- Bitcoin’s open interest increased by 9% on a weekly moving average.

- Technical analysis and short-term holder gains indicated that a bullish breakout is likely.

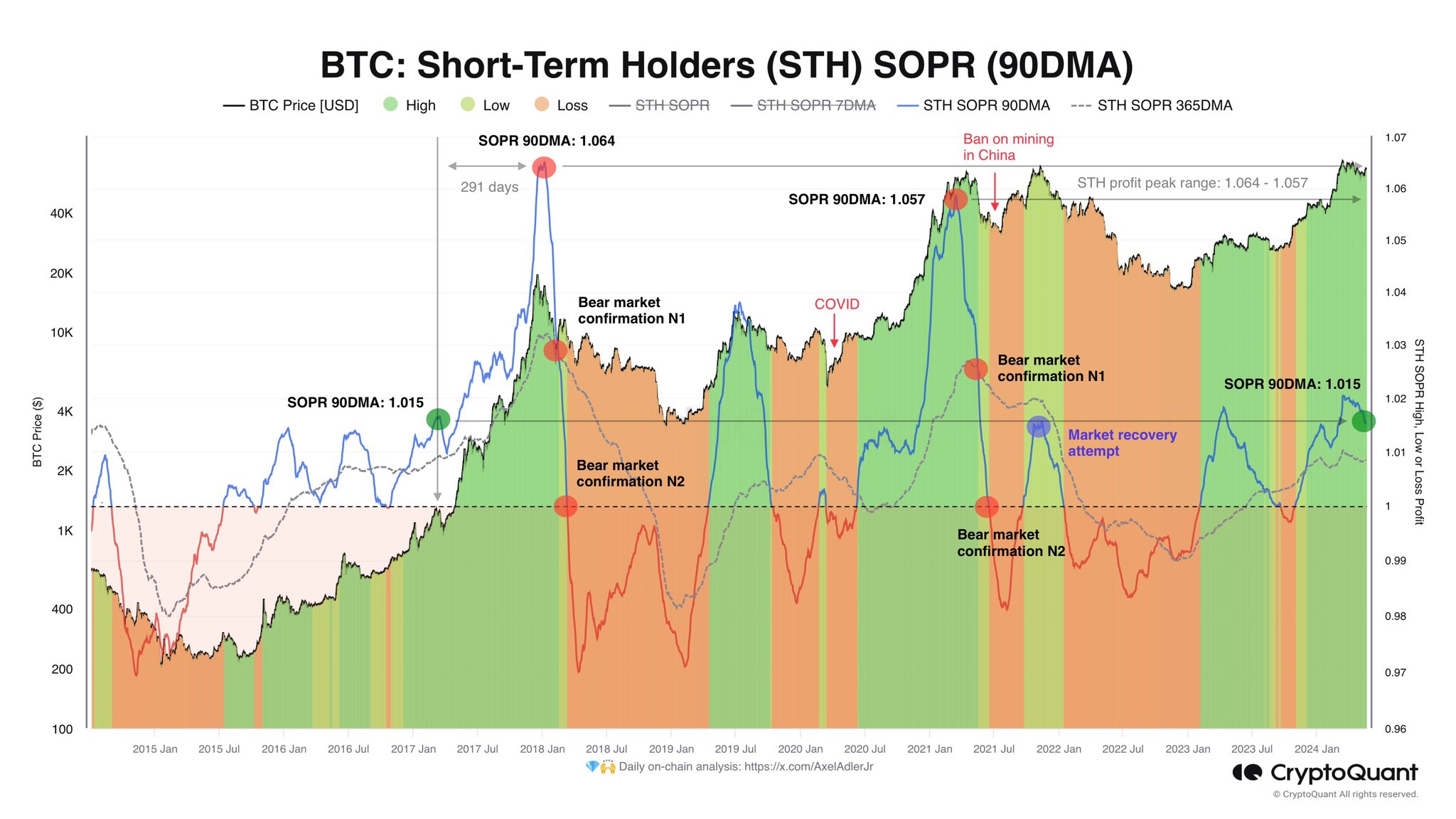

Bitcoin [BTC] According to cryptocurrency analyst Axel Adler, we could be entering a 300-day bull market. According to CryptoQuant data on short-term holder gains, he said the bull market is in full swing.

With the price just 4.2% below its $737,000 ATH from two months ago and the halving event having passed, buying pressure may be on the rise.

