Data shows that Bitcoin and Ethereum have little correlation with traditional markets, suggesting that cryptocurrencies are carving out their destiny.

Recently, Bitcoin and Ethereum have become the main characters of destiny.

According to market intelligence platform data into the blockthe correlation between BTC and ETH with traditional markets and commodities has recently been close to zero.

“Correlation” here refers to the statistical correlation coefficient (r). This is a metric that tracks how two quantities are related over time.

If the value of this indicator for two assets is greater than 0, it means that some positive correlation exists between their prices and the assets are moving in parallel. The closer this value is to 1, the tighter the relationship.

On the other hand, a negative value of the indicator indicates that although there is some correlation between the two, it is negative, as the price of one asset reacts with the opposite movement to the movement of the other asset. I am. In this case, the extreme value with the strongest correlation is -1.

A correlation coefficient of zero or near zero indicates that there is no relationship between the assets. In statistics, the variables are said to be independent in this case.

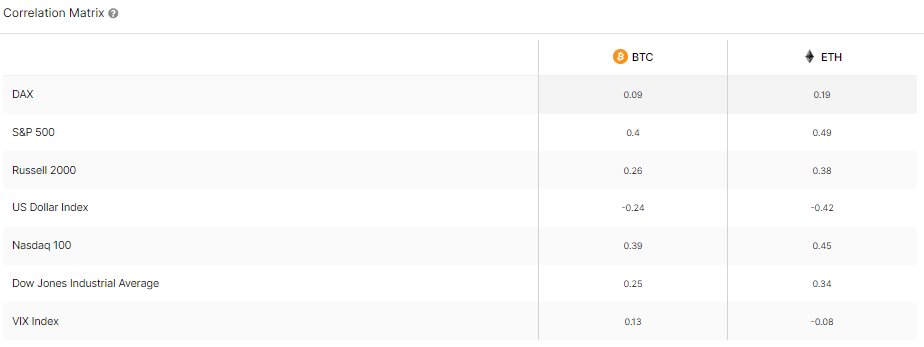

Here is a table showing how the 30-day correlation of Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, looks compared to some of the traditional assets. .

The data for the correlation matrix of BTC and ETH | Source: IntoTheBlock on X

As seen above, Bitcoin and Ethereum have appeared to have low correlations with these assets over the past month. Of these coins, the correlation with the S&P 500 was the highest with a coefficient of 0.4 for BTC and 0.49 for ETH.

Therefore, this means that ETH has a slightly higher correlation with the S&P 500 than BTC. As you can see, ETH also has a more pronounced relationship with other stocks on the list than his BTC, but it still doesn't have a strong correlation with any of them.

The low correlation coefficient with traditional markets suggests that cryptocurrencies have been operating more or less independently over the past month.

In general, investors should look at correlations when they are looking to add assets to their portfolio. Highly correlated assets compensate for poor diversification options because they mimic similar performance (positive coefficients) or cancel each other out (negative coefficients).

Bitcoin and Ethereum lack strong correlations with traditional markets and commodities, making these two coins potentially strong choices for traditional investors to add to their portfolios.

BTC price

Bitcoin has reversed its initial recovery in recent days, returning to the $61,100 level.

Looks like the price of the asset has been sliding down over the last few days | Source: BTCUSD on TradingView

Featured image by Pierre Borthiry – Unsplash.com, Peiobty on IntoTheBlock.com, Charts on TradingView.com