8:05 ▪

4

Minimum read time up to ▪

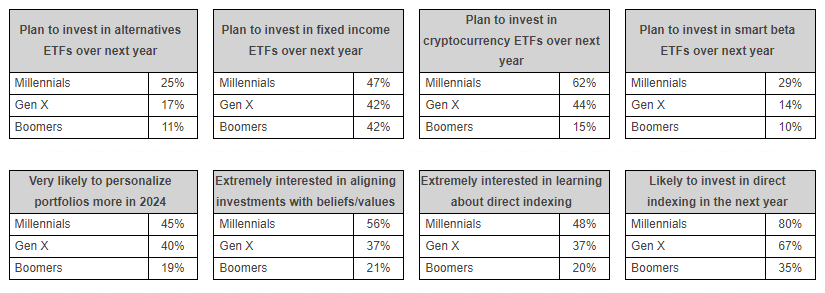

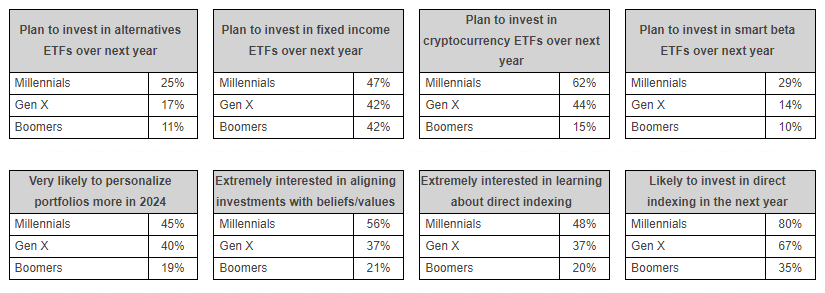

Millennials have always been at the forefront of adopting new financial technologies. A recent study by Schwab shows that this group of investors is increasingly turning to cryptocurrencies, primarily through ETFs. This report reveals their strong interest in digital assets, placing them at the top of their investment priorities for next year.

Why Millennials are betting on crypto ETFs

It has long been known that millennials are adopting cryptocurrencies in large numbers. However, research conducted by Schwab revealed that: Almost half of millennials surveyed plan to invest in crypto ETFsputting this asset class at the top of their preferences for next year. But why is there so much enthusiasm for cryptocurrencies via ETFs? Here's the answer Flexibility and accessibility.

In fact, crypto ETFs allow investors to: Benefit from cryptocurrency volatility While diversifying your portfolio with a regulated structure. For the Millennial generation, Opportunity to invest in asset classes with the potential to generate high returns There is no need to directly manage the crypto itself.

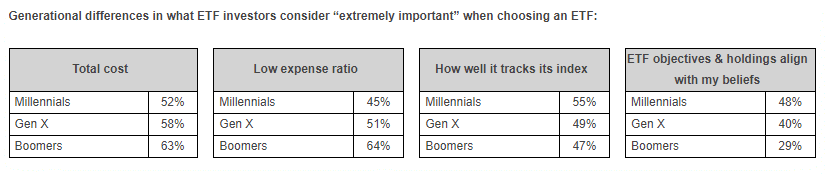

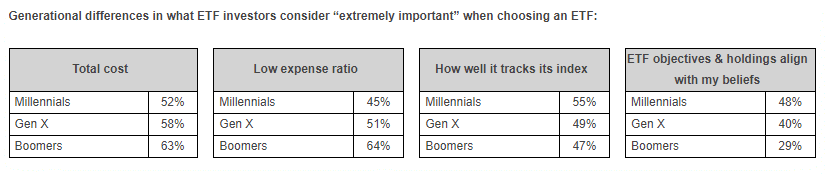

- 45% of Millennials are expected to invest in crypto ETFs in 2024.

- 57% believe diversification is their main goal.

- 46% are looking to reduce risk by integrating bonds into their portfolios.

David Botset, director of innovation at Schwab, emphasizes this approach:

“Millennial investors are bold and thoughtful. Their affinity for ETFs reflects their desire to combine risk and safety to achieve their financial goals.“

Increased adoption

Millennials aren't just investing. they are Customize your portfolio to match your values. According to research, 62% of them plan to invest in crypto-related ETFs. This generation is often referred to as “FOMO” (fear of missing out). maximize profits While aligning your investments with your beliefs.

this drives them Seeking investment opportunities that combine innovationresponsibility, and profitability.

Another important factor is how millennials adapt. ETFs to weather economic uncertainty. Unlike previous generations, they tend to take calculated risks in order to profit from the volatility of the crypto market.

Their goal is clear. Achieve rapid return on investment At the same time, they also benefit from the regulation of ETFs, which provides a more secure framework than direct cryptocurrencies.

They also prefer actively managed ETFs and look to leverage the expertise of portfolio managers to optimize their investments. This approach sets them apart from other generations, which tend to be more conservative.

Millennials therefore see crypto ETFs as an opportunity for diversification and growth. The questionable practices of traditional banks have left many people high and high, but millennials are determined to reverse this trend by betting on Bitcoin to get rich. I am.

Get the most out of your Cointribune experience with the “Read to Earn” program! Earn points every time you read an article and get access to exclusive benefits. Sign up now and get rewards.

Blockchain and virtual currency revolution! Affect the fragile social situation, have a serious impact on the economic society, and solve the problems of your choice.

Disclaimer

The views, ideas and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Please do your own research before making any investment decisions.