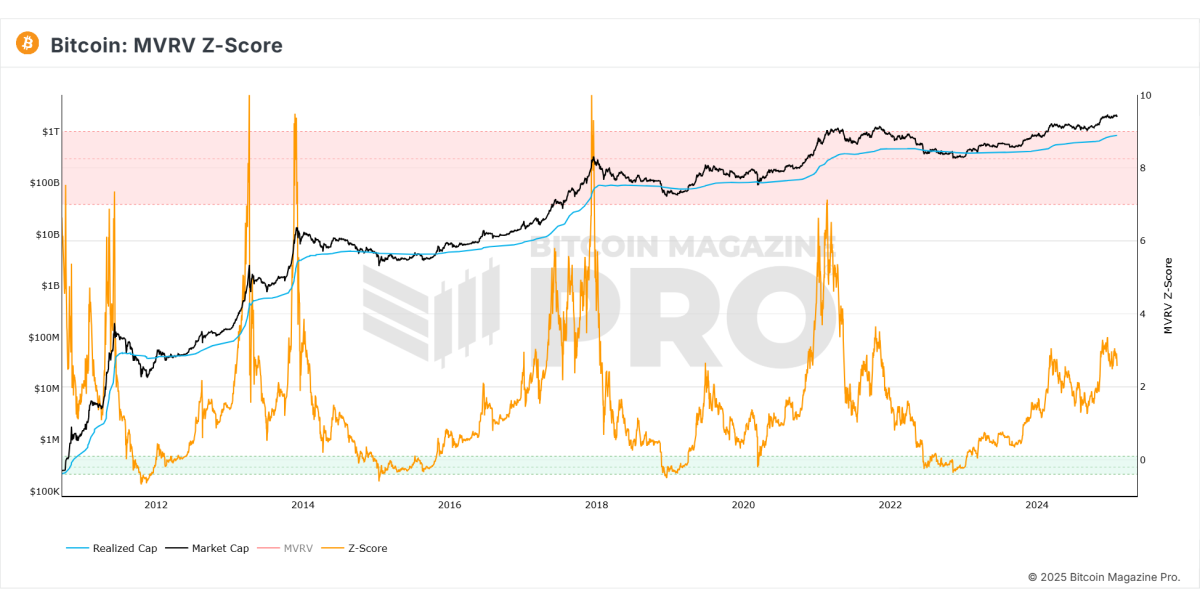

MVRV Z score

The MVRV Z score, which measures market value, has now indicated that bitcoin still has a significant rise. Historically, the upper part of the bitcoin cycle occurs when this metric enters the overheated red zone, but does not apply to it now.

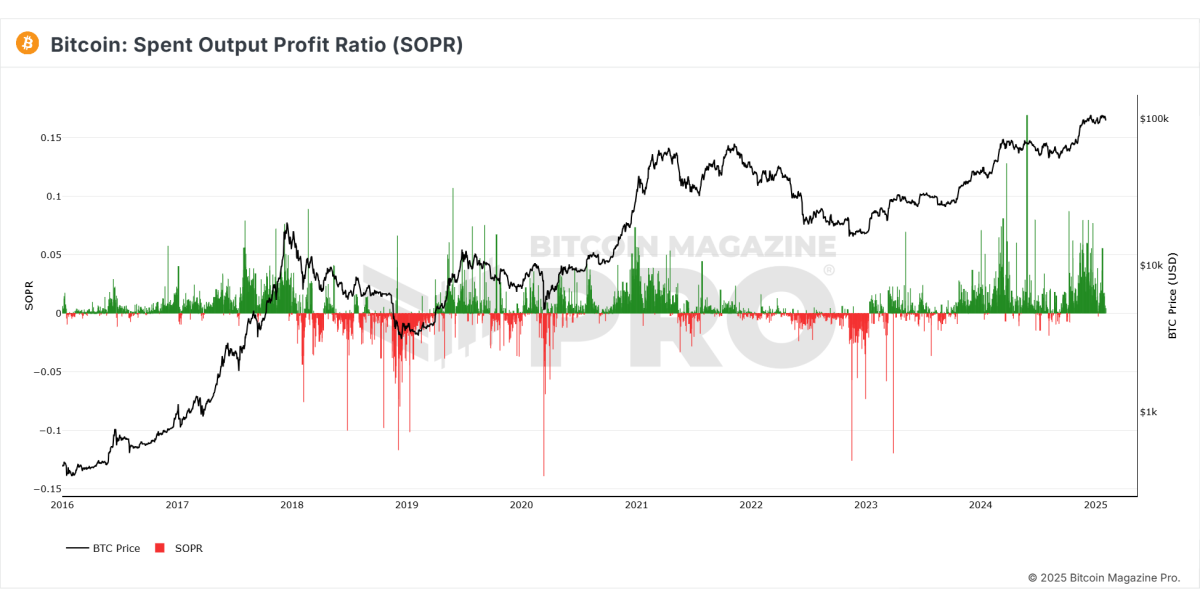

Used output profit margin (SOPR)

This metrick clarifies the ratio of used output of profits. Recently, SOPR has shown a decrease in realization, suggesting that there are few investors selling ownership and strengthening market stability.

