- ETH stalls on the charts as meme coins gain momentum throughout this week

- A strong catalyst may be required to cause a short squeeze

Cryptocurrency market rises, driven by Bitcoin [BTC] Closer to the former ATH, Ethereum [ETH] This was a weekly increase of nearly 10%. At the time of writing, the altcoin was trading at $2.6,000.

This reflects a common trading strategy, where high-value altcoins thrive when Bitcoin hits key resistances, prompting retail investors to move their funds to reduce risk.

However, unlike previous cycles, ETH has continued to consolidate over the past three days. Meanwhile, BTC recorded daily gains of over 2% over the same period.

Simply put, there is a fundamental shift in market dynamics.

Meme coins benefit the most

Over the past seven days, meme coins have skyrocketed dramatically on the price charts, with three of them top The five gainers are meme tokens.

Notably, DOGE led the pack with an impressive weekly gain of 30%. This is a sign of investors' confidence in high-risk assets that can deliver quick and huge returns.

According to AMBCrypto, interest in ETH waned as traders began to see upside potential in the memecoin, leading to stabilization on the charts.

However, another AMBCrypto report He suggested that the rise in DOGE could be a sign of market overheating. Something that may face amendments in the near future.

Therefore, the question arises, could this potential pullback pull capital back into ETH and set the stage for a short squeeze?

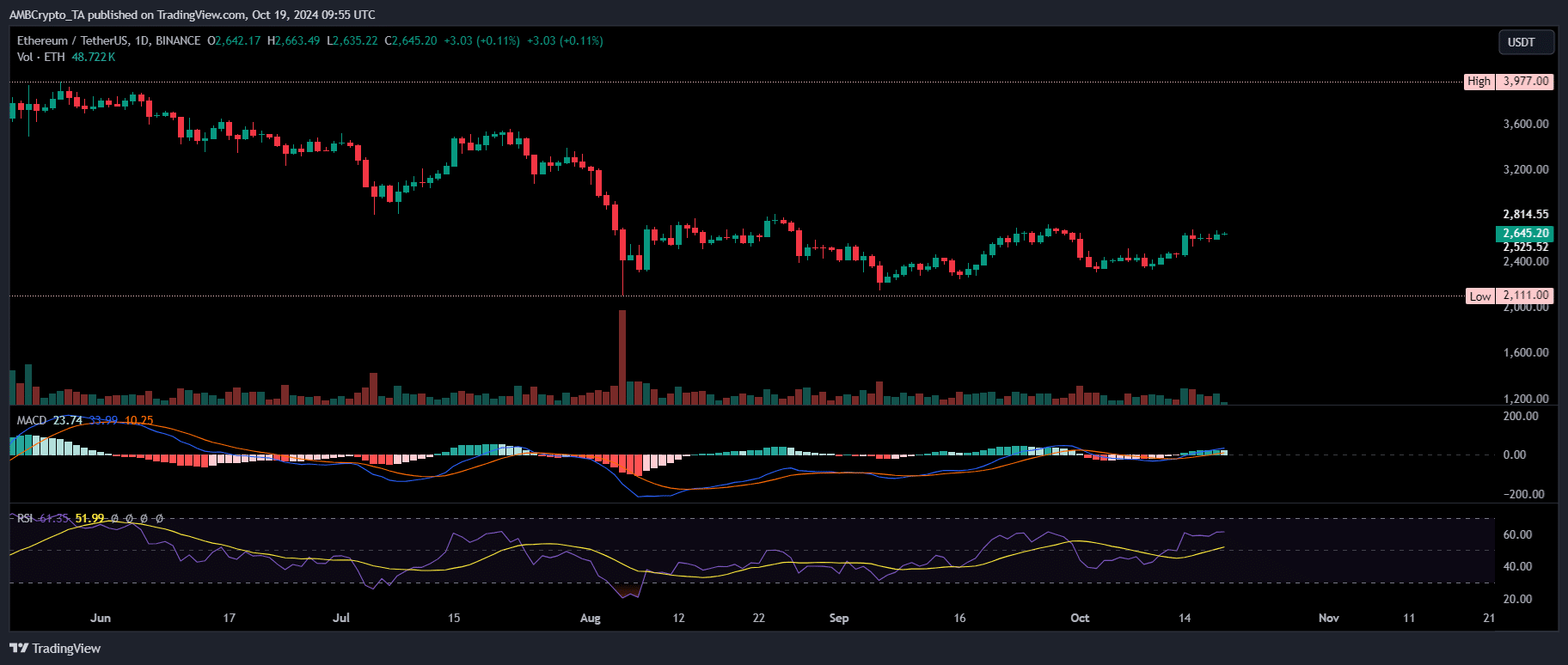

Source: TradingView

At the time of this writing, the MACD line was close to crossover. If all goes as planned, it could provide further confirmation of the expected ETH movement over the weekend.

On the contrary, the RSI has trended upward for 74% of the price movements over the past two weeks, predicting overbought conditions and increasing the likelihood of a trend reversal soon.

Overall, it can be argued that ETH is losing momentum in key areas. metricsselling pressure is building as traders continue to ride the meme coin wave.

If this trend persists and is not counteracted by a change in momentum, it could cause the liquidation of long positions and force holders to sell.

This situation will limit ETH's ability to gain momentum when BTC peaks. This is usually an indicator of the start of an altcoin season.

ETH holders are aiming for a decline

Typically, retail investors unloading their holdings signals a high market ceiling as they cash out their profits.

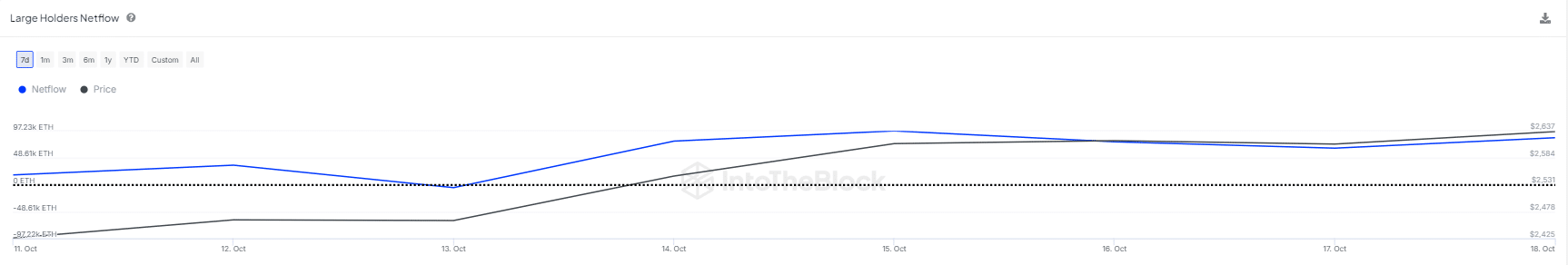

Conversely, if large holders enter the accumulation phase at local lows, they can establish a market bottom and view it as a potential buying push.

Over the past three days, large holders have strategically bought ETH at bargain prices as ETH has stalled. They predicted that BTC would continue to rise and more investors would seek refuge in altcoins.

Source: Into the Block

As a result, despite the concerns prevalent in the market, a significant amount of ETH tokens were withdrawn from exchanges, causing a weekly appreciation of 10%.

read ethereum [ETH] Price prediction for 2024-2025

In short, ETH is at a critical juncture, influenced by a variety of factors that will shape its future trajectory.

If Memecoin continues to drain liquidity from BTC traders, the potential for a short squeeze may depend on the activity of large holders. This could make ETH more vulnerable to uneven concentration and sudden price fluctuations.