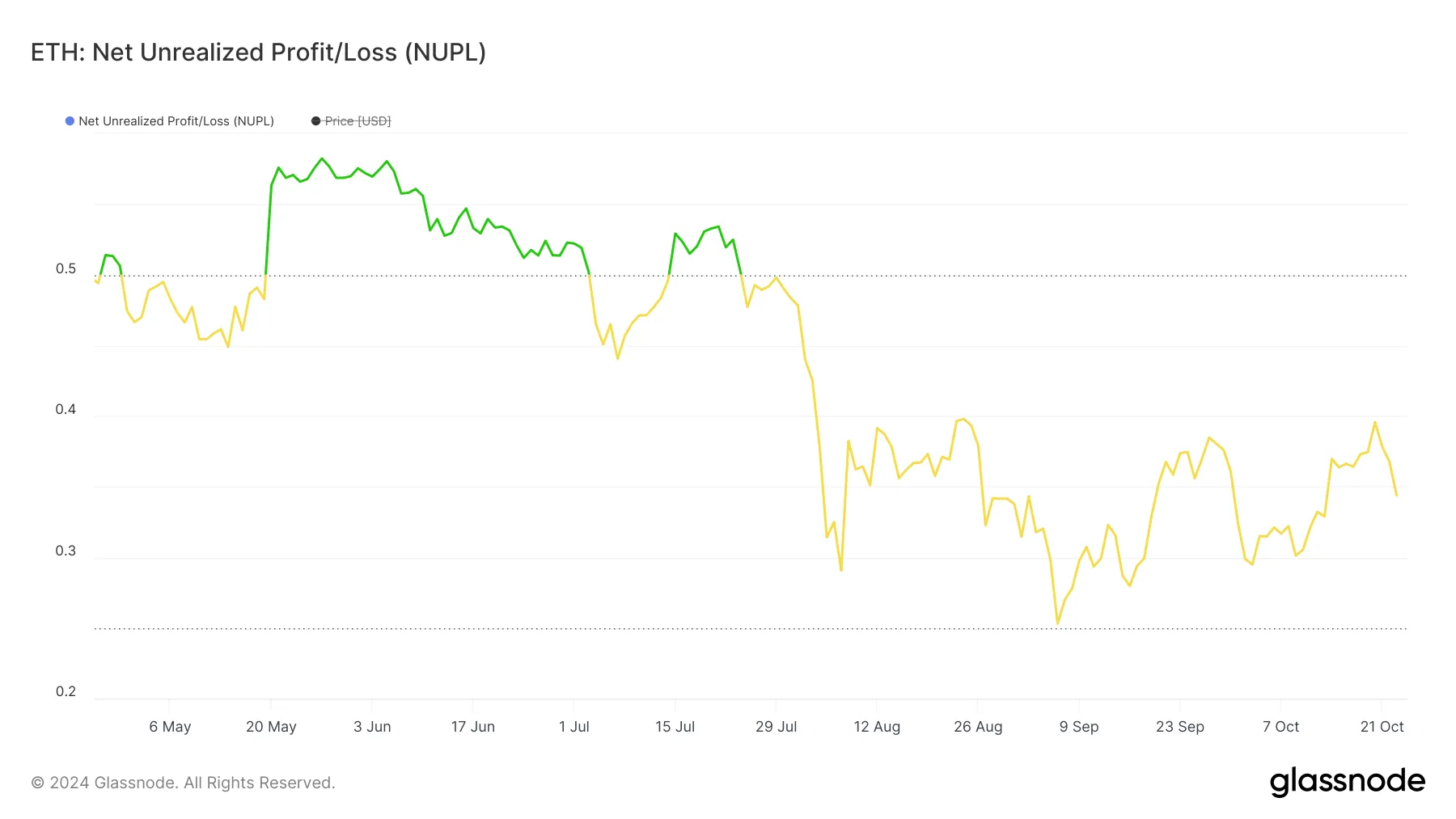

Ethereum (ETH) price appears to be moving within a neutral range, as shown by several market indicators. Current net unrealized gains and losses (NUPL) values indicate that most investors are not making much money or experiencing significant losses.

This balanced sentiment suggests a mix of cautious optimism and trepidation, but lacks the strong emotions that typically cause dramatic price movements. Combined with large holder movements and key technical indicators, ETH could continue to move sideways in the short term.

ETH NUPL is currently neutral

ETH’s NUPL is currently 0.34, indicating a neutral market. This value suggests that most investors are neither making significant gains nor incurring significant losses. This reflects a balanced sentiment among holders, with a mix of optimism and anxiety, but without the extreme sentiment that usually causes large market swings.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

NUPL (Net Unrealized Profit/Loss) measures investor sentiment by comparing unrealized gains and losses. A positive NUPL indicates that the holder is making a profit; a negative NUPL indicates a loss. A value of 0.34 puts ETH in the “optimism-concern” stage, suggesting that investors are cautiously optimistic but also cautious.

ETH is far from the extreme stages of “hope-fear” and “belief-denial” and represents a stable and neutral market situation. This neutrality indicates that there is no strong buying or selling pressure prevailing at the moment, so sideways price movements are likely in the short term.

