- Due to factors such as the CME, the US economy, and long-term holders, the crypto market is in good shape again.

- Bitcoin bulls are facing stress as the price returns to its immediate support level at $68,000.

The global cryptocurrency market capitalization rose 1.8% in the past 24 hours, continuing what appears to be a gradual recovery since the beginning of the weekend.

This time yesterday, Bitcoin was [BTC] It barely cost $60,000. At the time of writing, it was worth $63,111 and was up 4% on the daily chart. But is there any special reason for this slight increase? And will it hold firm?

Why is Bitcoin going up?

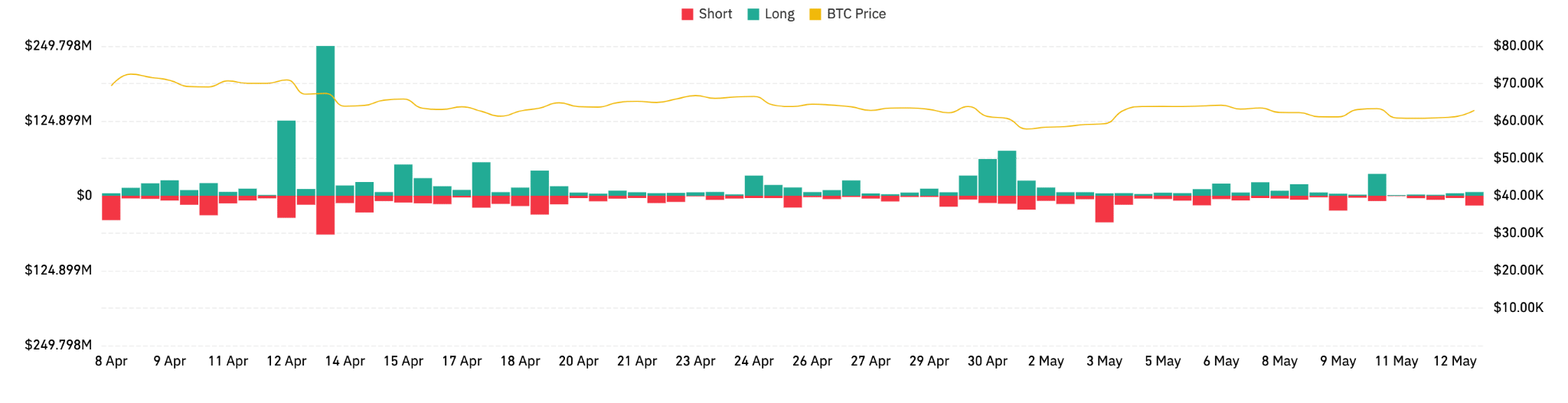

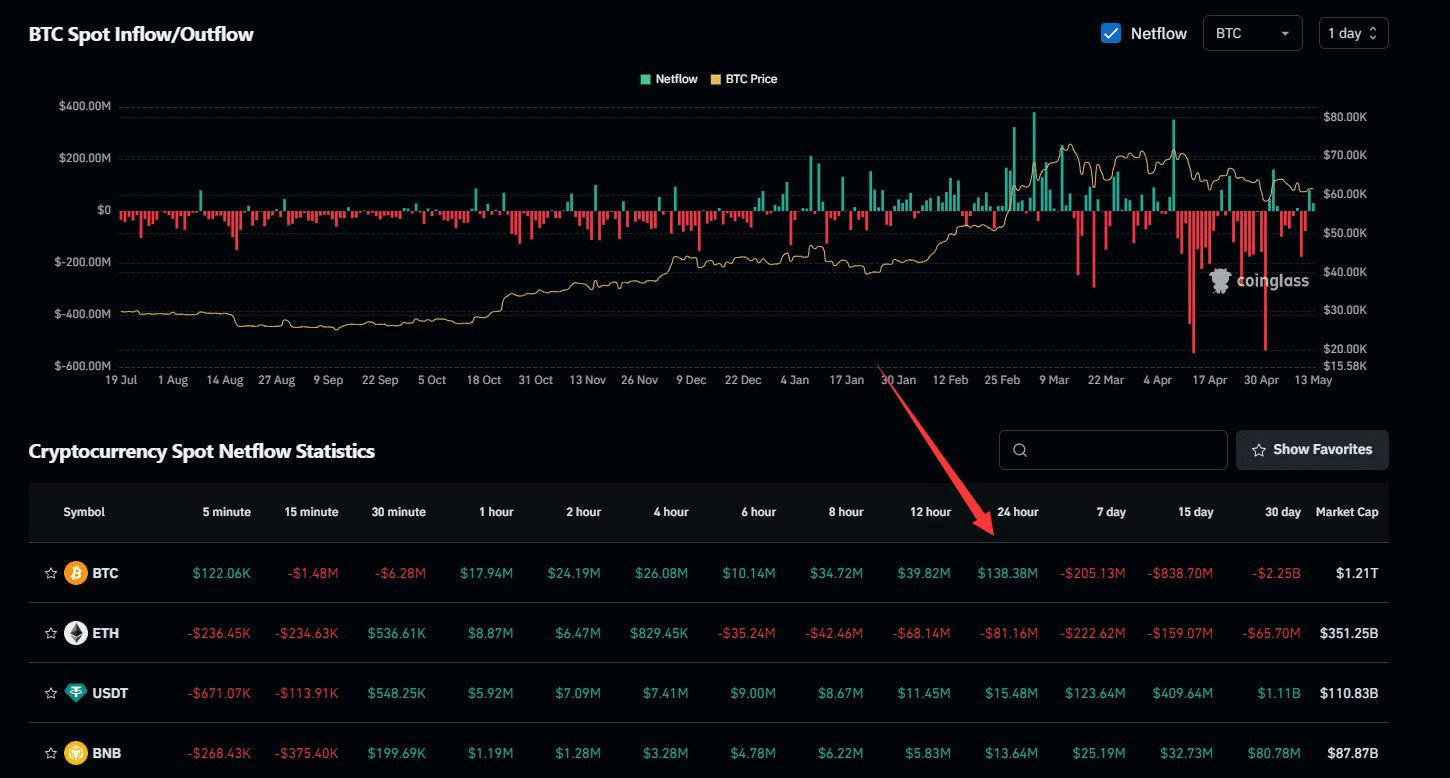

Looking at data from Coinglass, Bitcoin is the most liquid asset over the past day. More than $36 million was leaked, most of it from Binance [BNB].

Overall, the data suggests that traders are actively responding to price changes and market positions are changing accordingly, with the market highly susceptible to both external influences and changes in internal sentiment. It shows that you are sensitive to.

Source: Coinglass

still. Bitcoin is in the green and rising.Coin Glass examines the reason for sudden resilience data We can also see that Bitcoin's CME open interest increased by over 3% in 24 hours.

In addition, spot net flows are expected to be around $140 million over the same period.

Source: Coinglass

Another reason why Bitcoin is performing well is the US economic indicators that will be released on May 14th.

Following the negative pattern established by Jerome Powell this year, the interest rate decision has proven to be bullish for Bitcoin, given that a rate cut is unlikely to happen anytime soon.

Meanwhile, experienced Bitcoin holders are reflecting the mood of the 2021 bull market, as some on-chain suggests data.

Currently, long-term holders (LTH) are increasing their holdings after selling their BTC earlier this year.

The data suggests that these long-term holders are looking to capture a larger share of BTC supply, similar to mid-2021.

They see low Bitcoin prices as an opportunity to buy more coins at a discount and sell when market excitement builds.

The pattern can be traced from 2018 and 2021 and shows a repeating cycle of long-term holders buying at market lows and selling at market highs.

Despite these cycles, there is a noticeable and persistent trend in which the majority of Bitcoin is held by long-term holders.

