- Most of the bets were predicting a bullish closing price for BTC and ETH.

- ETH could fall below the max pain point and BTC could end the week above the max pain point.

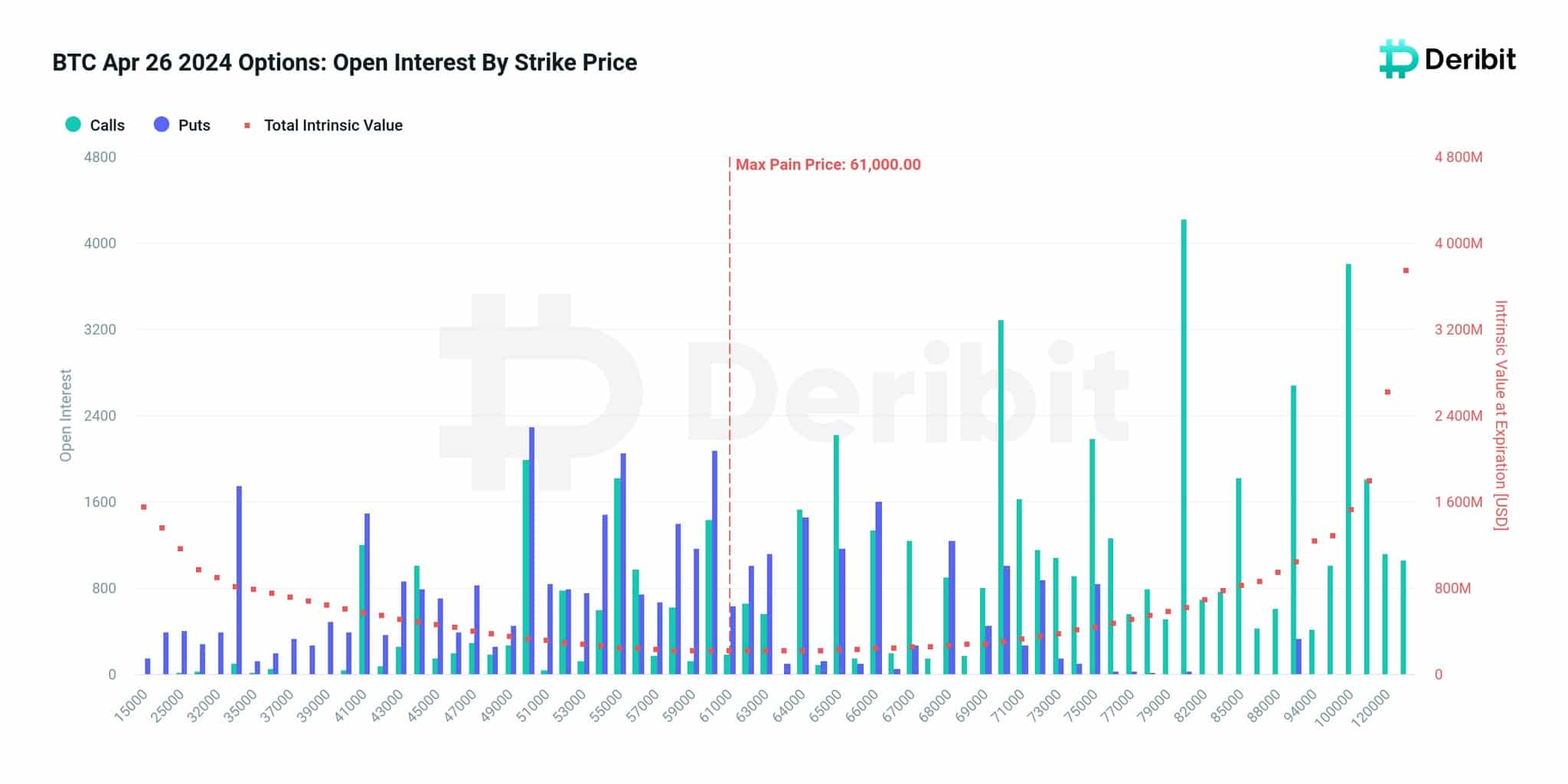

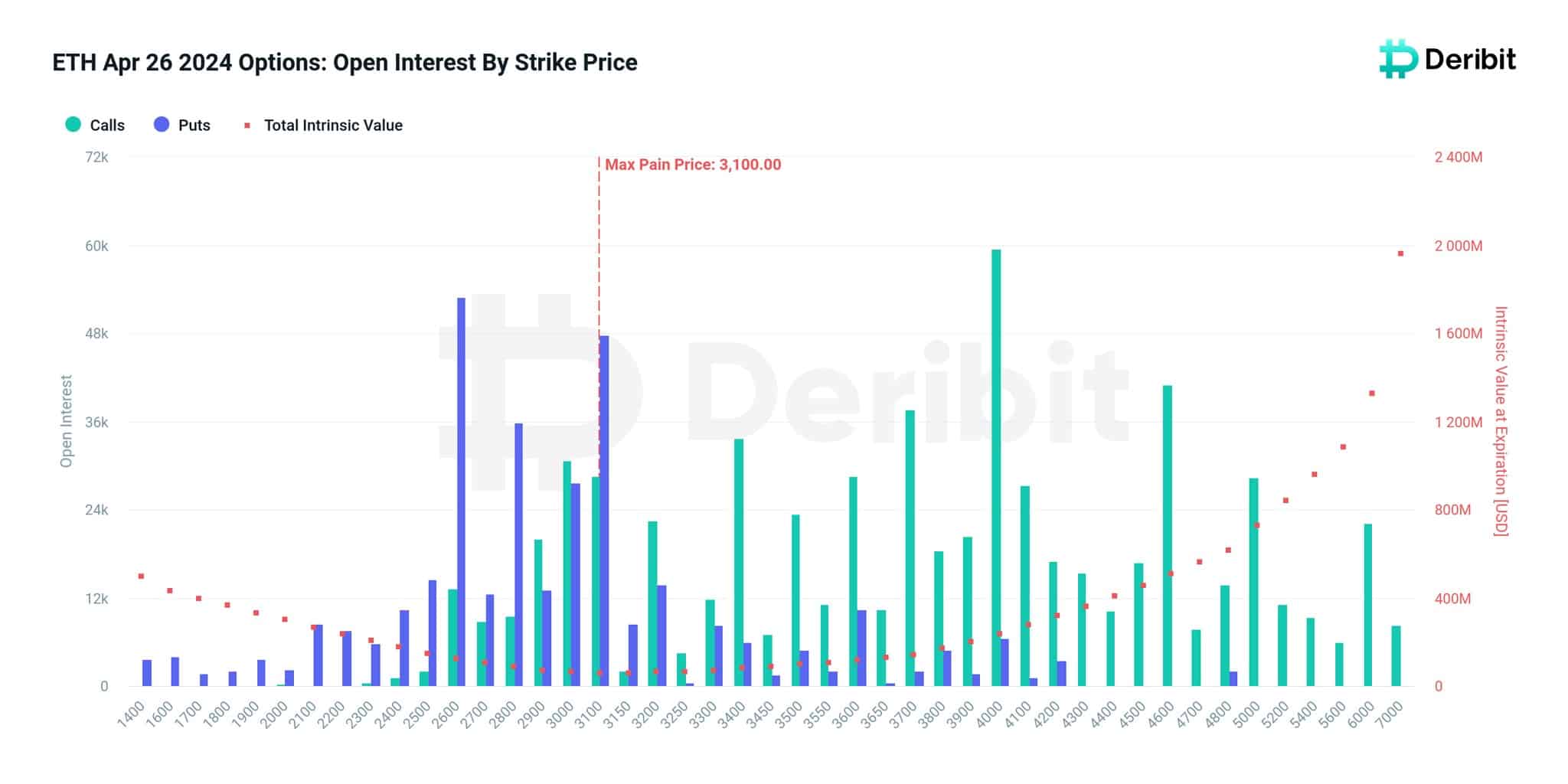

96,000+ Bitcoin options contracts [BTC] 978,000 for Ethereum [ETH] Expiration date is Friday, April 26th.

According to Deribit exchange Deribit, the value of BTC contracts was $6.2 billion and the value of ETH contracts was $3.1 billion, bringing the total value to an astonishing $9.3 billion.

Options allow traders to purchase contracts that allow them to buy or sell cryptocurrencies at predetermined prices. As an option approaches expiration, traders must decide whether to buy, sell, or close the contract.

Source: Deribit

Optimism rises despite decline

According to details obtained by AMBCrypto from Deribit, BTC’s put-call ratio was negative. This indicates that most of the bets were calls and traders were bullish on the coin's price.

The same was the case with ETH. For those unfamiliar, purchasing a call option means that the trader makes a profit if the price increases. Put options, on the other hand, are bearish bets that allow traders to profit if the price falls.

Source: Deribit

Depending on where the prices of BTC and ETH end, the exchange will I got it. Sellers are likely to benefit the most if BTC reaches $61,000. In the case of ETH, buyers could lose a large amount of money if the altcoin's value reaches $3,100.

