Minutes from the Fed's September meeting further dampened expectations for a 50 basis point (bps) rate cut in November. This provides a bearish outlook for Bitcoin price, given that the market is already pricing in a 50bps rate cut following Fed Chairman Jerome Powell’s dovish speech after the September FOMC meeting. be.

Fed September meeting minutes add to uncertainty

The Fed's September meeting minutes will further increase market uncertainty, which is bad for Bitcoin price. Until now, market participants had confidently expected the US Federal Reserve (Fed) to cut interest rates by another 50 basis points at the November FOMC meeting.

However, the September FOMC meeting minutes indicate that market participants are not very confident about a rate cut, much less a 50bps rate cut in November. Fed officials said at the FOMC meeting that they will continue to monitor “the impact of future information on the economic outlook” in assessing the appropriate stance for monetary policy.

The Committee added that it stands ready to make appropriate adjustments to monetary policy if there is a risk of impeding the goal of achieving 2% inflation.

The committee's assessment considers a wide range of information, according to the Fed's minutes. This includes analysis of “labour market conditions, inflation pressures and expectations, financial and international developments.”

Some of the information the Fed will be watching includes tomorrow's Consumer Price Index (CPI) inflation statistics. All eyes were already on the US CPI data after last week's US employment report dampened hopes for a 50 basis points cut in interest rates.

The Fed’s September minutes only further dampen those hopes, leaving traders wondering whether to allocate more capital to flagship cryptocurrencies. This kind of market uncertainty is bad for the Bitcoin price, as investors are worried about their investments during this period.

The upcoming US presidential election is another factor.

The impending inauguration of the US president also contributes to the current market uncertainty. In addition to the Fed minutes and whether there will be a rate cut in November, investors are also wary of the potential outcome of the election.

The market typically experiences significant volatility during this period. This explains why many investors choose capital preservation. Interestingly, Bernstein analysts predict that Bitcoin prices will trend higher ahead of the election if Donald Trump's chances in the polls improve.

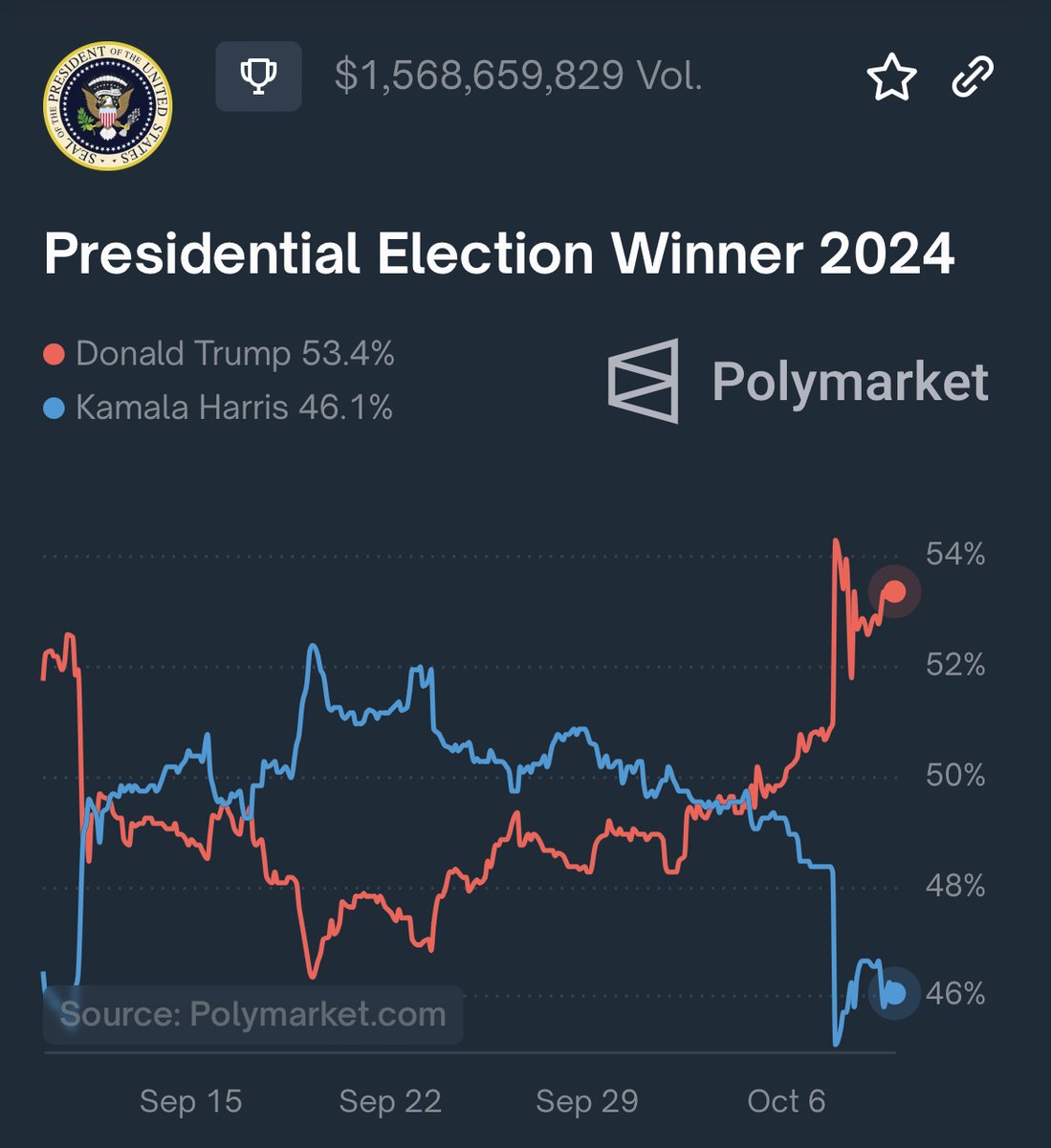

According to the latest Polymarket odds, Donald Trump is up more than 7% and the former US president has a 53% chance of becoming the next US president, while Kamala Harris has odds of 46%. It has become. These Burstein analysts say that if Trump ultimately wins, BTC price could reach $90,000.

However, history tells us that no matter who wins the election, BTC will reach a new all-time high (ATH) after the election. According to Fed minutes, the November FOMC meeting begins on the 6th, the day after the US election.

Meanwhile, it is worth mentioning that veteran trader Peter Brandt predicted that BTC would rise to $135,000 by August or September 2025. This is approximately when BTC is likely to peak in this market cycle.

Disclaimer: The content presented may contain the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or publication assumes no responsibility for your personal financial loss.

✓ Share: