- This week, net Ethereum inflows to exchanges increased to a two-year high.

- Market sentiment remains significantly bearish.

Ethereum [ETH] Net inflows to virtual currency exchanges are collected, Highest level in 2 years This week, we are in the middle of a “legal campaign” to classify major altcoins as securities.

Previously AMBCrypto report The US Securities and Exchange Commission (SEC) has revealed that it has sent investigative subpoenas to US companies, including the Ethereum Foundation, a Swiss-based nonprofit organization that supports the network. There is.

According to the report, the regulatory watchdog began investigating the Ethereum Foundation after the Ethereum network transitioned from a proof-of-work consensus mechanism to a proof-of-stake (PoS) model in September 2022.

Price rises due to coin collapse

According to data from IntoTheBlock, the net amount of ETH flowing into exchanges this week totaled $720 million. According to the data provider, the last time weekly coin inflows into exchanges were this high was in September 2022.

When an asset witnesses an increase in net flows to an exchange, it generally indicates that its holders are selling for a profit or moving their tokens to the trading platform to hedge further losses. I am.

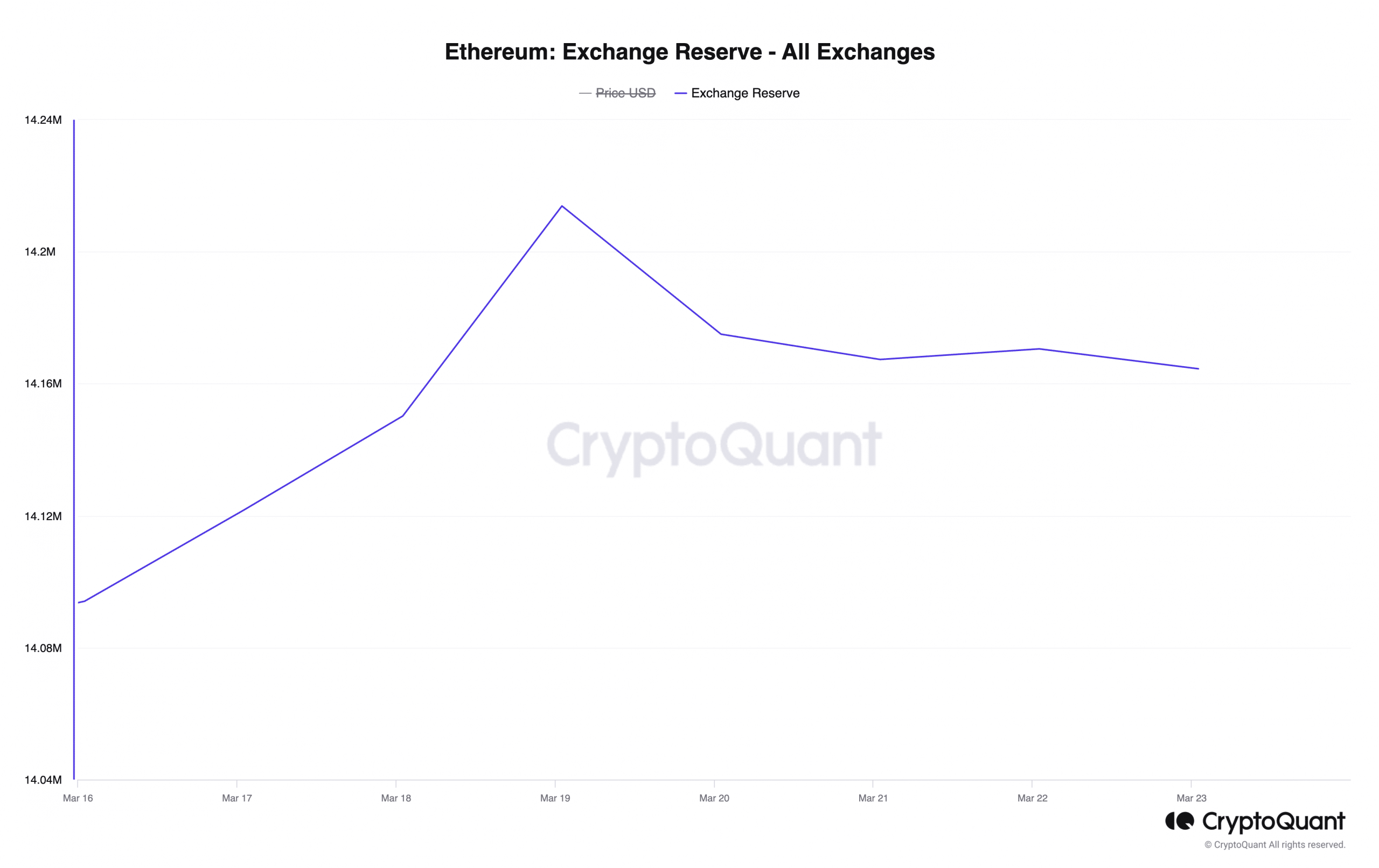

These inflows resulted in a slight increase in ETH exchange reserves during the period under review.according to cryptoquant's According to the data, it increased by 1%. At the time of writing, 14.2 million ETH, worth approximately $47 million, was held across exchanges.