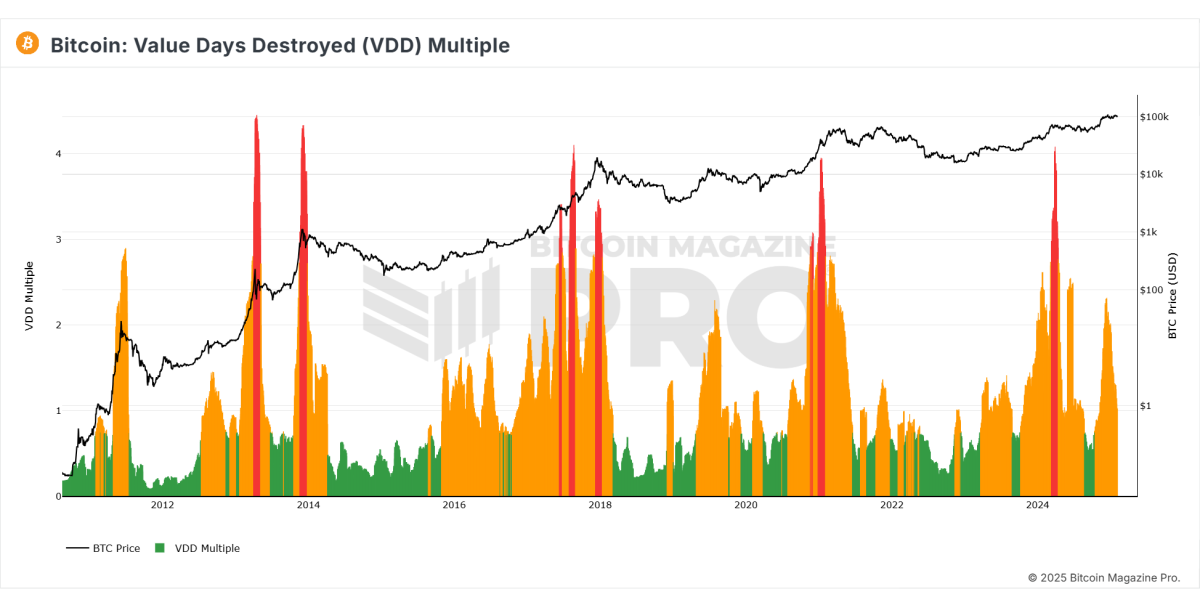

Destroyed value date (VDD)

VDD shows the sale of long -term holders. Metric has shown a decrease in sales pressure, suggesting that bitcoin is stable at a high level, rather than heading for a long time.

Institutional and market emotions

- Institutional investors such as MicroStrategy continue to accumulate bitcoin and shows trust in its long -term value.

- The centement in the derivative market has changed negatively, and historically, it has a potential short -term price because excess leverage traders betting on bitcoin may be cleared.

Macro economic factor

- Quantitative tightening: Central banks are reducing fluidity and contributing to a temporary decrease in bitcoin.

- Global M2 Money Supply: Money Supply's contraction has affected risk assets, including bitcoin.

- Policy on the Federal Reserve: There are signs from major financial institutions, including JP MORGAN, and quantitative easing may return by mid -2025, which can increase the value of bitcoin.

Related: Is $ 200,000 a real bitcoin price goal for this cycle?

Future outlook

- Bitcoin's price action shows signs of an integration stage before another potential rally.

- On -fin data suggests that there is still room for growth before reaching the cycle peak found in the previous bullish market.

- If bitcoin is further brought back to $ 92,000, this could have a strong opportunity to a long -term investor.

Conclusion

Bitcoin has experienced a temporary retribution, but the on -fin metric and history data suggest that the Burecycle has not yet been over. Institutional interest is still strong, and macro economic conditions may change with support of bitcoin. As usual, investors need to carefully analyze data and examine long -term trends before making investment decisions.

If you are interested in more detailed analysis and real -time data, consider checking Bitcoin Magazine Pro for valuable insights on the bitcoin market.

Disclaimer: This article is only for information provision and should not be regarded as financial advice. Before making an investment decision, we will always conduct our own surveys.