- Bitcoin has gained 7.96% over the past week.

- Market fundamentals suggested that Bitcoin may soon experience a market correction.

As expected, Bitcoin [BTC] We experienced a strong October. Although this month started on a down note, cryptocurrencies posted significant gains that outweighed previous losses.

Since hitting a low of $58,867, BTC has seen a strong rally, reaching July levels of $69,000.

In fact, as of this writing, Bitcoin is trading at $69,028. This marked 7.96% over the past week, with the cryptocurrency gaining 9.52% on the monthly chart.

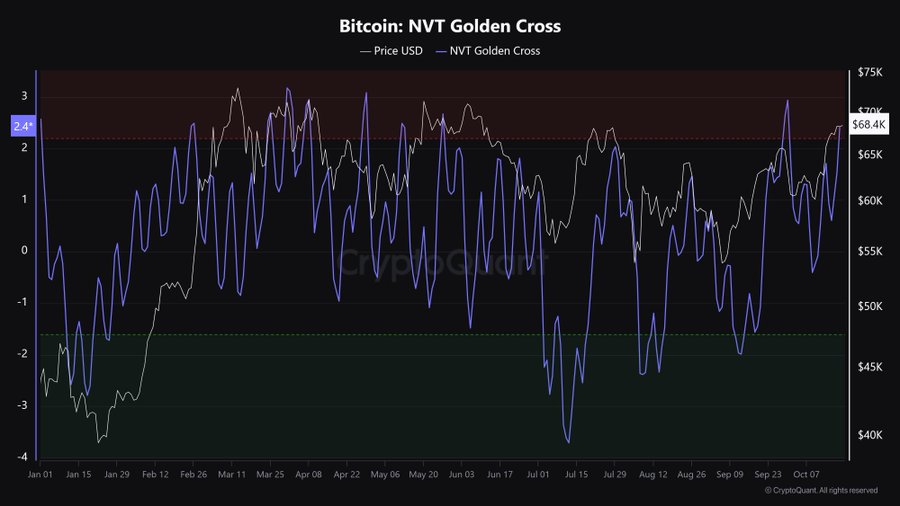

Analysts are equally optimistic and pessimistic about the recent economic boom. For example, CryptoQuant analyst Burak Kesmeci suggested that Bitcoin could undergo a market correction, citing NVT's golden cross.

market sentiment

In his analysis, Kesmeci hypothesized that Bitcoin's NVT golden cross entered the hot zone in the short term.

Source:X

He said the market will eventually experience a correction and then trend back up.

For the uninitiated, the NVT Golden Cross hitting the hot zone suggests that BTC is currently experiencing higher network activity than is warranted.

Therefore, it is overvalued compared to the amount of value transferred on the blockchain.

This suggests a potential overbought condition where the price increase is not supported by the underlying usage of the network.

These situations often occur prior to a price correction, where the market corrects and brings prices back in line with network fundamentals.

Based on this analogy, Bitcoin will experience a pullback in the short term.

What the BTC chart tells us

As Keshmeshi observed, the current fundamentals do not support a sustained rally and the stock could fall to meet demand.

The question, therefore, is how sustainable the current rally is and what market indicators are suggesting.

