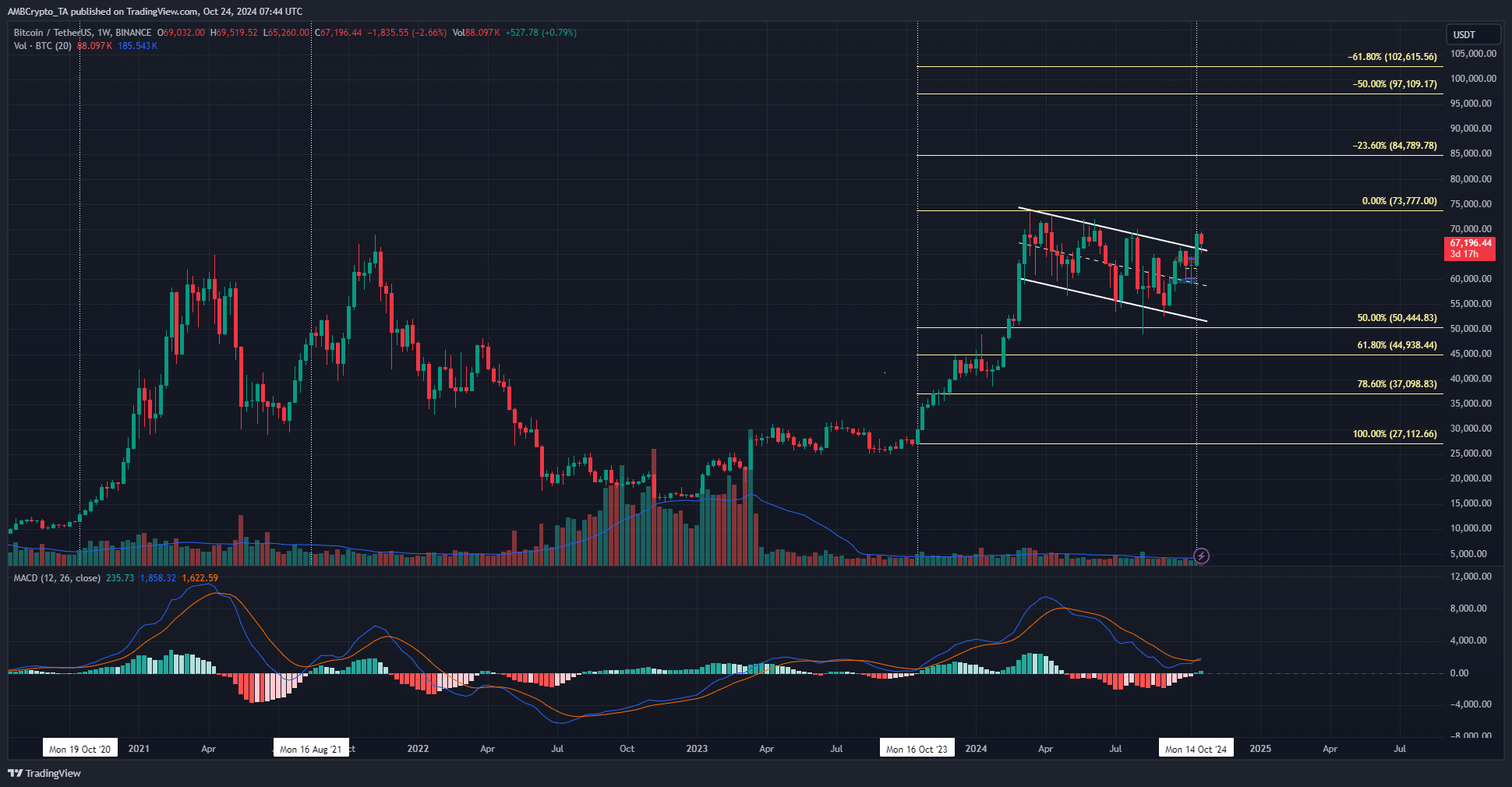

- Analysts expect Bitcoin to rise 40% before the cycle top.

- Fibonacci extension levels indicate targets of $109,000 and $132,000.

Bitcoin [BTC] The number of accumulated addresses has increased rapidly. The HODL idea was growing in popularity. Bitcoin addresses with a minimum of 10 BTC that have never been leaked previously held 1.5 million coins at the beginning of 2024, but currently hold 2.9 million coins.

The Bitcoin Rainbow Chart showed a very optimistic forecast for the current cycle, with a target of over $288,000. However, based on past trends, this cycle's high could be closer to $100,000.

Bitcoin expected to rise another 40% before cycle top?

