- The Ethereum ETF saw over $20 million in outflows.

- ETH gave up most of the gains from the previous trading session.

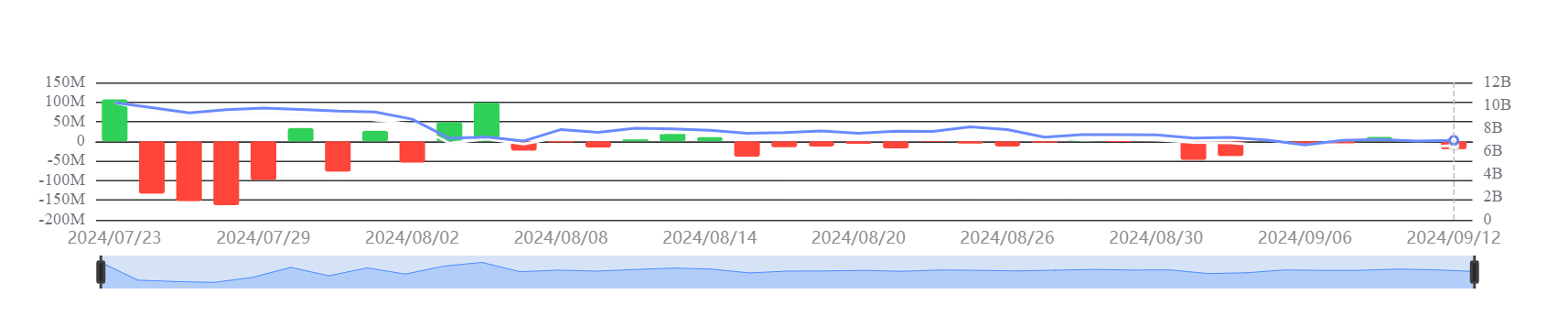

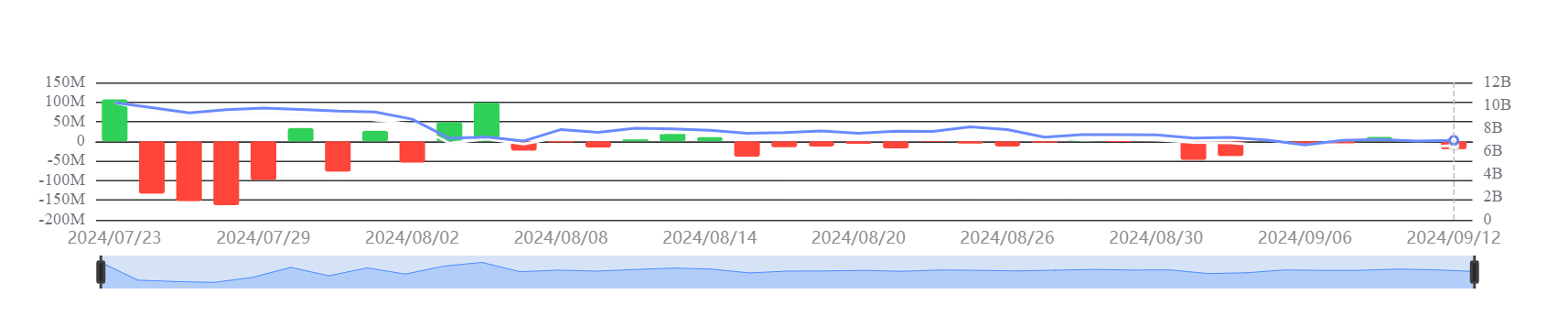

Recent data shows that the Ethereum ETF experienced negative outflows in the last trading session, marking the second consecutive day of outflows.

This is Ethereum [ETH] The stock closed in positive territory, ending the trading session on an upswing.

Ethereum ETF sees continuous outflows

According to data from Sosovalue, the Ethereum ETF experienced another outflow on Sept. 12, marking a continuing trend despite ETH closing the previous trading session in the positive.

Additionally, the analysis revealed that other U.S.-based ETFs saw zero net inflows, except for Grayscale, which saw an outflow of $20.14 million, with an overall net asset value of about $6.45 billion as of this writing.

Source: SosoValue

The outflows from the ETF could indicate that investors are taking profits or reallocating capital even as Ethereum's price continues to trend upwards.

This pattern suggests that while there may be some short-term repositioning among institutional investors, retail and direct market demand for Ethereum remains strong, potentially allowing the price to stabilize or grow despite ETF outflows.