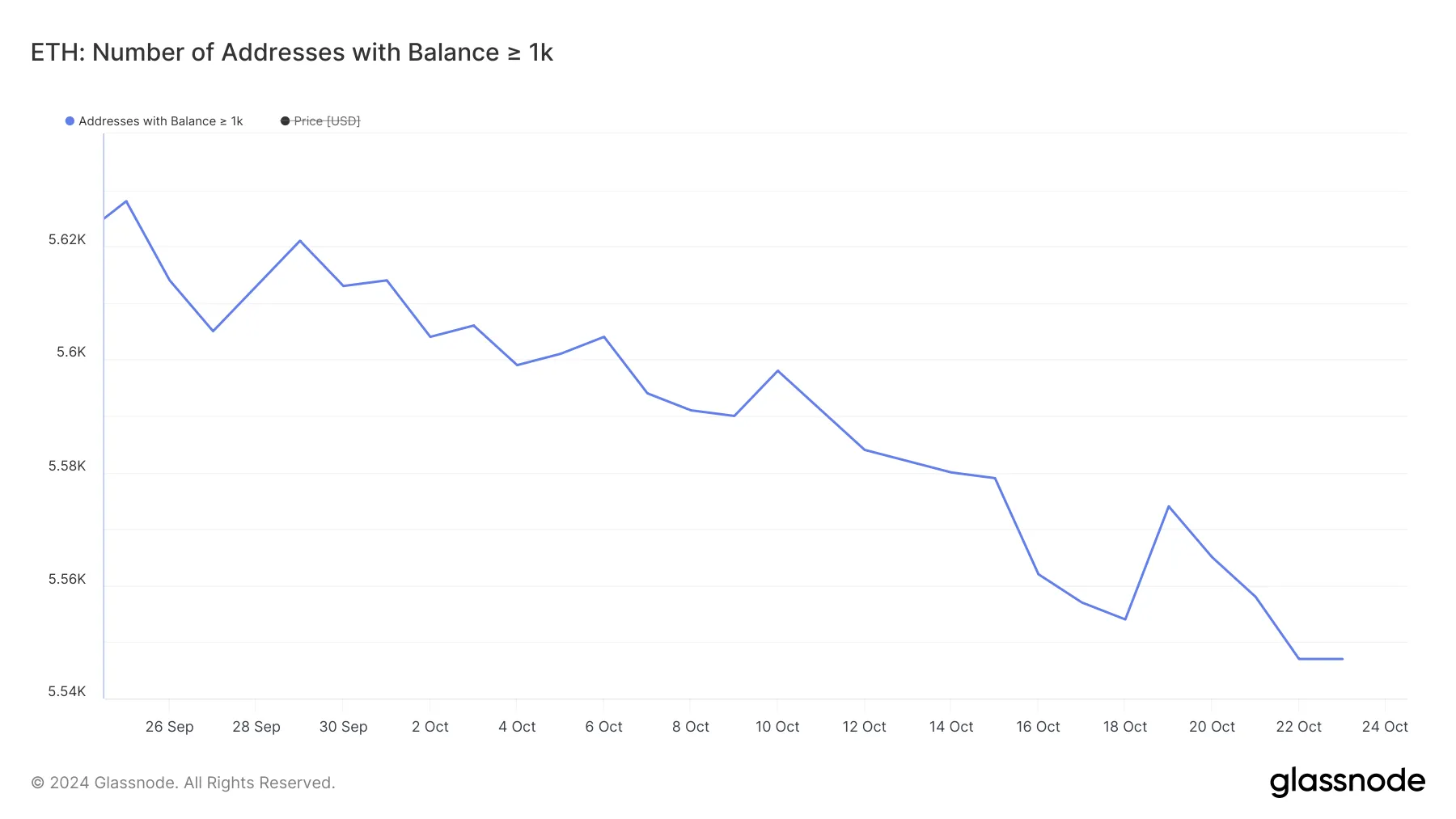

Ethereum whales are not accumulating

The number of addresses holding at least 1,000 ETH is decreasing, indicating that whales are not accumulating ETH. On September 25, there were approximately 5,628 such addresses; this number has now decreased to 5,547. This steady decline suggests a lack of confidence among large holders.

It is very important to track the addresses of these whales as they can have a huge impact on market trends. Whales often show optimism when they accumulate, which can push prices higher. Conversely, declines indicate hesitance and risk aversion.

The consistent decline in whale addresses over the past month suggests that large investors are not confident enough to accumulate ETH at this time. Instead, it could be reallocated to other assets or wait for a clearer signal before purchasing more ETH.

ETH price prediction: Will there be more sideways movements in the future?

This Ethereum (ETH) chart displays several major moving averages (EMAs) and potential support and resistance levels. ETH is currently trading around $2,526, slightly below multiple EMA lines, indicating downward pressure.

It is also reinforced by the fact that its short-term line is falling. If they fall below the long-term one, this will generate a bearish signal.

Read more: How can I invest in Ethereum ETFs?

The chart also highlights clear resistance levels at $2,728 and $2,820, where previous attempts to break out of these points failed. A convincing breakout of these levels is needed to trigger strong bullish momentum. On the downside, support levels are marked at $2,308 and $2,150, indicating areas where buyers can intervene.

The presence of these support and resistance levels, along with the lack of definitive movement around the EMA, suggests that ETH could continue to consolidate, with price movements bounded before a clear trend is formed. It suggests something.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.