- Ethereum price is approaching $4,000 on optimism over a newly approved ETF.

- Market analysts suggest that Ethereum could reach $10,000 in the current cycle.

Following the U.S. Securities and Exchange Commission (SEC) approval of Ethereum's application [ETH]The king of altcoins, Bitcoin (ETF)-based exchange-traded funds, are seeing a strong rally.

The week has started on a strong note, with Ethereum recording a 3.7% increase over the past 24 hours, bringing the price closer to the crucial $4,000 level and a significant increase from recent weeks.

At the time of writing, Ethereum is trading at $3,899, rebounding sharply from previous fluctuations.

Ethereum Could Face $4,500 Target

Amid Ethereum price fluctuations, Arthur Chong, CEO of Defiance Capital, was suggested Ethereum could hit $4,500 before spot ETF trading begins, possibly by July or August.

Chung drew parallels with the 2017 cryptocurrency boom and suggested the introduction of a spot Ethereum ETF could attract a significant number of retail investors.

This is very similar to Bitcoin [BTC] Meanwhile, over 70% of positions are held by individual investors.

There is a noticeable enthusiasm among investors and market participants regarding Ethereum’s future performance.

However, it is important to remember that these forecasts remain highly speculative and the actual market trajectory will depend on a variety of factors, including broader economic conditions and investor sentiment.

Furthermore, the current regulatory environment of the SEC You will only see the green light for the first 19b-4 request The Ethereum ETF is still waiting for the required S-1 form to be approved.

Ethereum bullish trend

Despite these regulatory hurdles, Ethereum market trends are showing robust growth not only in price but also in fundamental on-chain metrics.

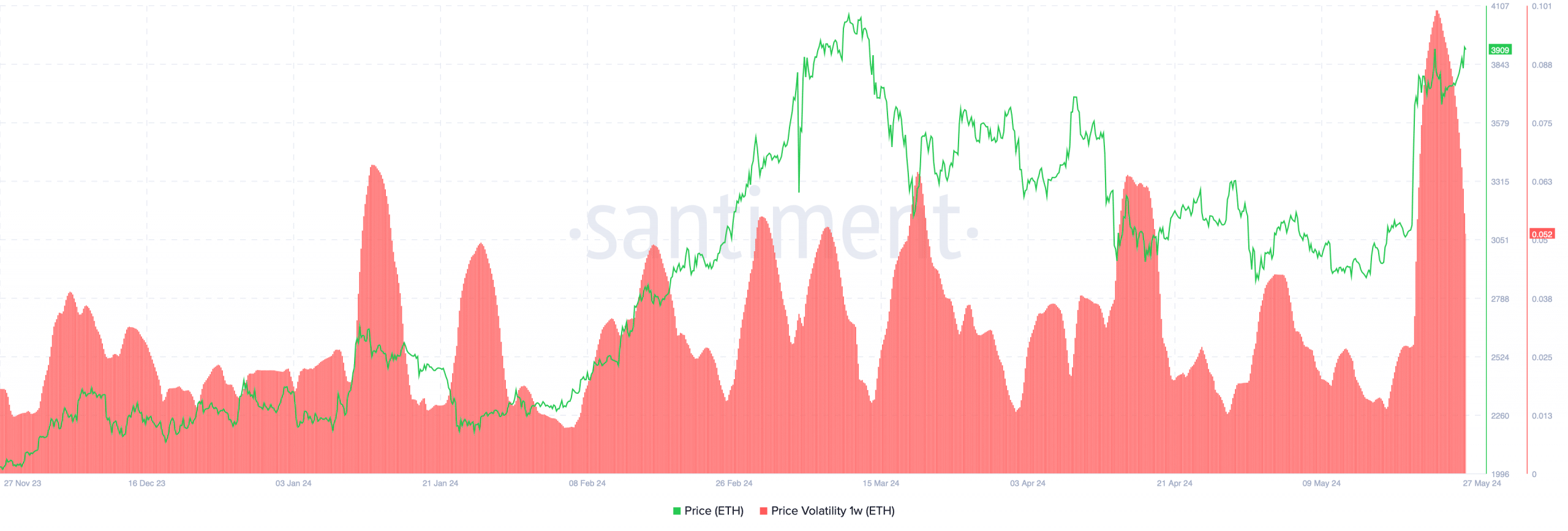

data The Santiment report highlights the sharp increase in Ethereum price volatility, with the metric rising significantly from its lows over the past two weeks to today's notable peak.