“Removal of Bitcoin options and up to 61,000 pain price points, and approximately $3 billion in open interest and up to $3.1,000 of expiring pain price points in Ethereum options.”

At the time of writing, the price of BTC is $64,140, representing a decline of 8.52% in the past 30 days. Meanwhile, ETH changed trade at his $3,129. This is a drop of 12.46% in his 30 days.

The top two have different patterns.

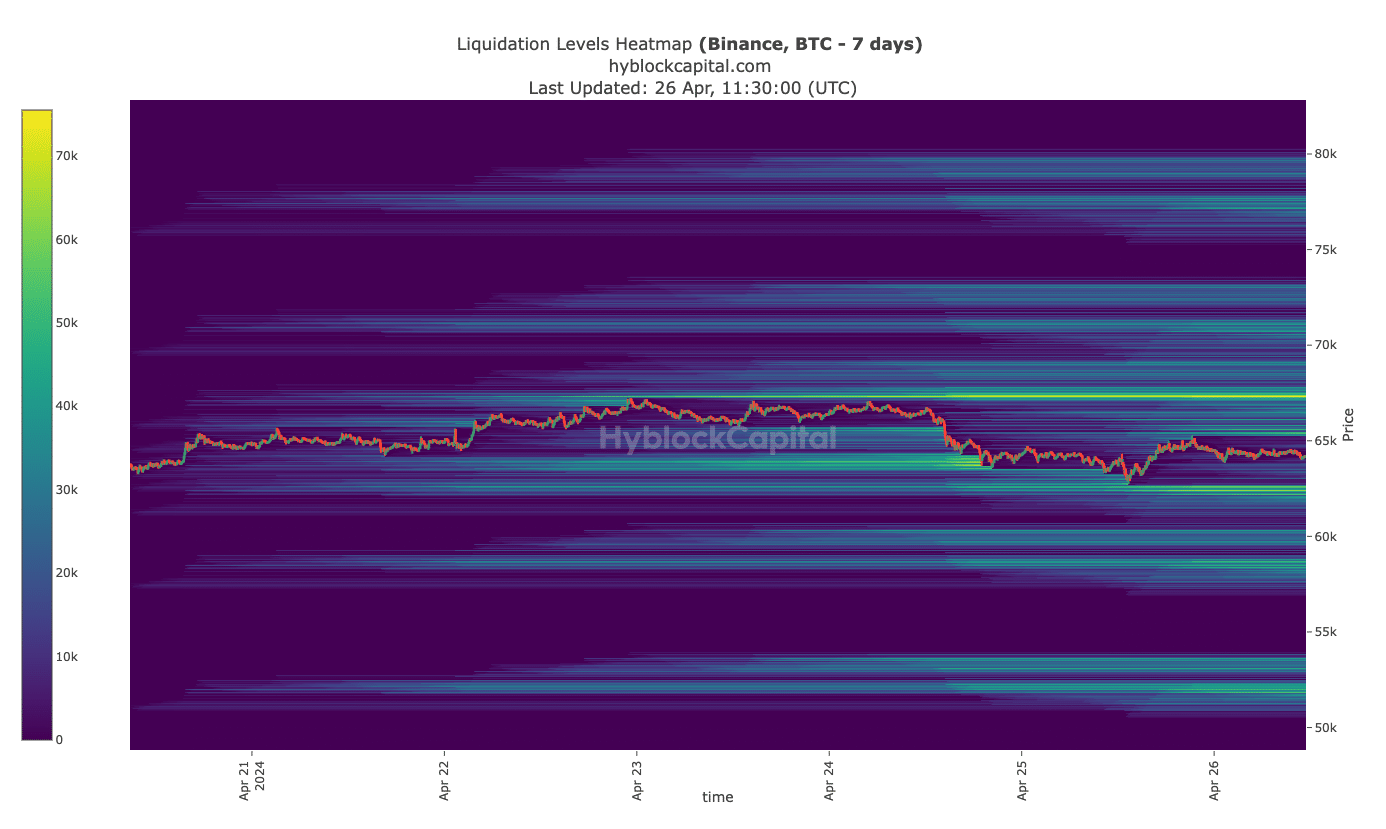

To see where prices end this week, AMBCrypto looked at the liquidation heatmap. Liquidation heatmaps show areas of high liquidity (magnetic zones) for traders.

This helps identify potential large liquidation points and the likelihood that price will move towards a particular region. According to data obtained from Hyblock, a magnetic zone (yellow) appeared on the BTC liquidation heatmap at $67,250.