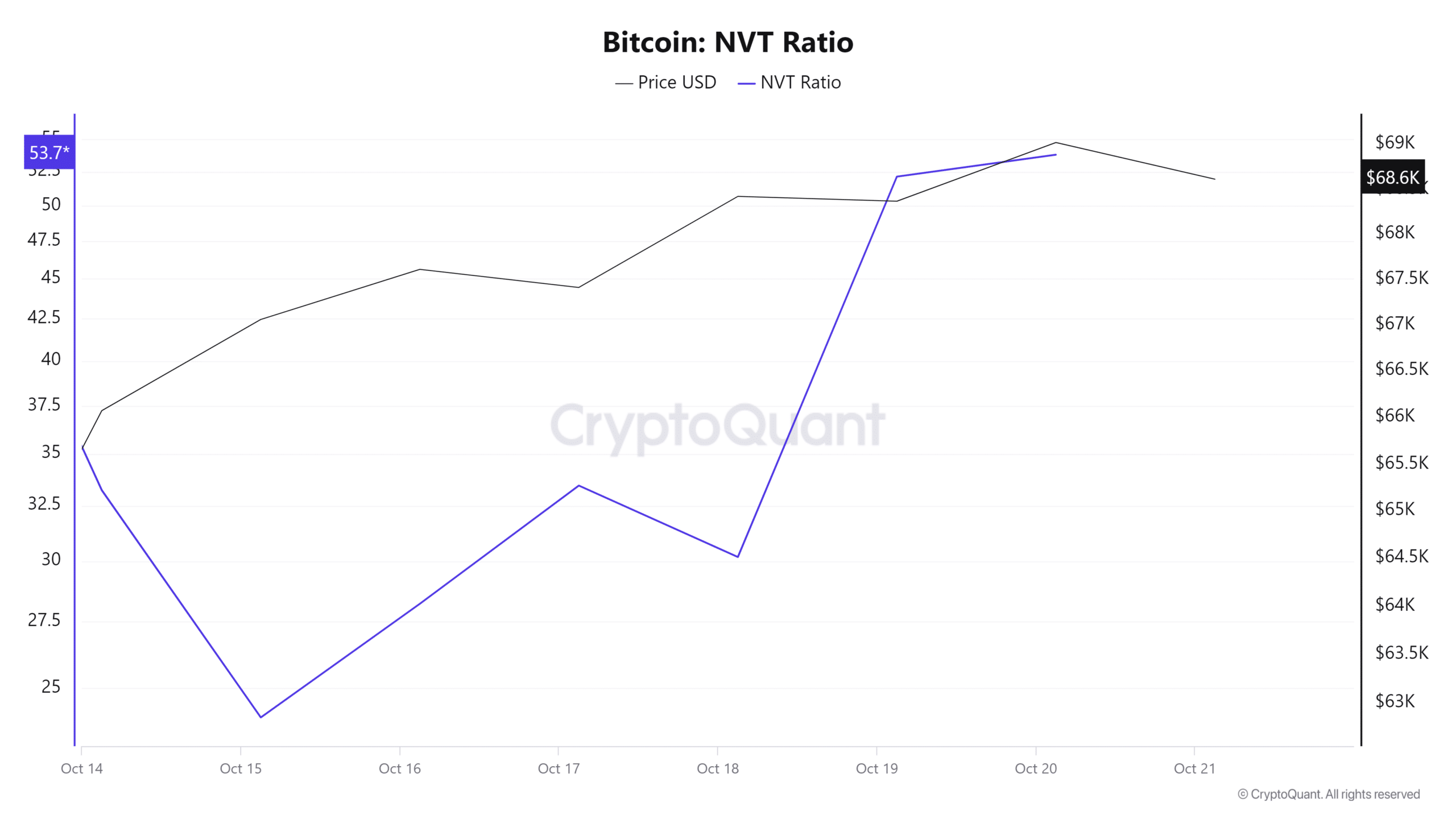

Source: CryptoQuant

The first metric to consider is Bitcoin's NVT ratio, which measures the network value for transactions.

According to CryptoQuant, the NVT ratio has increased over the past week. This increase means that BTC is overvalued compared to actual utilities and network activity, pushing the price unsustainably high.