Bitcoin's current position

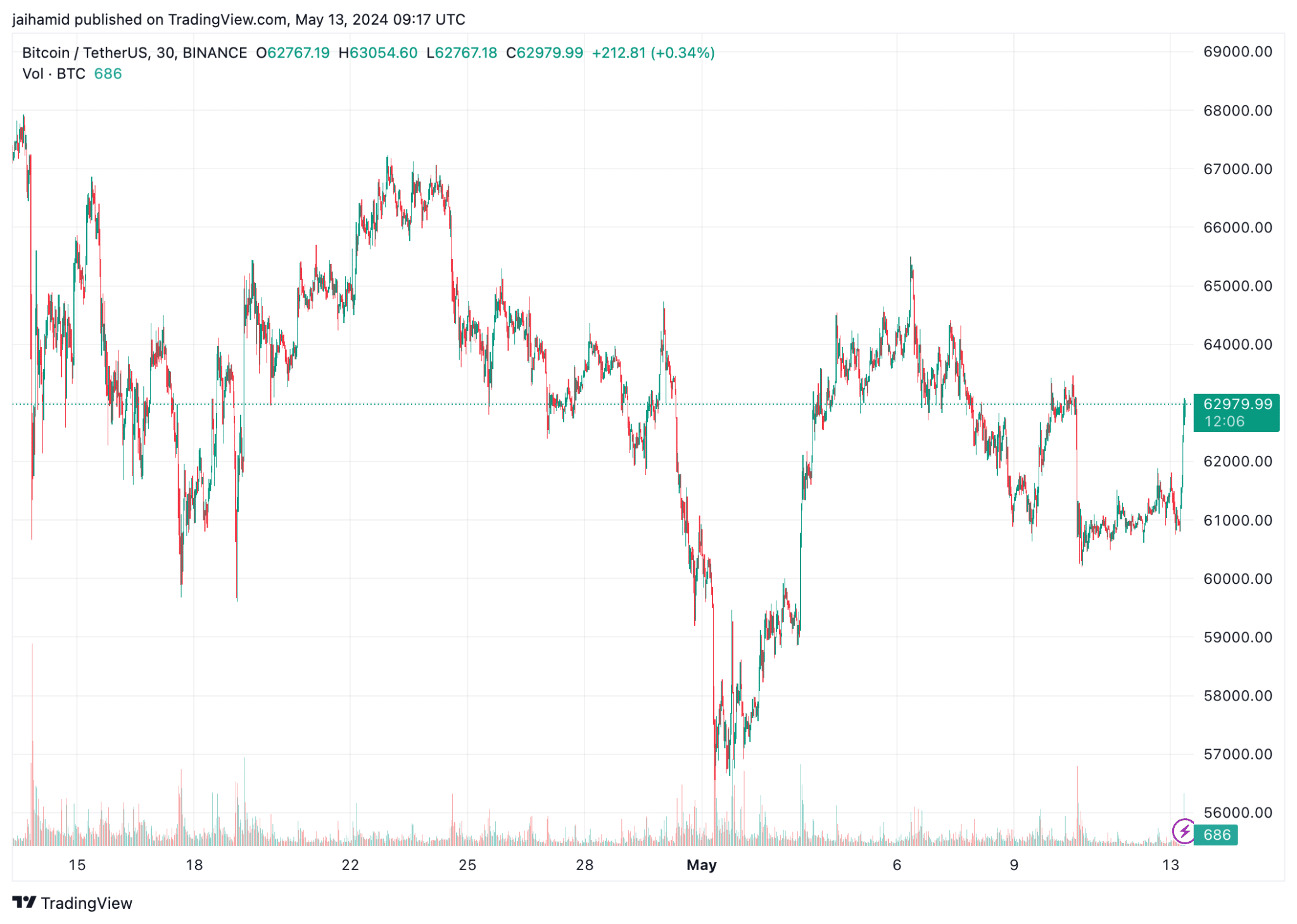

AMBCrypto's analysis of TradingView data for the BTC/USDt pair reveals strong resistance near $68,000, but BTC has tested this resistance numerous times over the past month, but it remains A breakthrough was not possible.

Conversely, there is a clear support level around the $60,000 level, below which we could see a further correction above $55,000 if Bitcoin declines.

Frequent and relatively large price movements over a short period of time (as evidenced by the size of the candlesticks) highlight the continued volatility of the Bitcoin market.

This pattern suggests a market for traders who can take short-term profits based on quick moves.

Source: TradingView

read bitcoin [BTC] Price prediction for 2024-2025

As of the latest data point, the price has fallen again towards the upward support level.

If the pattern holds true as the previous examples suggested, this could indicate another potential buying opportunity. Overall, the bears are in complete control.