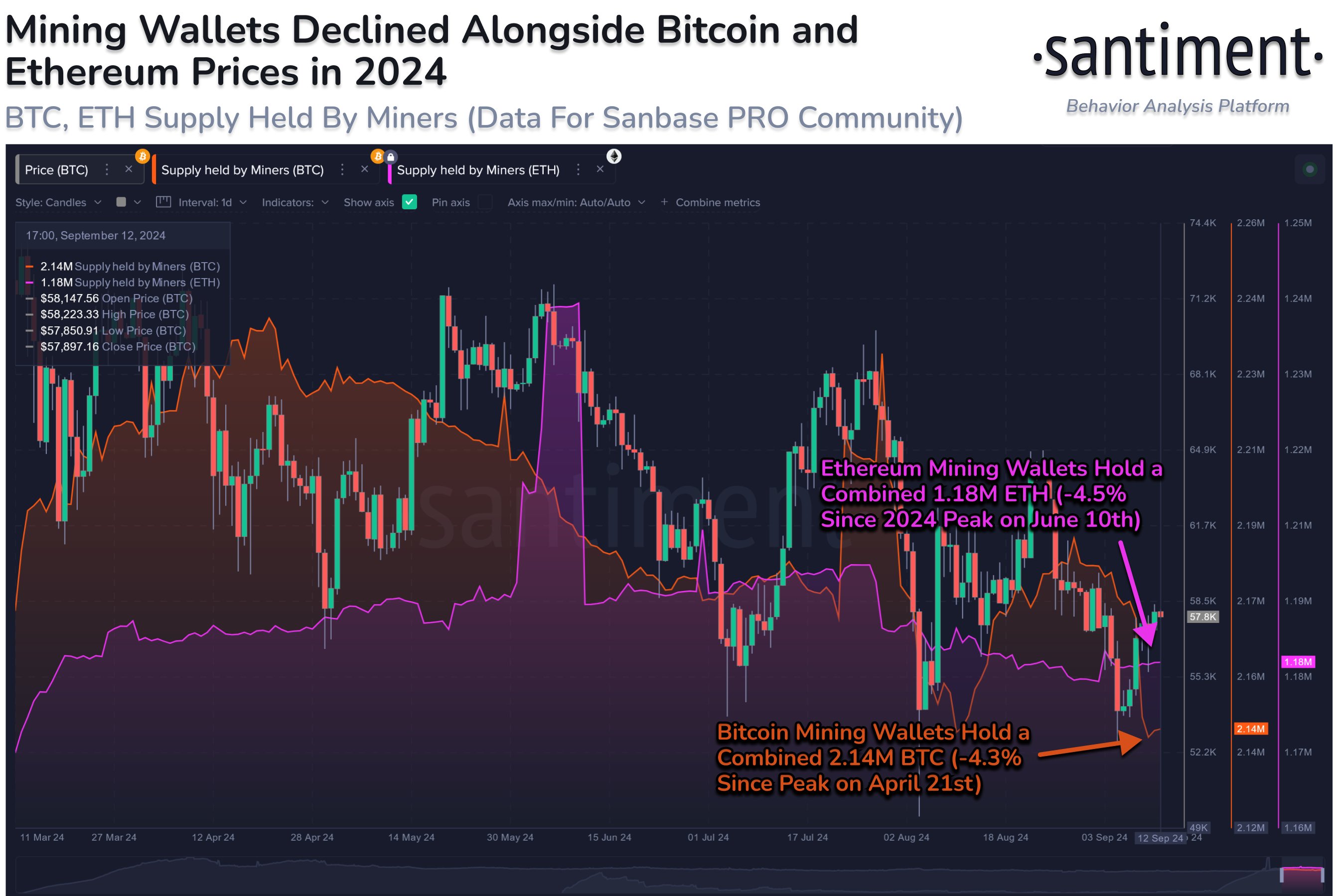

- Bitcoin and Ethereum mining wallets have noted a decline in their holdings since the first half of 2024.

- The recent recovery in the combined supply of Bitcoin and Ethereum mining wallets is a sign of potential upside for the assets.

- BTC and ETH are hovering near key support levels on Friday.

Cryptocurrency mining is the process by which new Bitcoin and Ethereum are generated in circulation. Data from Cryptocurrency Info Tracker shows that Bitcoin and Ethereum miners' wallets saw their holdings decline in the first half of this year.

Analysts believe the recovery in holdings could signal a bull market for both assets.

This could be a sign of a bull run for Bitcoin and Ethereum

Analysts at cryptocurrency tracking firm Santiment noted in X's recent tweet that the recovery in BTC and ETH holdings in miner wallets can be seen as a sign of a bull market. As shown in the chart below, Bitcoin and Ethereum mining wallets saw a sharp decline in their holdings in the first half of 2024, they noted.

Bitcoin mining wallets hold 2.14 million BTC, down 4% from their April peak. Similarly, Ethereum mining wallets hold 1.18 million Ether tokens, down 4.5% from their 2024 peak. Analysts say the increased supply held by mining wallets could be seen as a sign of an upcoming bull market for the two assets.

Bitcoin and Ethereum mining wallet supply

This phenomenon can be better explained by considering that Bitcoin and Ethereum miners typically sell their holdings to cover operational costs. Selling pressure from miners increases profit-taking by traders, which typically has a negative impact on asset prices.

If miners reduce the supply they sell or transfer to centralized exchanges and maintain their holdings of BTC and ETH assets, this could ease the selling pressure and signal an expected rally for the two cryptocurrencies.

Therefore, analysts view the increasing supply of mining wallets as a sign that a bull market is approaching. At the time of writing, Bitcoin is trading at $57,940 and Ether at $2,349.

Traders will be watching for other signs of a BTC or altcoin bull market, such as Bitcoin's dominance compared to altcoins and the performance of the top 50 altcoins ranked by market cap against Bitcoin.