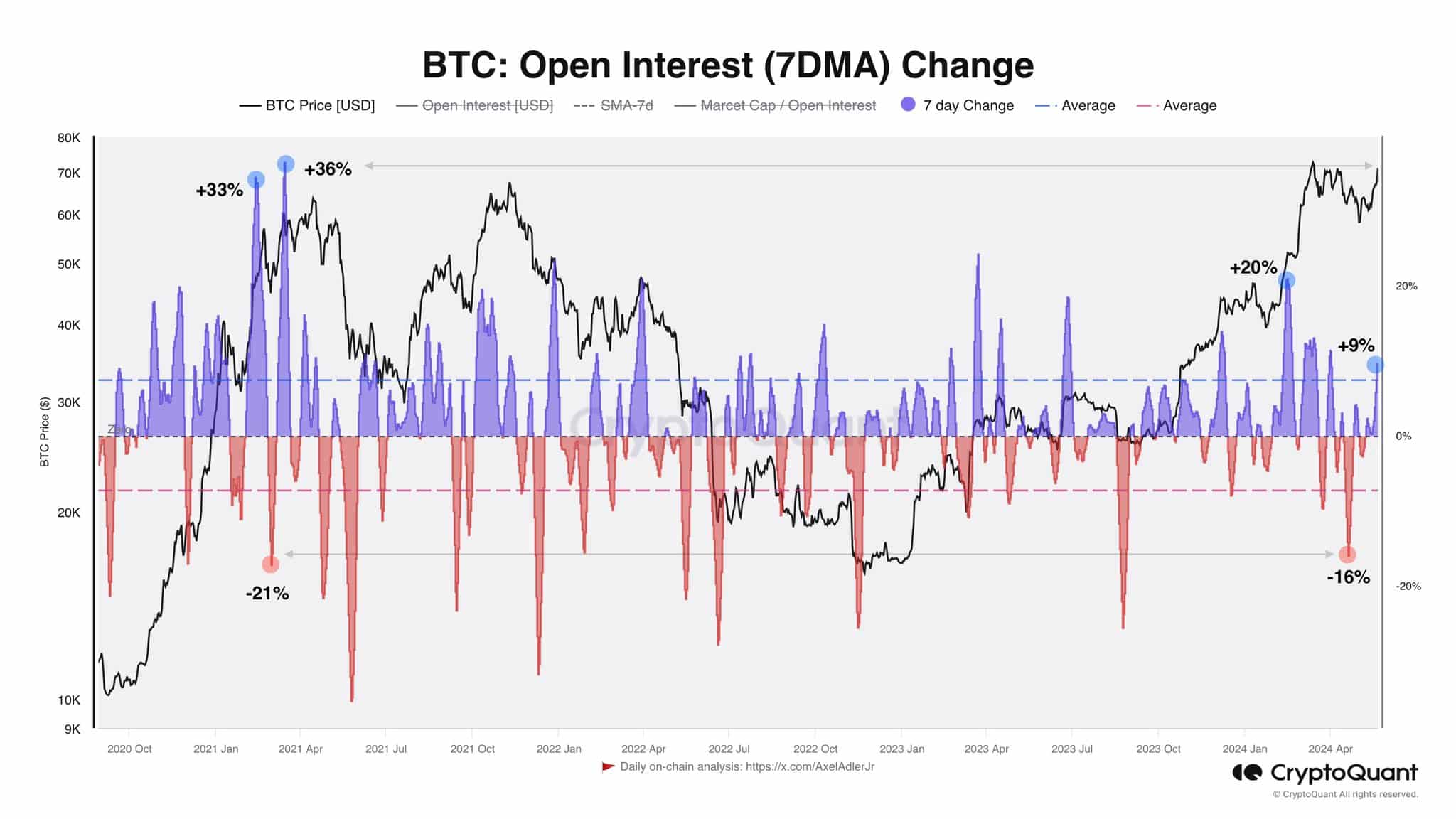

Open interest suggests there is more room for price appreciation.

Evaluate past peaks and what they predict for the future

Source: Axel Adler of X

The 90-day SMA of Short-Term Holders Expended Output Return (STH SOPR) peaked at 1.064 in January 2018 and 1.057 in March 2021. This suggests that the peak range of STH profit is between 1.064 and 1.057.

At the time of writing, the 90-day moving average for STH SOPR was 1.015.

This indicates that there is more room for upside and that the upside is very likely not in. Additionally, there were 291 days between the SOPR 90DMA reaching 1.015 and the cycle peak.

However, in the 2020-2021 cycle, the number of days between the same values was only 105. Therefore, a 3- to 12-month bull market is likely.

Source: Axel Adler of X

Analysts also noted that the 7-day moving average of open interest has increased by only 9% in recent moves.

By comparison, January 2024 was 20%, and we've seen OI 7DMA move close to 20% multiple times in the 2021 run as well.