Source: CryptoBullet by X

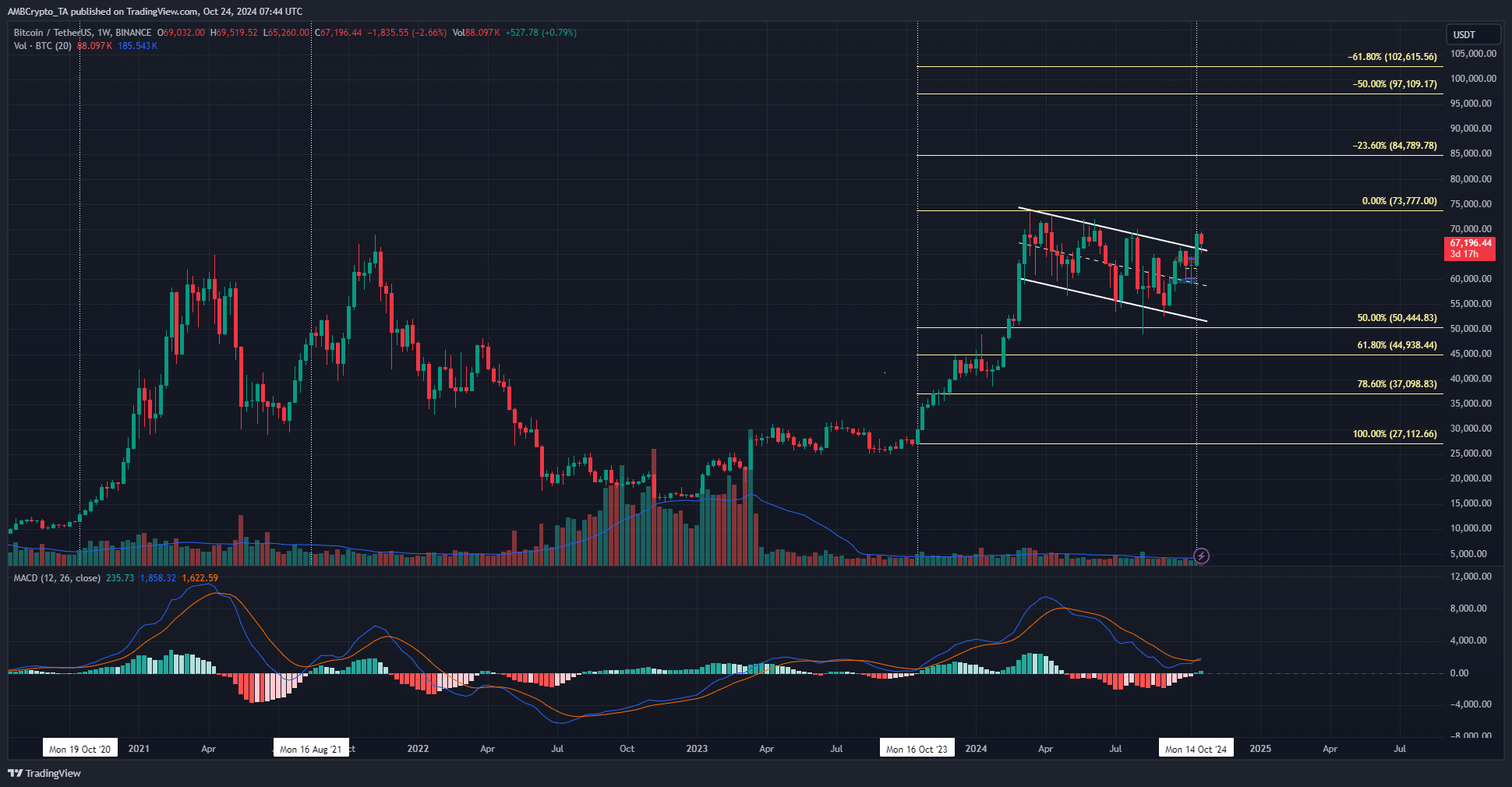

In a post on X, cryptocurrency analyst CryptoBullet noted that the weekly MACD has formed a bullish crossover for the first time since October 2023. At the time, it was a 172% increase in less than five months.

However, this rally took place before the Bitcoin halving event. The current debate is whether we should expect a similar rally or whether the next higher leg will form a lower MACD high and mark the end of the bull market.

Analysts favored the latter scenario. A multi-month hold following a vertical rally followed by a bullish MACD crossover likely won't result in a triple-digit percentage increase. CryptoBullet suggested in its chart that another 40% rally is a reasonable goal.

Measuring Bitcoin’s current target

Source: BTC/USDT on TradingView

History rhymes, but it doesn't need to be repeated. The 2017-2018 bull market saw a 617% return on the weekly MACD bullish crossover, and 2020 saw a 468% move. The 2023 one had a 172% return, but it occurred before the halving.

Is your portfolio green? Check out our Bitcoin Profit Calculator

In 2019 and 2020, Bitcoin recovered 190% from its low of $3.2 million, reached 18 months before the halving. The pre-halving run that BTC saw could break down and the 40% price extension target listed by CryptoBullet for the next leg could be wrong.

But as it stands, that seems to be a reasonable expectation. It also matches well with the Fibonacci extension levels plotted on the weekly chart above.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.