The Securities and Exchange Commission (SEC) is considering delaying the anticipated approval of an Ethereum exchange-traded fund (ETF), according to Bitwise Chief Investment Officer Matt Hogan.

This development follows Bitwise Asset Management's intention to list a Spot Ethereum ETF.

Possible delay in Ethereum ETF approval

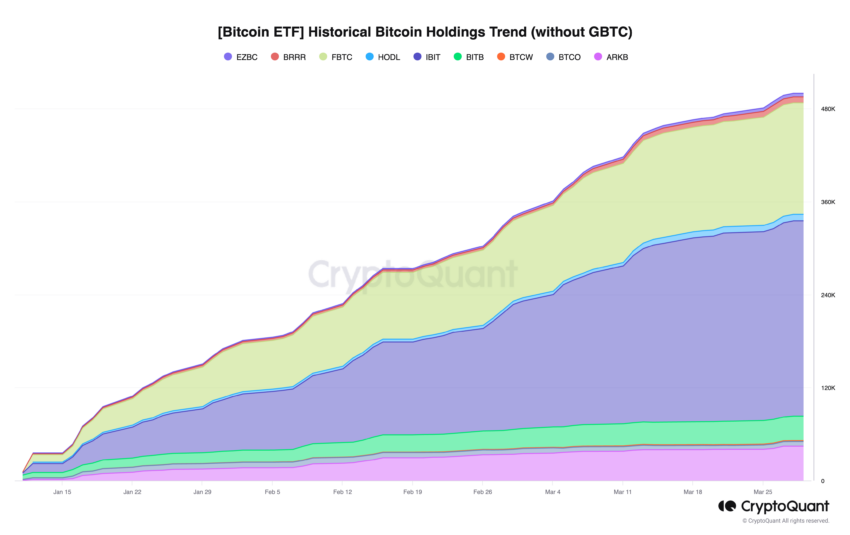

Bitwise launched the Bitwise Bitcoin ETF (BITB), a Bitcoin spot ETF, on January 11th. Since then, the ETF has enjoyed a meteoric rise, amassing more than $2 billion in assets and ranking fifth in the so-called “Cointacky Derby.”

Mr. Hogan shared insights on the explosive growth of BITB and other spot ETFs, highlighting the unprecedented acceleration compared to past ETF launches.

“these [spot Bitcoin ETFs] It is the fastest growing ETF in history. I think the fastest growing ETF before these was the Nasdaq 100 ETF (QQQM). We went from zero to $5 billion in one year. These ETFs have raised over $10 billion in net in less than two months,” Hogan emphasized.

Read more: How to trade Bitcoin ETFs: A step-by-step approach

Despite the success of Bitcoin ETFs, Hogan warned that the approval of Ethereum ETFs could be delayed. This may stem from regulatory vigilance given the growing interest in crypto investments and the complex dynamics of the market.

Hogan expressed confidence in the eventual launch of an Ethereum ETF. Still, he predicted that delaying it until later this year could actually benefit the market by giving traditional finance (TradFi) more time to understand and embrace cryptocurrencies.

“We think this is the natural path that crypto investors have been following for 15 years. They want to start with Bitcoin and then move on to other things. Ethereum is very attractive. I think it's true. I think [Ethereum] ETFs are more successful if launched within 12 months than if launched in May. As crazy as it sounds, TradFi is still digesting Bitcoin, and if you give TradFi time to get used to Bitcoin and cryptocurrencies, they'll be ready for what's next,” Hogan said. explained.

This strategic patience could pave the way for a stronger and more informed entry into Ethereum for institutional and retail investors following the overwhelming success of Bitcoin ETFs.

Read more: Ethereum ETF explained: What is Ethereum ETF and how does it work?

Hogan's insights reveal that perceptions of cryptocurrencies have changed significantly, from skepticism to recognition of the potential for significant return on investment. As the SEC considers its decision, the crypto community remains nervous and hopeful for a green light that could further legalize and encourage investment in Ethereum and other areas.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.