ETH oscillates between gains and losses

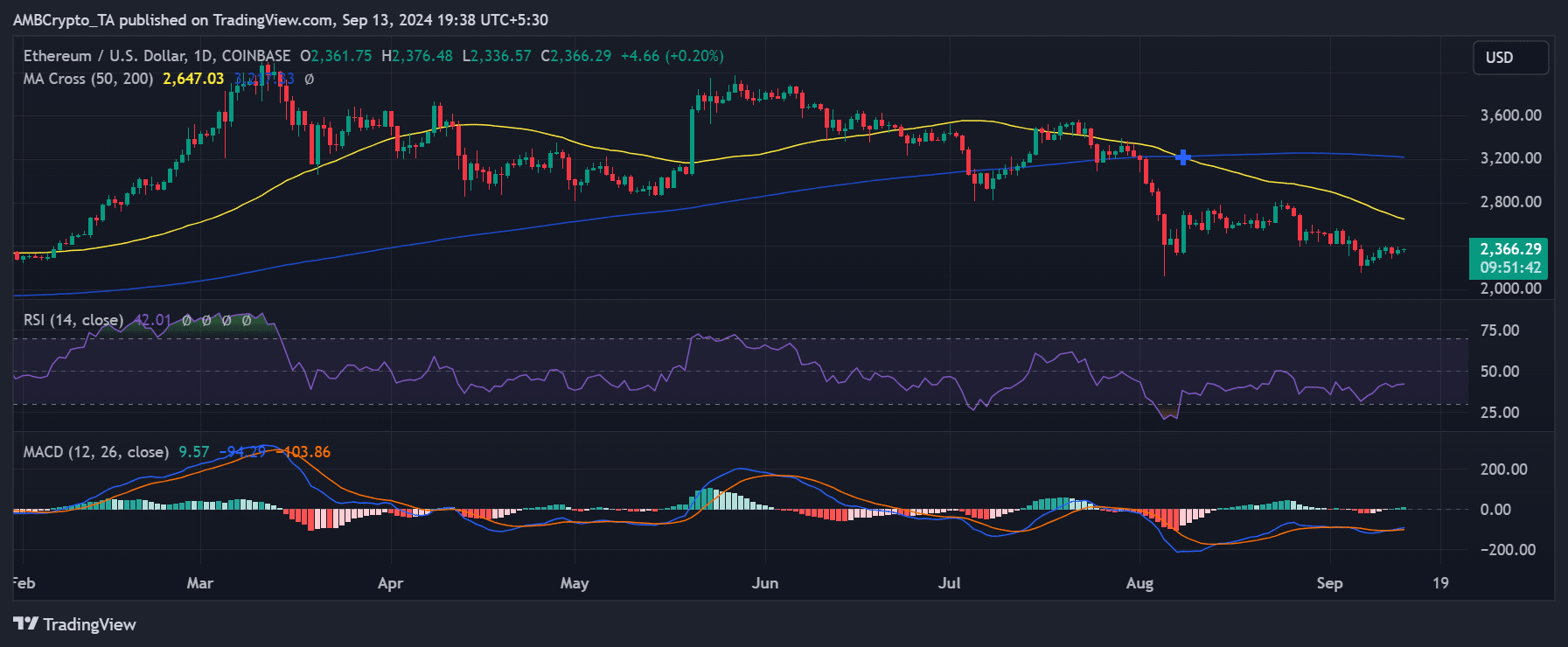

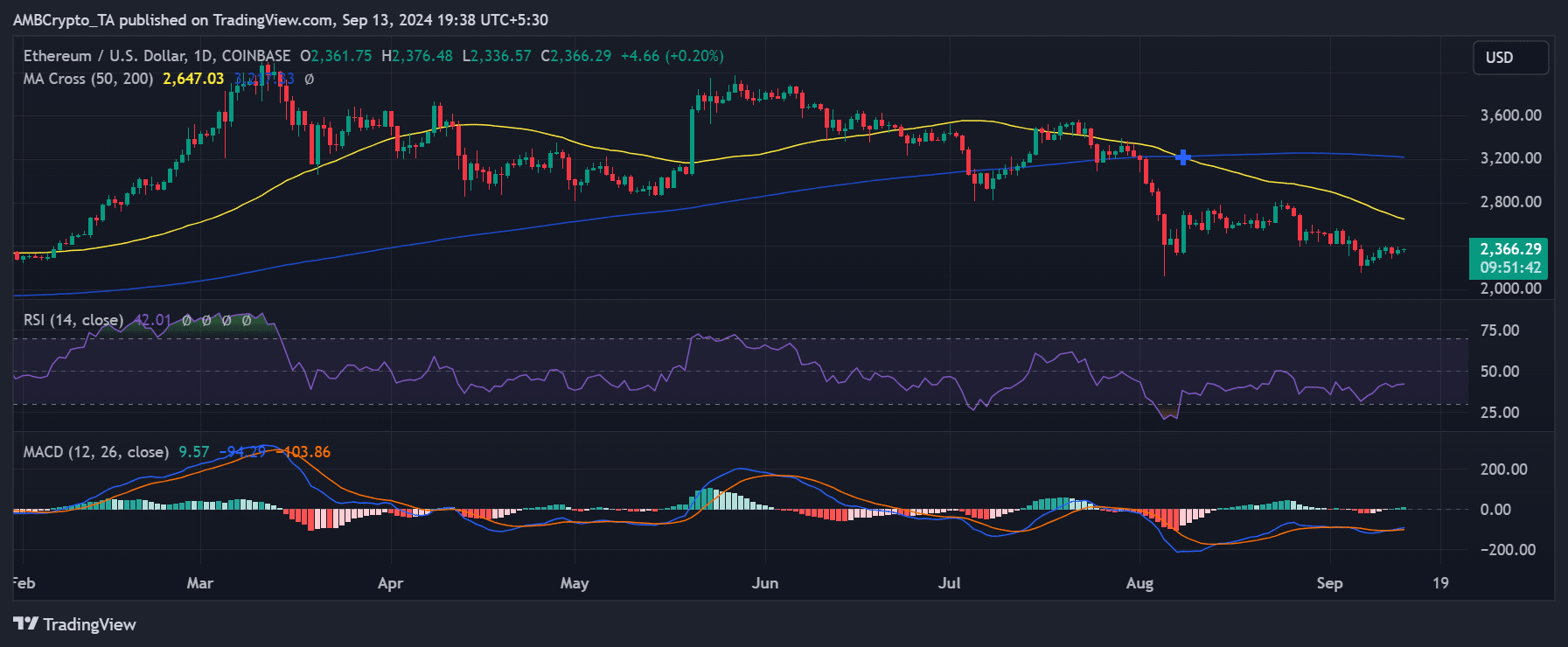

According to an analysis of Ethereum daily price charts by AMBCrypto, ETH ended the previous trading session up nearly 1%, trading at around $2,361.

However, as of the time of writing, the king of altcoins has lost most of those gains and is trading at around $2,350 at the time of writing, reflecting a decline of 0.45%.

Source: TradingView

Further analysis shows that ETH price is struggling to rise towards the $2,500 price level and remains subdued, as is the trend in Ethereum ETF flows.

The short-term moving average (yellow line) acts as a key resistance around this price level, and ETH has not been able to consistently break above it.

This resistance around $2,500 is holding strong and poses a major obstacle for Ethereum price momentum.