Both observations taken together support the idea that the Bitcoin market is only just beginning to rise.

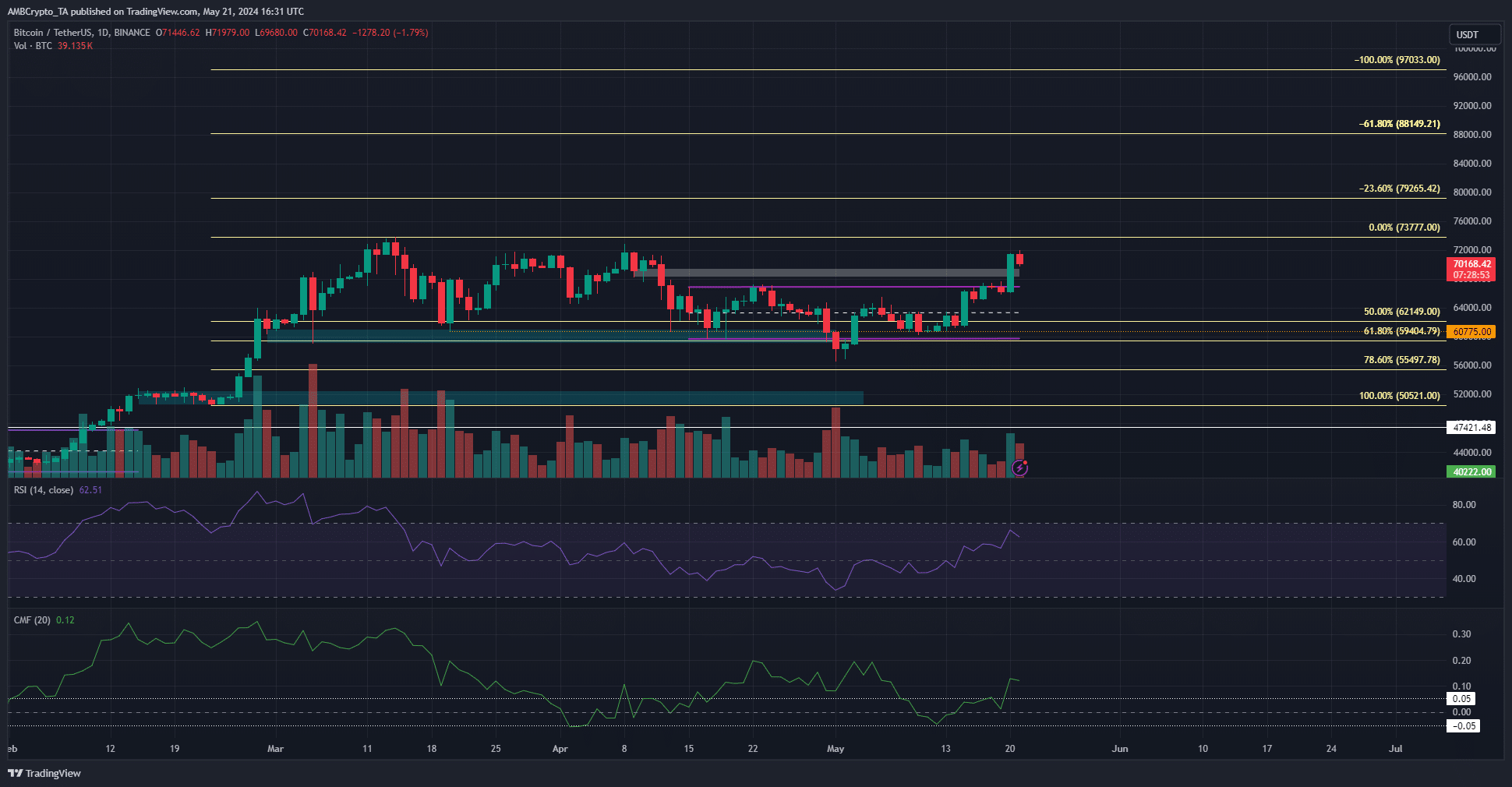

What are the resistance levels to watch out for after crossing ATH?

Source: BTC/USDT on TradingView

Both the local ranges (purple) and imbalances (white) were convincingly broken, and if this momentum continues, the $73.7k high could be blown away quickly.

Although the RSI has not yet crossed 70, this would be a strong sign that BTC is showing bullish dominance near all-time highs.

read bitcoin [BTC] Price Forecast 2024-25

The CMF surged above +0.05, indicating significant capital inflows and increased demand.

The Fibonacci extension levels (light yellow) indicated that $79,200, $88,100, and $97,000 are the next resistance levels to watch.