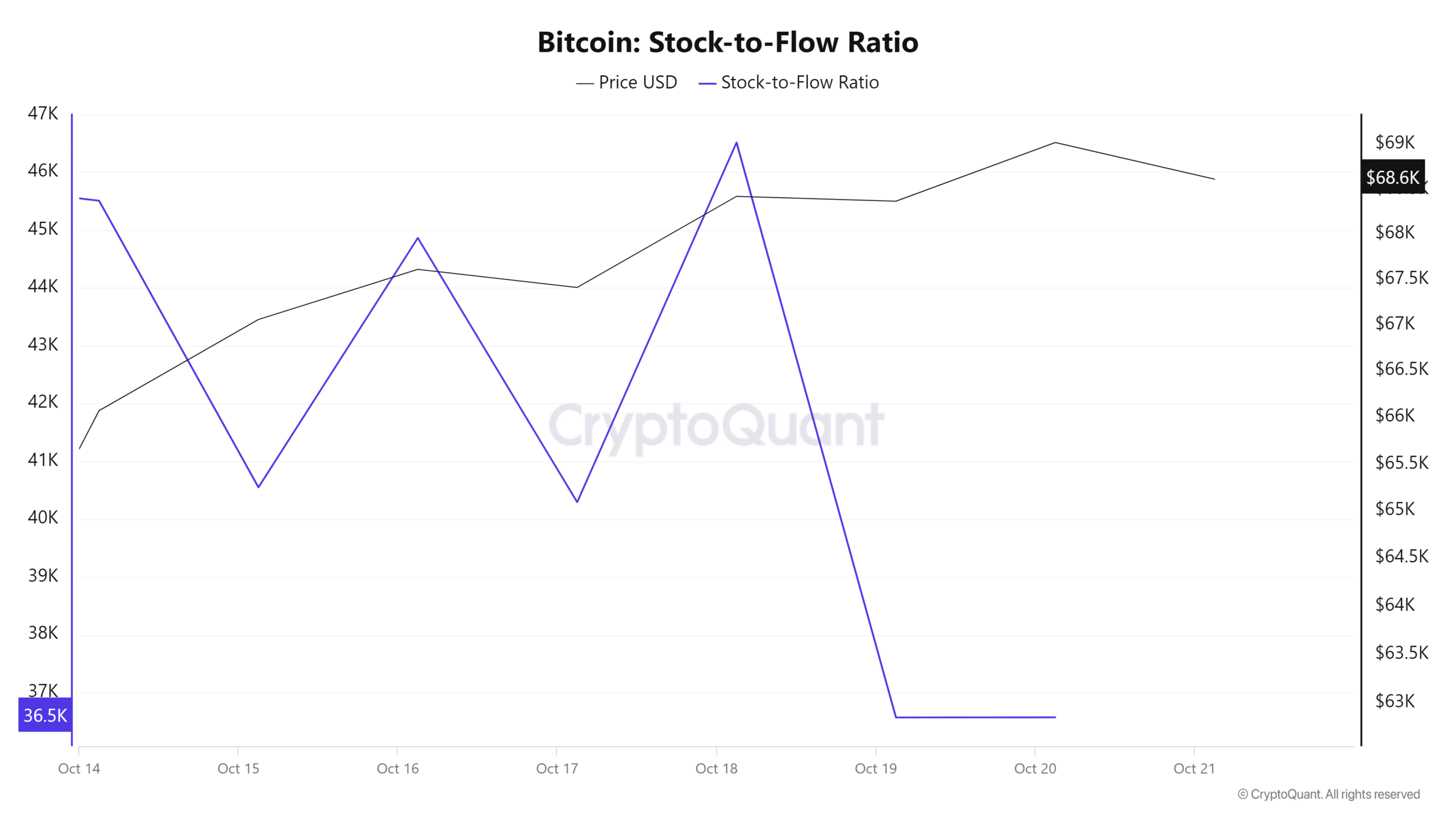

Source: CryptoQuant

Additionally, Bitcoin's stock-to-flow ratio has declined over the past week, suggesting an increase in supply. Increasing availability of BTC tends to make the market bearish, especially if demand is not growing.

Source: Santiment

Finally, Bitcoin price DAA divergence has remained negative throughout the past week. This indicates that unsustainable price increases are occurring.

If the price DAA is negative, it suggests that the current rise is caused by speculation or short-term demand.

read bitcoin [BTC] Price prediction for 2024-2025

Simply put, although BTC has soared to recent highs, market fundamentals suggest a correction is imminent. As such, the current rally is largely driven by speculation and not by demand.

A correction will likely push Bitcoin down to the $65,872 support level.