- Ethereum has fallen below the $3,000 price range.

- Profit from ETH supply decreased by approximately 5 million.

Ethereum [ETH] After trading activity ended on April 30th, the market witnessed a significant price decline. This decline had a noticeable impact on several key indicators related to the asset.

Ethereum falls 6%

AMBCrypto’s Ethereum analysis reveals a negative conclusion for April, which was characterized by a significant price decline.

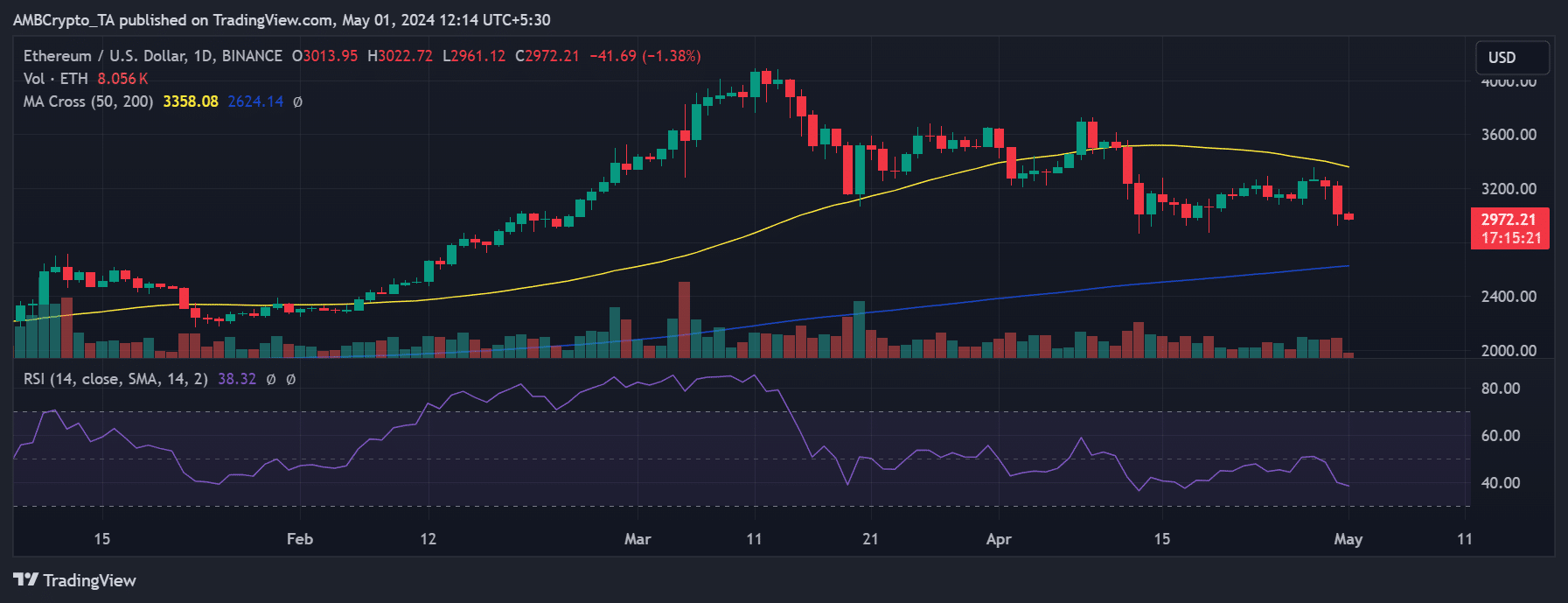

On April 30th, ETH fell by 6.29% and traded around $3,013, managing to maintain the $3,000 price level.

However, as of the latest update, the decline continues and Ethereum has fallen below the $3,000 threshold. At press time, the price was approximately $2,972.

Source: TradingView

Initially, Ethereum appeared poised to break out of the short-term moving average (yellow line) that acted as resistance in the $3,300 to $3,500 range.

However, the recent economic downturn has pushed Ethereum further away from this goal, forcing it to cross an even larger threshold on the Relative Strength Index (RSI).

At the time of writing, ETH is below 40 on the RSI, indicating a strong bearish trend.

