Today will be the most interesting day of the week as we see some market-moving releases. I believe the market is more focused on growth right now as inflation continues to ease (albeit at a much slower rate) and central banks are more inclined to cut rates than to hike them, so I will look at the data in that context.

09:00 GMT Eurozone first quarter 2024 negotiated wage indicators

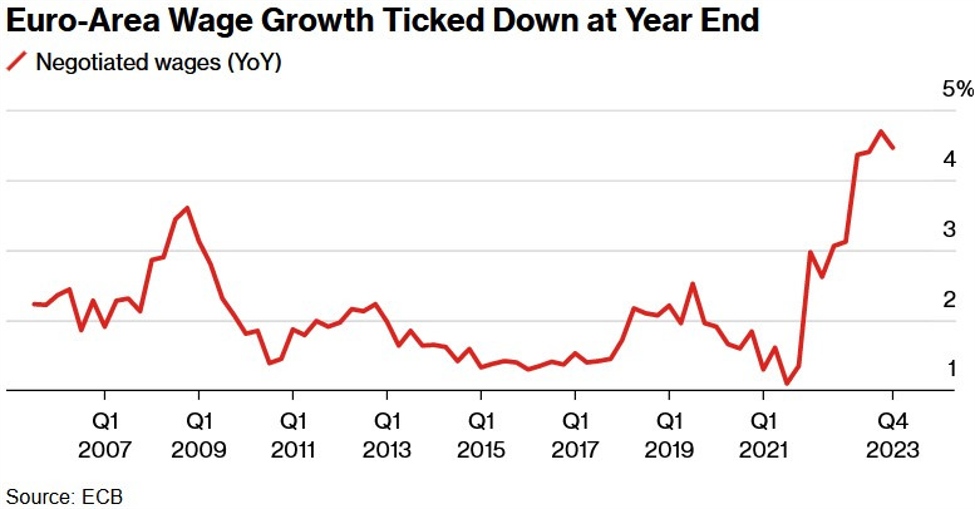

This is the kind of data the ECB has been waiting for months to give it more confidence in the inflation outlook. The data is unlikely to change plans to deliver the first rate cut in June. In the meantime, they had foretold it so strongly that it would be really unseemly to back out at this point. It may shape market expectations Regarding the number of interest rate cuts for the remainder of the year.

Eurozone wage growth

08:00 GMT Eurozone May Flash PMI

PMI has increased significantly since the beginning of the year, Prospects for monetary policy easing led to positive growth impulsesUnless there is a big surprise, the data is unlikely to be game-changing for the market. That said, the positive numbers should support growth prospects.

- Manufacturing PMI The prediction was 46.2, and the previous one was 45.7.

- Service PMI Expected 53.5, last time 53.3.

- Comprehensive PMI The prediction was 52.0, and the previous prediction was 51.7.

Eurozone Composite PMI

08:30 GMT UK May PMI preliminary figures

Similar to the Eurozone, UK PMIs have risen strongly since the start of the year, with positive growth impetus coming from expectations of central bank easing.

- Manufacturing PMI Expected score was 49.5, advance score was 49.1.

- Service PMI 54.7 compared to 55.0 last time.

- Comprehensive PMI The prediction was 54.0, the previous one was 54.1.

UK Composite PMI

12:30 GMT (08:30 ET) US unemployment claims

U.S. jobless claims remain one of the most important releases to track each week because it is a timely indicator of the state of the labor market, as a weakening labor market increases the likelihood of disinflation toward the Fed's goals.

However, the resilience of the labor market could make achieving the target more difficult.

Initial claims continue to hover near cycle lows while continuing claims remain strong near the 1.8 million level. Initial claims are now expected to be 220,000 versus 222,000 previously, while there is no consensus on continuing claims, although previous releases have indicated an increase to 1,785,000 expected, and 1,794,000 versus 1,781,000 previously.

U.S. unemployment insurance claims

13:45 GMT (11:45 ET) US May preliminary PMI

As always, the US PMIs will be the biggest market-moving release today, as last month's data surprised on the downside (although was subsequently revised up), signalling that the positive impulse from rate cut expectations in Q1 has faded somewhat.

Since then, we have seen several weaker than expected data, including NFP, retail sales, ISM PMI, and jobless claims (still at cyclical lows). In fact, Citi's US Economic Surprise Index has fallen since peaking in April.

- Manufacturing PMI Expected value was 50.0, previously it was 50.0.

- Service PMI Expected 51.3, last time 51.3.

- Comprehensive PMI The prediction was 51.1, and the previous one was 51.3.

US Composite PMI

Today's central bank speakers:

- 11:30 GMT (07:30 ET) BoE Pill (Neutral – Voter).

- 19:00 GMT (15:00 ET) Fed's Bostic (Hawk – Voter).