Source: CryptoQuant

This week's surge in ETH inflows to exchanges was in part due to the SEC's action against the Ethereum Foundation, but was also due to the overall market decline recorded during that period.

around CoinGecko's According to the data, the global crypto market capitalization has fallen by 4% in the past seven days due to the coin's sharp decline.

ETH holders approach with caution

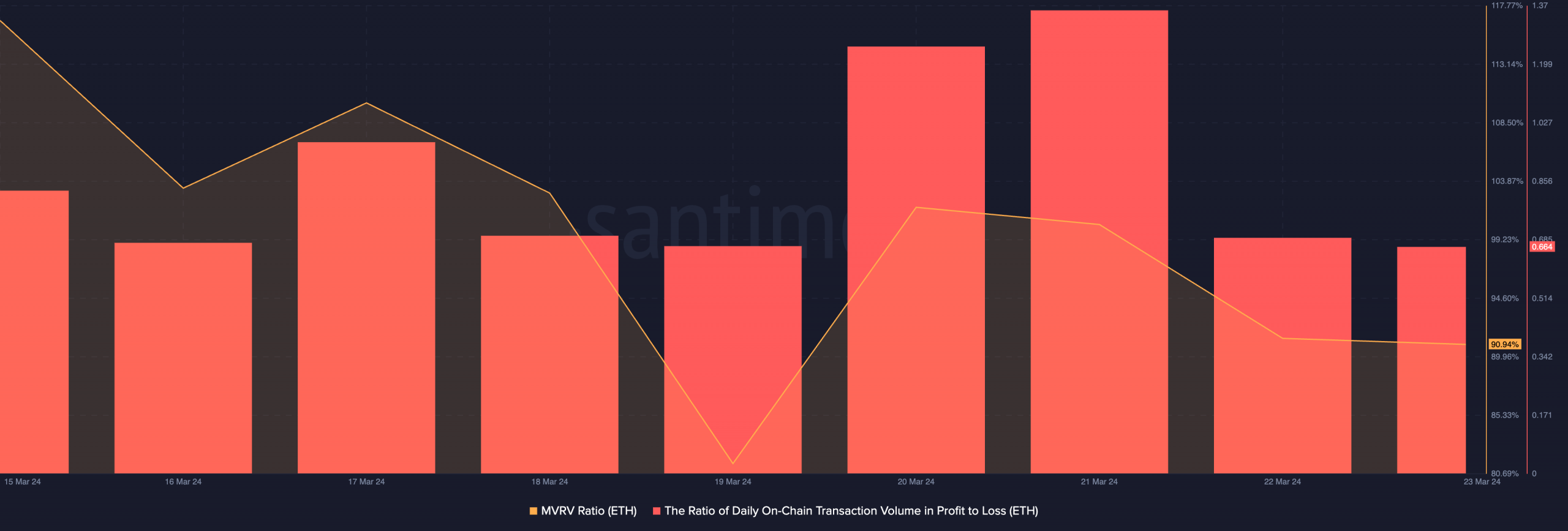

This week's review of ETH trading profitability revealed significant bearish sentiment in the market.

ETH's market value to realized value (MVRV) ratio has plummeted by 22% and is found to have reached 90% at the time of writing. Similarly, ETH's daily trading volume profit-to-loss ratio plummeted to a low of 0.664.

When these two key on-chain metrics are considered together, there is a difference. ETH's MVRV ratio of 90% suggests potential undervaluation and could mean now is the time to buy.

What is 1,10,100 ETH worth today?

On the other hand, the daily ratio of profit to loss in ETH trading volume of 0.664 indicates that there are more investors selling their coins at a loss.

This divergence suggests that although ETH is currently undervalued, now may be a good time to buy. Near-term investor sentiment remains cautious to bearish. This is because investors are willing to sell their coins at a loss rather than hold onto them or buy more.

Source: Santiment