Long feels the heat of the dip

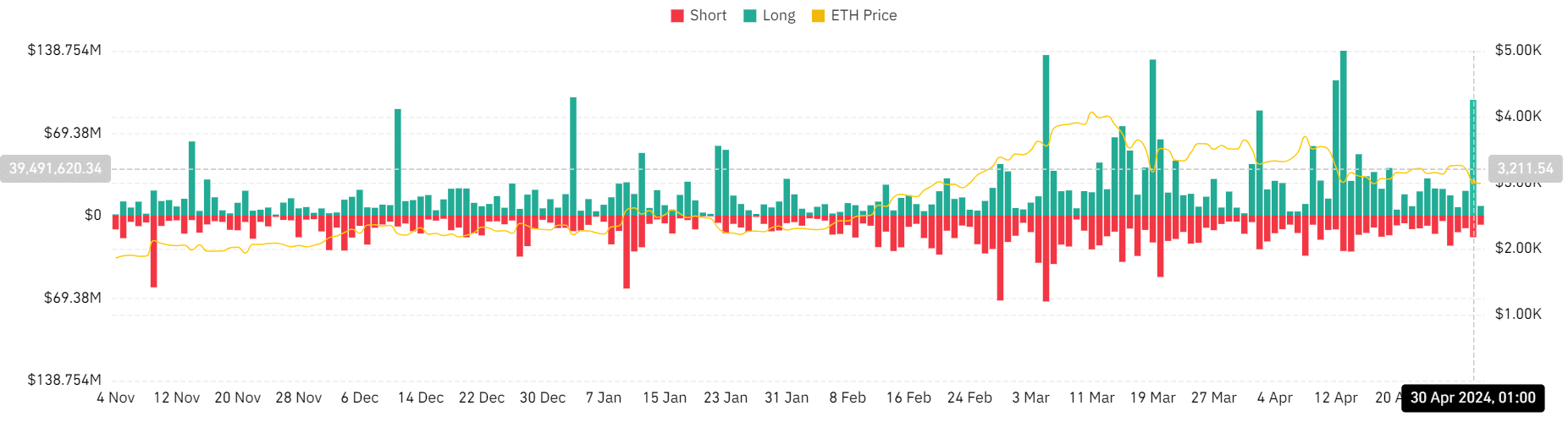

AMBCrypto’s analysis of Ethereum liquidation charts on Coinglass reveals a notable spike in liquidation amounts on April 30th.

The altcoin king recorded its highest liquidation value in weeks, totaling more than $115 million by the end of the day.

A closer look at the chart reveals that long positions accounted for around $97.4 million and are bearing the brunt of liquidations. In contrast, short positions contributed $18.11 million to the total.

Source: Coin Glass

This surge in long liquidations marks the highest trading volume in recent weeks, meaning that traders who had taken long positions or were anticipating a rise in Ethereum's price were forced to liquidate their positions. ing.

Possible reasons for Ethereum decline

Discussions are taking place over the Hong Kong ETF, which was launched on April 30th, with some observers saying: express disappointment Performance due to low volume.

The total amount was around $12.7 million, of which more than $9.7 million was in Bitcoin and more than $3 million in Ethereum, according to the numbers.

but, contrasting views The volume was adequate, suggesting it was not a failure, as other observers have suggested. The slow start led to negative movement in Ethereum price.

Additionally, concerns that the Federal Reserve may maintain its hawkish stance at the Federal Open Market Committee meeting on May 1 may have added to the decline.

Cryptocurrency markets have historically seen declines in the lead-up to FOMC meetings, with persistent inflation in the U.S. economy discouraging expectations for interest rate cuts and investors cautious in anticipation of policy changes.

Is your portfolio green? Check out our ETH Profit Calculator

Ethereum supply decreases and profits decrease

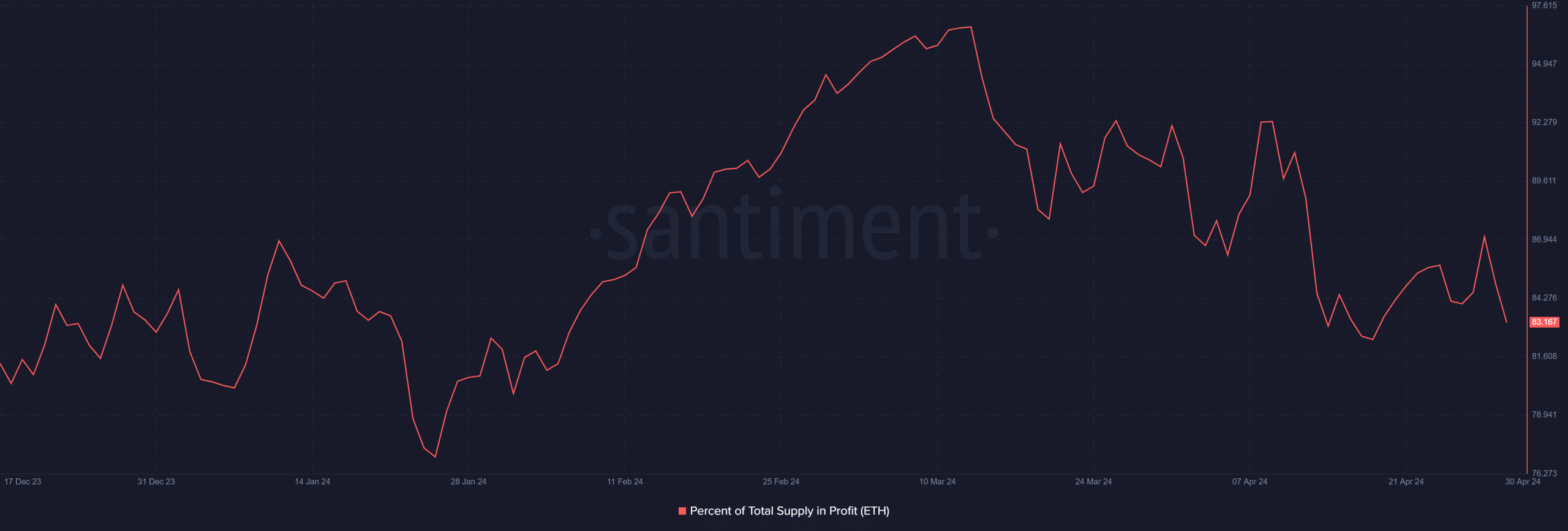

Ethereum’s profit supply has revealed a sharp decline. According to his analysis of AMBCrypto via Santiment, between April 28th and 30th, ETH profit supply decreased from over 87% to approximately 83%.

This change represents a decrease in trading volume from over 119 million ETH to approximately 114 million ETH. It suggested that more holders are holding their ETH assets at a loss as prices continue to fall.

Source: Santiment