At some point in your investing journey, you may look at your returns and wonder if they could be better.

If you're a Betterment customer? Have you ever invested in one of our globally diversified portfolios? Be prepared for one question in particular to creep into your mind.

“Wait, why isn't my core portfolio keeping up with the S&P 500?”

This question comes up from time to time, and the answer lies mostly in a little thing called home bias. To understand it better, let's first take a quick look into the magical world of markets.

Hello World. We are here to invest.

At Betterment, we talk a lot about “markets,” but in reality, there is no single market. Instead, there are many interconnected markets spread out across the world. And broadly speaking from our perspective here in the United States, you can place them in one of three buckets:

- us market

- International developed markets (Japan, most of Europe, etc.)

- International emerging markets (Brazil, India, etc.)

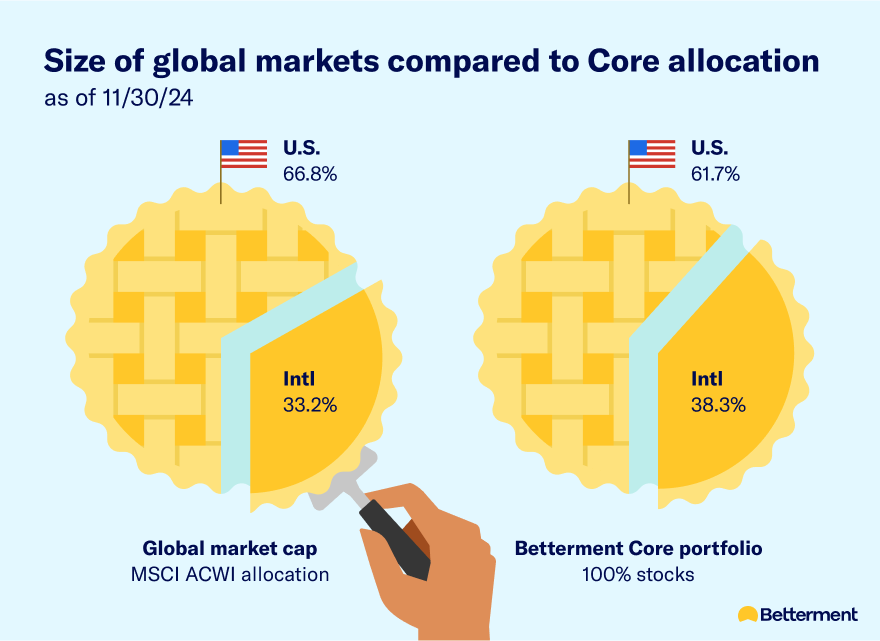

Although the US market is large, it is not the only player in the game. There are still trillions of dollars of assets traded in international markets. This is why our core portfolio, built in part on the idea that more diversification means less risk, roughly reflects the relative weightings of these players.

The US market has been cracking since 2010. But it won't last forever. So let's switch gears to performance and think about how we view recent trends through a more historical lens.

Hello, Home Bias (“USA! USA!”)

American exceptionalism runs in our blood. That can't be helped. It's also reflected in our investments. Home bias, or the tendency for American investors to favor American markets. And is there anything surprising at the moment? The U.S. economy recovered from the pandemic much faster and to a much wider extent than other countries.

Although the S&P 500 does not represent the entire U.S. stock market, it is made up of America's largest companies and well-known brands such as Apple and Ford, making it shorthand for investors' Team America. And while that market has exploded in the last decade, the 2000s saw the international market consolidate. Historically, people take turns leading the charge every five to 10 years.

So what's an investor to do?

We do not recommend market picking, so the caveat about stock picking applies here as well. If you're investing for the long term, there's a good chance the U.S. market will go into a tailspin at some point. And in that scenario, a globally hedged portfolio would very likely smooth out returns from year to year, making your investment journey feel less like a hair-raising roller coaster.

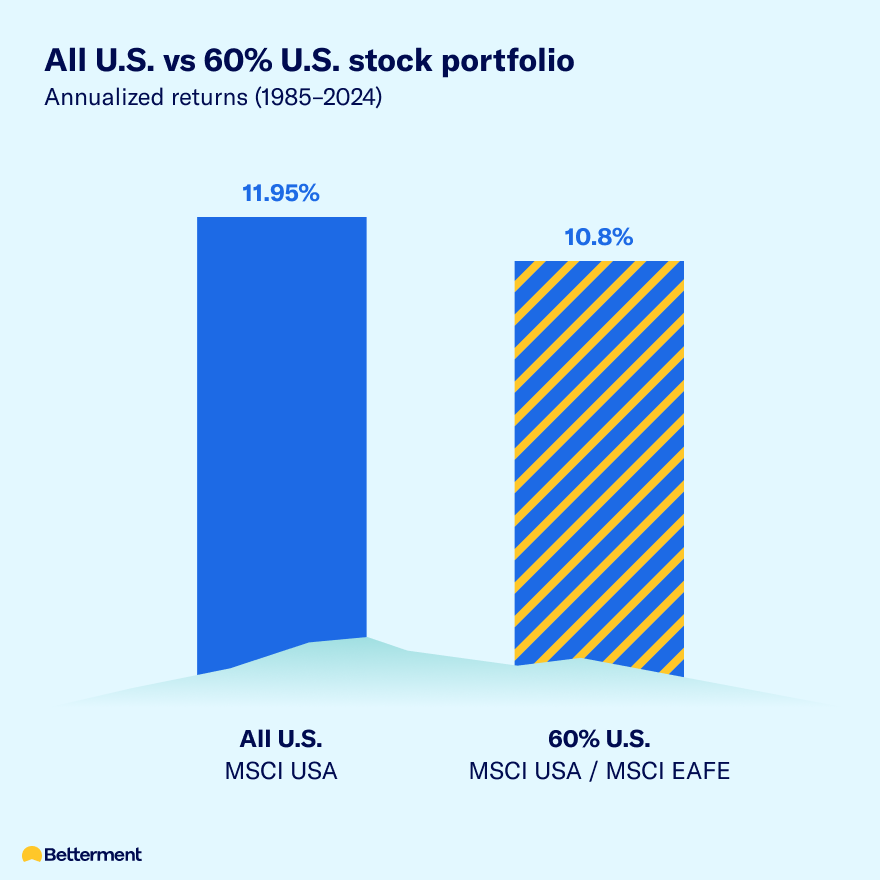

That being said, diversification is a sliding scale. There is no pass/fail, bad or good. And sometimes, just enough is enough. Imagine you've been saving for your retirement for the past 40 years. The difference in annualized returns between an all-US stock portfolio and a globally diversified portfolio (e.g. 60% US) over that period would be (drumroll please): 1.15%.

And while 1% makes a difference over time (which is why we're so picky about taxes and fees); If you've been saving steadily by then, you're likely in good shape anyway.

So here's another chance to breathe easy. Both the All-American and Almost American options have been reliable paths to long-term wealth for the past 40 years.

Although this number is purely hypothetical and educational in nature, it clearly illustrates the point. They do not reflect the performance of Betterment's customers, but rather reflect two different ways of constructing portfolios.

We offer several globally diversified portfolios, each comprised primarily of U.S. stocks, as well as two additional ways to make investing more accessible. I am.

- Invest in our flexible portfolio and reallocate your international exposure to US asset classes.

- When you sign up for Betterment Premium, you get access to exclusive investment options, including a U.S.-only portfolio.

Either way, it will be home sweet home (biased).