Source: Santiment

Notably, cryptocurrency price volatility has increased along with price, signaling periods of increased trading activity and interest, often driven by speculative buying.

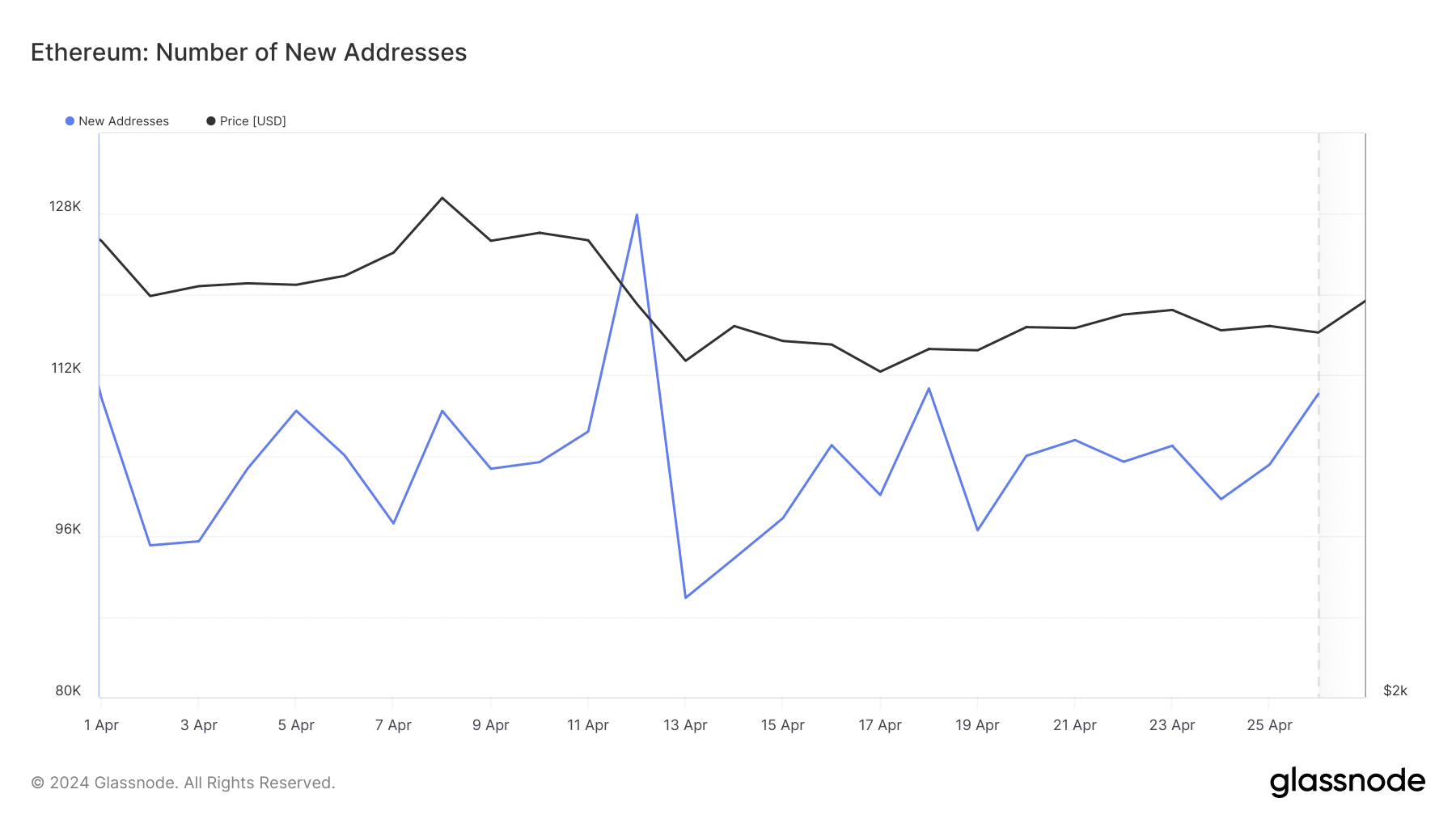

Further adding to the growing interest is Glassnode. report The number of new Ethereum addresses is increasing, suggesting a growing user network.

Such an increase typically signifies increased market participation and is likely fueled by positive market sentiment and broader adoption.