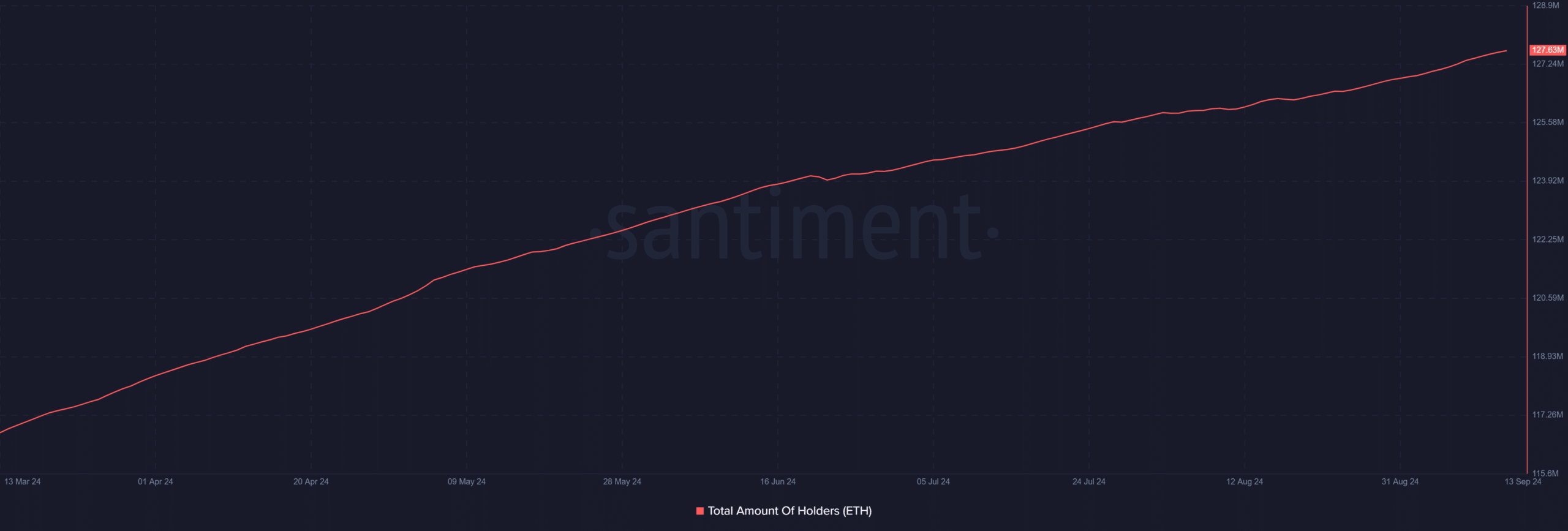

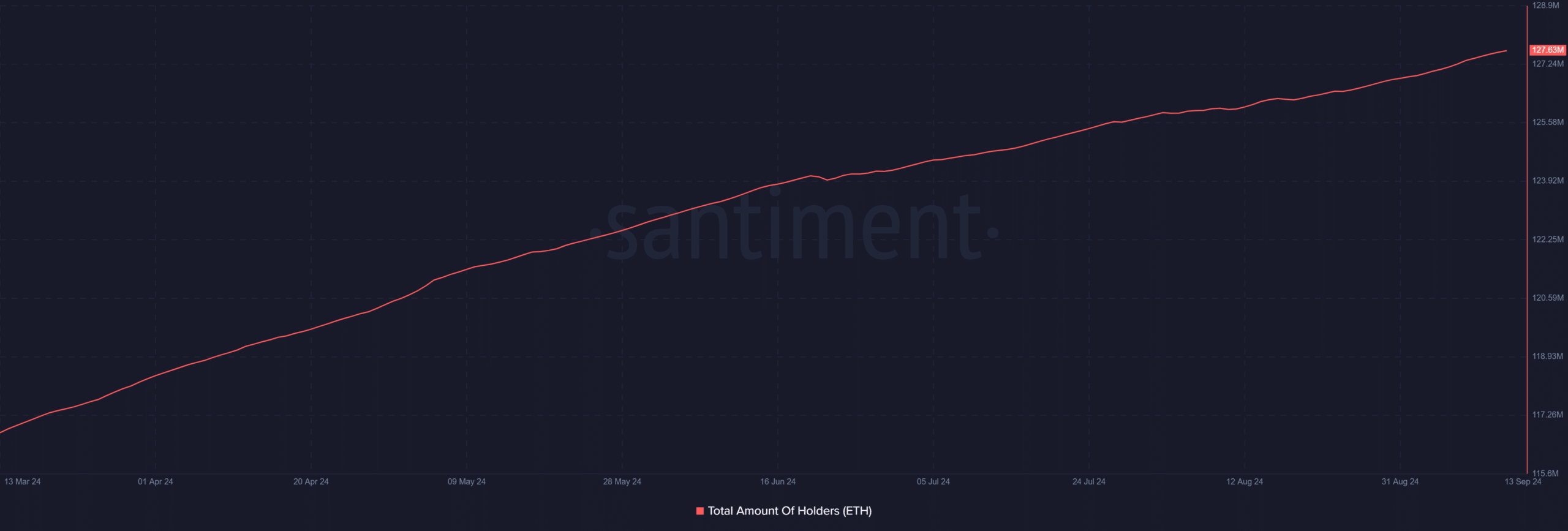

Holders continue to buy

A chart analysis of Ethereum holders reveals that the number of ETH holders continues to grow despite the recent trend of Ethereum ETF outflows.

At the time of writing, the number of holders exceeds 127 million and has been steadily increasing.

Ethereum [ETH] Price Forecast 2024-25

This indicates that the number of addresses with non-zero balances is increasing, suggesting that more addresses are actively purchasing ETH.

Source: Santiment

The increase in holder count is seen as a positive trend, especially given the current calm in price fluctuations and Ethereum’s resistance near the $2,500 mark.