The focus today will be on the Eurozone's flash CPI for May and the US's April PCE, the Fed's preferred inflation gauge. Other notable releases scheduled for today include the Swiss Manufacturing PMI and Canadian GDP, but are unlikely to move the market.

09:00 GMT – Eurozone May CPI Flash

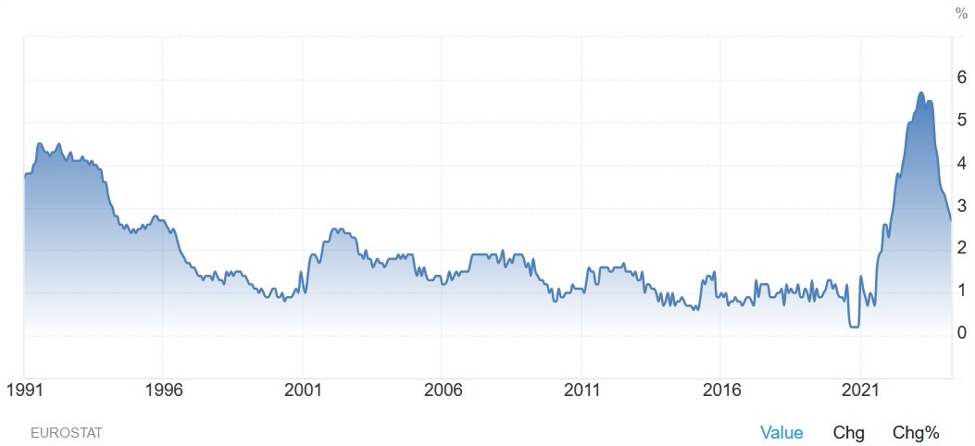

Eurozone headline CPI is now expected to rise to 2.5% y/y, up from 2.4% previously, while core CPI is up from 2.7% y/y. The report is likely to influence market expectations for the path of rate cuts after the June meeting.. Indeed, higher inflation data following robust PMI, wage growth and labour market reports is likely to trigger a hawkish revision in interest rate expectations from the current 55bps of rate easing expected by the end of the year.

Eurozone Core CPI YoY

12:30 GMT/08:30 ET – US April PCE

US Headline PCE is expected to be 2.6% YoY, up from the previous 2.7%, while MoM is up from the previous 0.32%. Core PCE is expected to be 2.75% YoY, up from the previous 2.8%, while MoM is up from the previous 0.32%. Forecasters can reliably predict PCE once the CPI and PPI are released, so the market already knows what to expect.

This report is unlikely to change anything for the Fed, as the central bank will remain in “wait and see” mode until at least September. In fact, despite calls for a rate cut in July or November, I believe the Fed would prefer to deliver its first rate cut at the meeting that includes the SEP (unless the labor market deteriorates sharply).

The market has been in a negative mood for the past few days, and it is becoming increasingly likely that this is simply due to the end-of-month turmoil. A positive report (or even an expected report) could bring back risk-on sentiment, while a better-than-expected number could put a bit of pressure on sentiment.

US Core PCE YoY

Central Bank Speakers:

- 07:30 GMT – ECB's Vujicic (neutral – will not vote in June).

- 08:30 GMT – ECB's Panetta (dovish).

- 22:15 GMT/18:15 ET – Fed President Bostic (Neutral – Voter).