Source: Glassnode

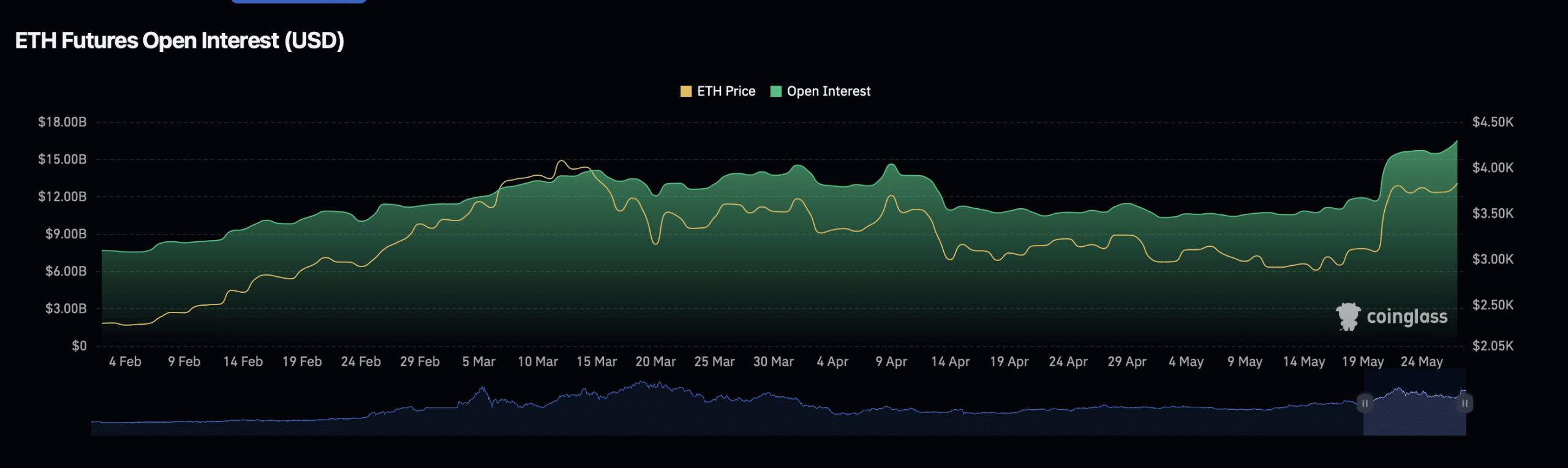

In addition, coin glass data Ethereum open interest surged, highlighting the revitalization of the derivatives market due to increased trading volume.

This not only indicates increased liquidity, but also increased speculative interest as traders anticipate upcoming price movements.

Source: Coinglass

However, higher open interest also means increased market leverage, which can magnify both profits and losses depending on market direction.

