Key takes

- By bit CEO estimates that the liquidation of cipher can reach up to $ 10 billion.

- API restrictions can cause inconsistencies in reported clearing data.

Please share this article

Bibit CEO's Ben Zhou estimates that the total encryption liquidation of the entire exchange can reach $ 8 billion to $ 10 billion. According to Zhou, his platform alone recorded $ 2.1 billion in the past 24 hours, but coinglass data was only $ 333 million.

In other words, the actual cryptocation of the entire market may be much higher than the published numbers. Bibit CEO explained that it was behind the contradiction between the reported data feed restrictions and the actual liquidation numbers reported.

“we have [API] The amount of feed per second is the limit of pushing out. From my observation, other exchanges are practicing the same thing to limit the liquidation data, “Zhou said.

In accordance with these report gaps, Zhou added that bybit will launch a comprehensive clearing data.

“As we move forward, Bybit starts pushing all liquidation data. We believe in transparency,” he said.

The encryption market responded sharply and cruelly following the Trump tariff announcement on Saturday.

Bitcoin has been below $ 92,000 for the first time since January, and Ethereum and other altcoins recorded two digits. COINGLASS data has set up more than $ 2 billion in the entire exchange of encryption derivative during the sale.

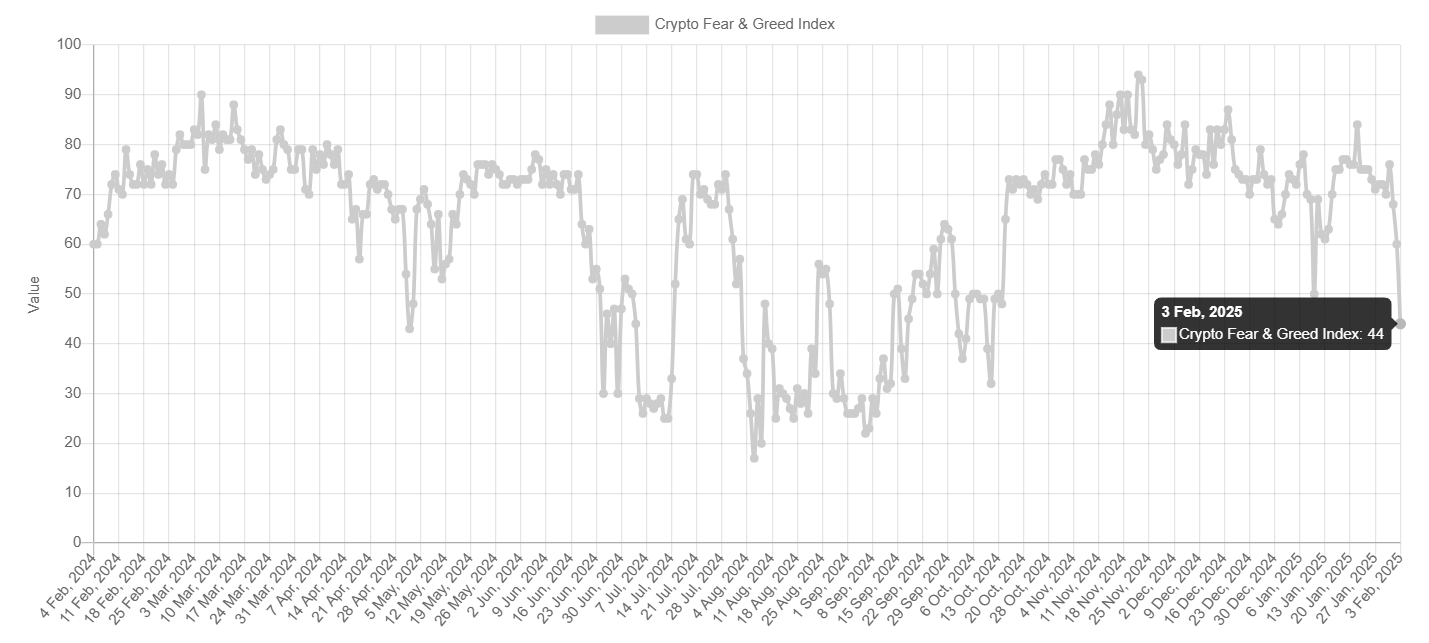

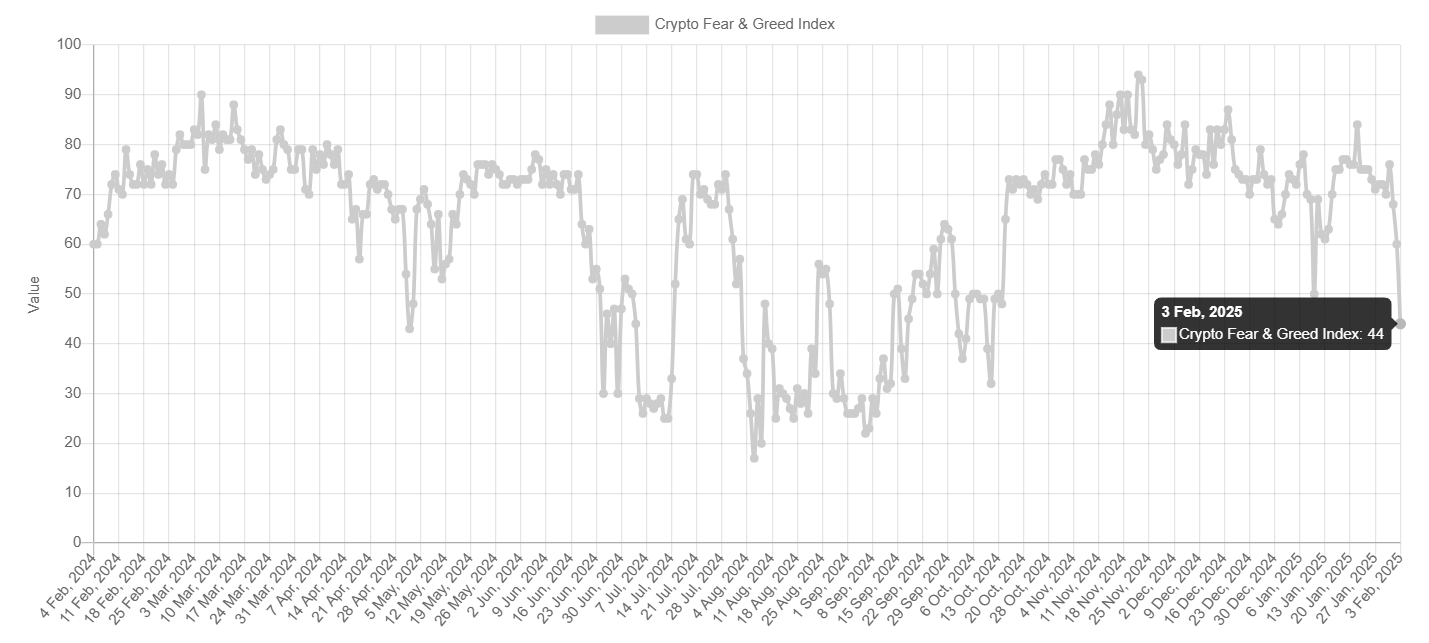

The fear of the cipher and the greedy index have fallen from 60 to 44, and have entered the “fear” zone at the lowest level since October 11.

President said that it would carry out 25 % of tariffs on imports from Canada and Mexico, and 10 % of Chinese products. This measure is planned to be effective tomorrow as part of the efforts of border security and fighting drug trafficking.

Economist warns that Trump's new tariffs can worsen inflation, which is still stubborn than 2 % of the FRB goals.

Last week, the Central Bank decided to change interest rates to 4.25 % to 4.50 %. Fed Chair Jerome Powell has indicated that future toll adjustments are required for incoming call data, labor market trends, and inflation development.

Powell had previously indicated that Central Bank would evaluate the impact of Trump's economic policy and make future prices. Jacob Channel, an advanced economist of Lendingtree, tells CBS News that the potential change in economic policy under Trump will “cause the revival of inflation, otherwise the economy may be abandoned.” Ta.

But the Jeff Park of Bitise Asset Management suggests that Trump's new tariffs could increase the demand for bitcoin as inflation hedges.

Please share this article