On the downside, another magnetic field was $62,600. If the Bitcoin price moves towards $67,250, most options contracts will eventually make a profit on their bets.

Source: High Block

On the other hand, a fall towards $62,600 could result in losses. However, the pain may be minimal unless the price reaches $61,000.

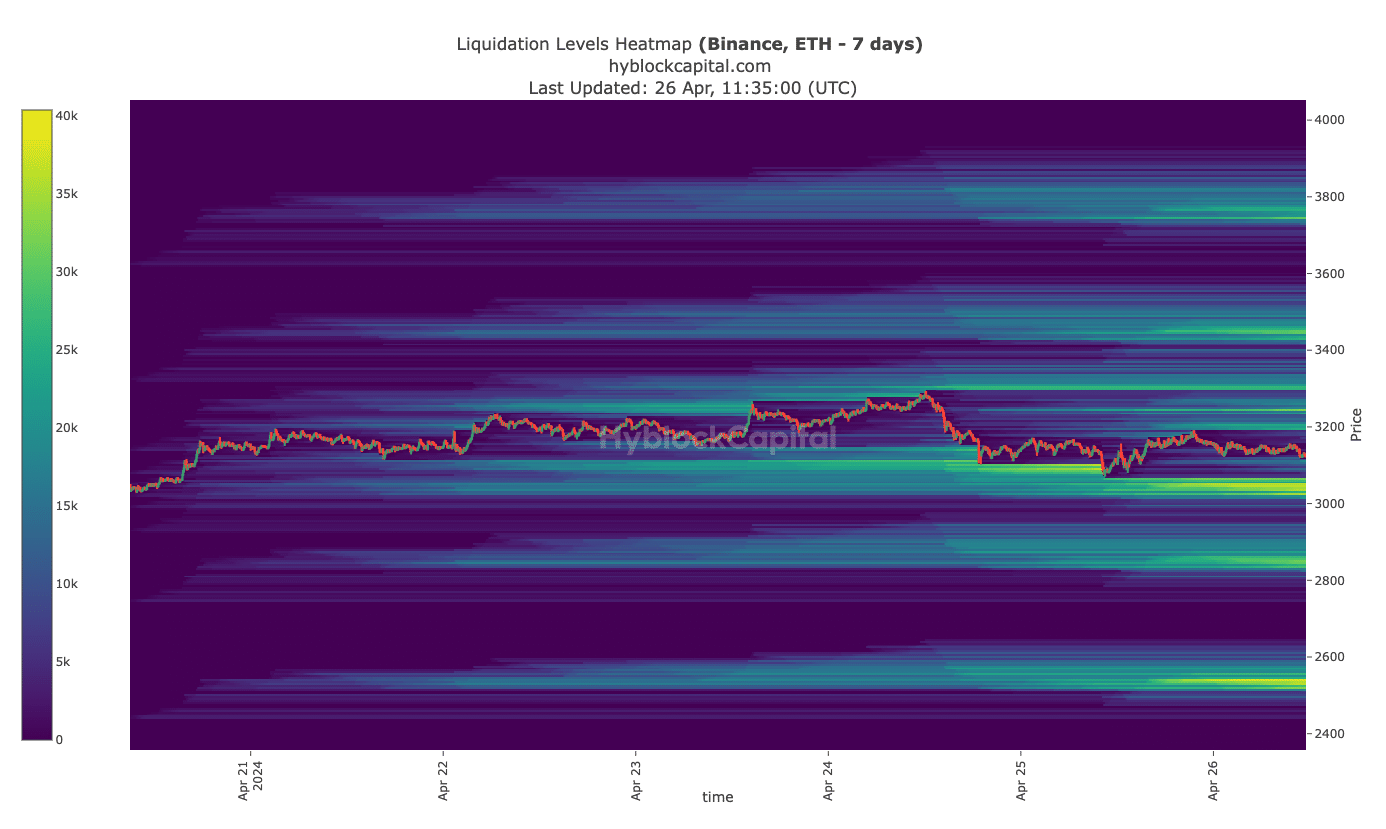

However, the same may not be the case for traders who choose the ETH call option.

Source: High Block

Whether it's realistic or not, the market capitalization of ETH in BTC terms is as follows:

At the time of writing, the area of high liquidity is around $3,025, indicating that the price could fall below the maximum pain threshold of $3,100.

That could wipe out much of the $3.1 billion that is due to expire. However, if ETH remains above $3,100, puts may not be the only ones that can profit from price movements.