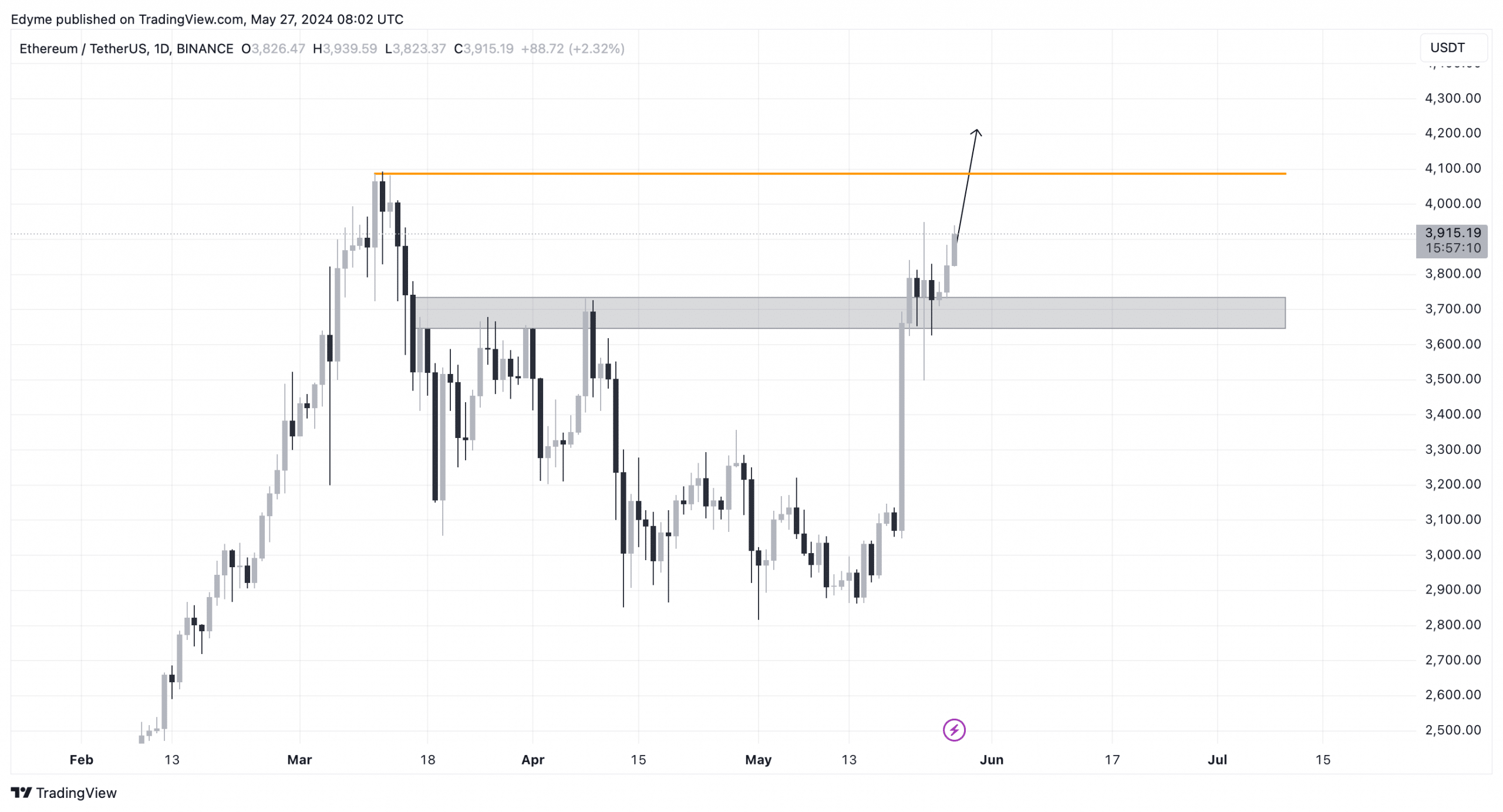

Technical analysis of Ethereum’s daily chart reveals that the cryptocurrency recently broke out of the $3,700 resistance level and turned into support, setting its sights on the next key milestone of $4,000.

This breakout suggests that bullish momentum is strong and could lead to further upside.

Source: TradingView

Is Your Portfolio Green? Check out our ETH Profit Calculator

At the same time, AMBCrypto, citing data from Glassnode, reported A significant decrease Ethereum Network Value to Transactions (NVT) Ratio.

A decline in this ratio indicates that the asset is currently undervalued and may signal an imminent market price increase.