- Analysts claim that ETH will outperform BTC in the crypto summer.

- US liquidity injection could boost the market in the second half of 2024.

Ethereum [ETH] It may exceed Bitcoin [BTC] The summer of virtual currency is slowly approaching. This bold prediction was made by Raul Pal, founder of Real Vision and a leading commentator on the crypto market.

In the X post, Pal emphasized that the summer of cryptocurrencies is the season for altcoins, where attention shifts from Bitcoin to other things.Some of his posts read,

“Summer in crypto is usually the start of alt season, and in the fall we are in full “bubble mood.” This is when ETH becomes the benchmark and starts to outperform BTC. This is when SOL accelerates his outperformance over BTC and ETH. ”

Pal added a timeline to his predictions, emphasizing how “crazy” things could get, emphasizing:

“Once the market is fully refreshed, the banana zone typically kicks in and full mania begins to build towards the second half of the year…and all the way through 2025.”

Source: X/Raul Pal

US liquidity factors

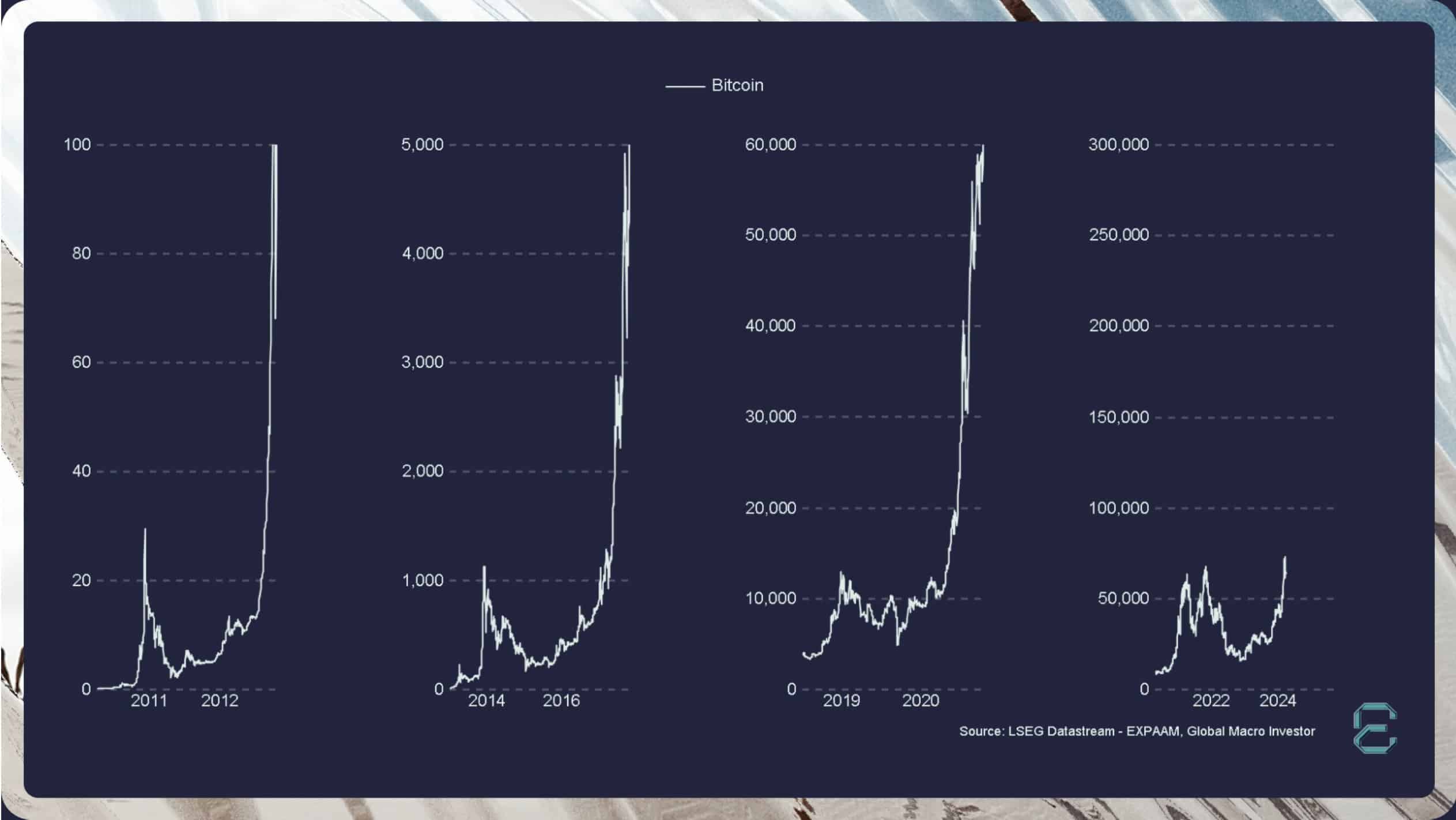

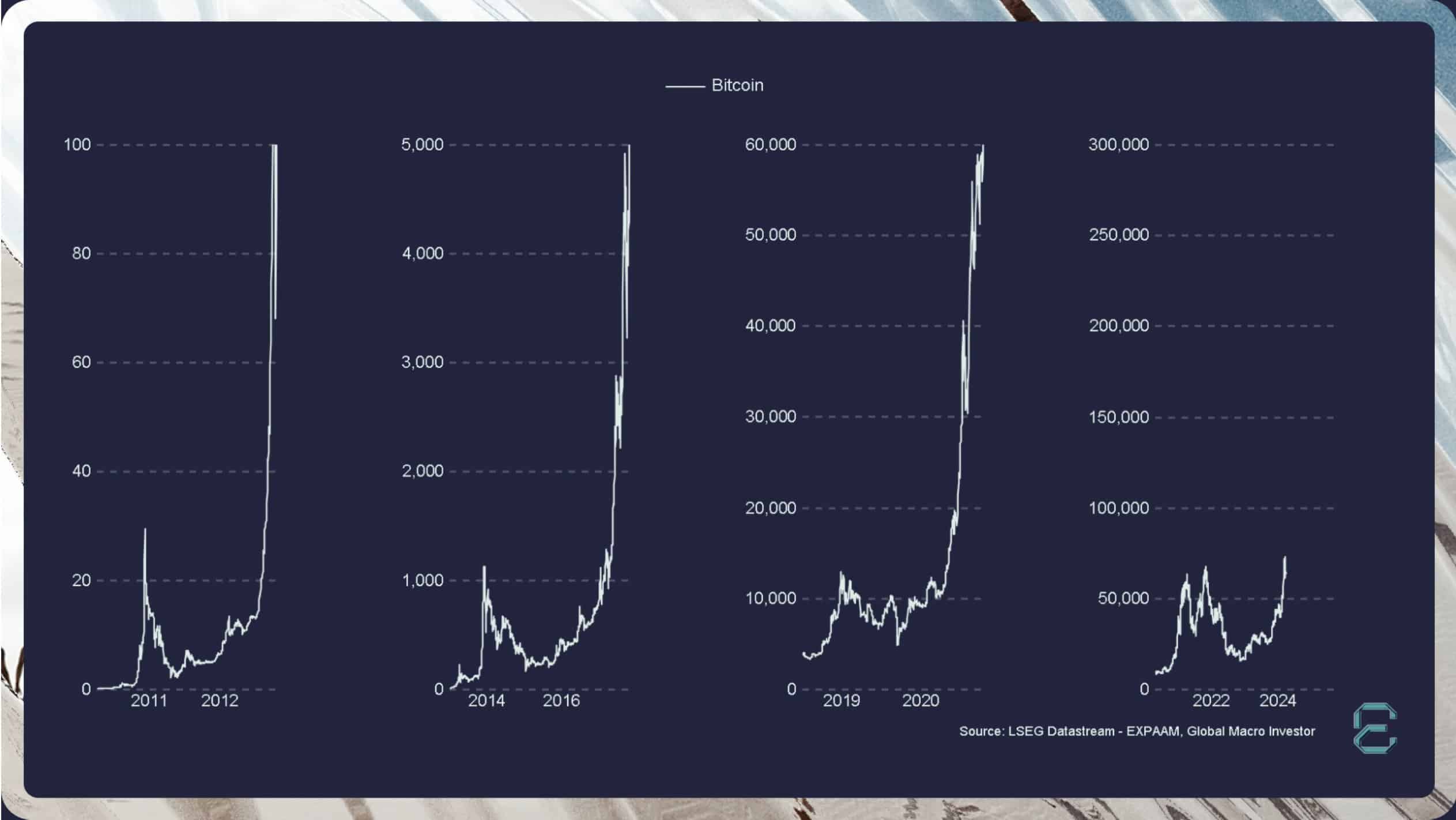

PAL's predictions are based purely on historical data. However, past performance does not necessarily determine future results. So what is the key trigger that causes Pal's outlandish projections?

One possible factor is the easing of the macro front. Singapore-based crypto trading firm QCP highlighted how the US liquidity injection could move the market.

In a weekend update on Telegram, the company acknowledged that U.S. inflation remains high. However, the U.S. Treasury reiterated that it may inject additional liquidity in the second half of the year.Part of the statement read,

“However, monetary policy may not be as important at this time as fiscal policy, which is the main driver of liquidity and asset performance.”

The company further added:

“The Quarterly Repayment Announcement (QRA), scheduled for May 1, could also increase U.S. short-term bill issuance. This will deplete the current $400 billion in RRP and also increase liquidity. To do.”

Last week, BitMEX founder Arthur Hayes said: similar projection. He emphasized that additional liquidity will be injected into the economy during the US election.

Increased liquidity means additional money supply within global or regional markets, especially if central banks reduce interest rates. This is the perfect condition for risk-on assets to rise.

It remains to be seen whether Ethereum will outperform Bitcoin. However, much of the hyped “summer of crypto” may be driven primarily by macro factors rather than historical cycles.