- Demand for Bitcoin weakened just before the halving.

- A resurgence is predicted, but investors need to be patient.

Bitcoin [BTC] Demand growth slowed due to ETF inflows in April. Julio Morenohead of research at CryptoQuant, posted a graph showing the decline in demand on X (formerly Twitter).

Geopolitical tensions escalated in the Middle East over the weekend.

From its peak of $668,000 at the beginning of Monday, BTC retreated 6% in one day and was trading at $62,700 at the time of writing. With the half-life just three days away, will participants wait to buy until things calm down?

Since the beginning of April, the power has weakened.

Bitcoin trading volume began a steady decline from the last week of March. Based on Coinglass data, open interest also started falling after April 1st.

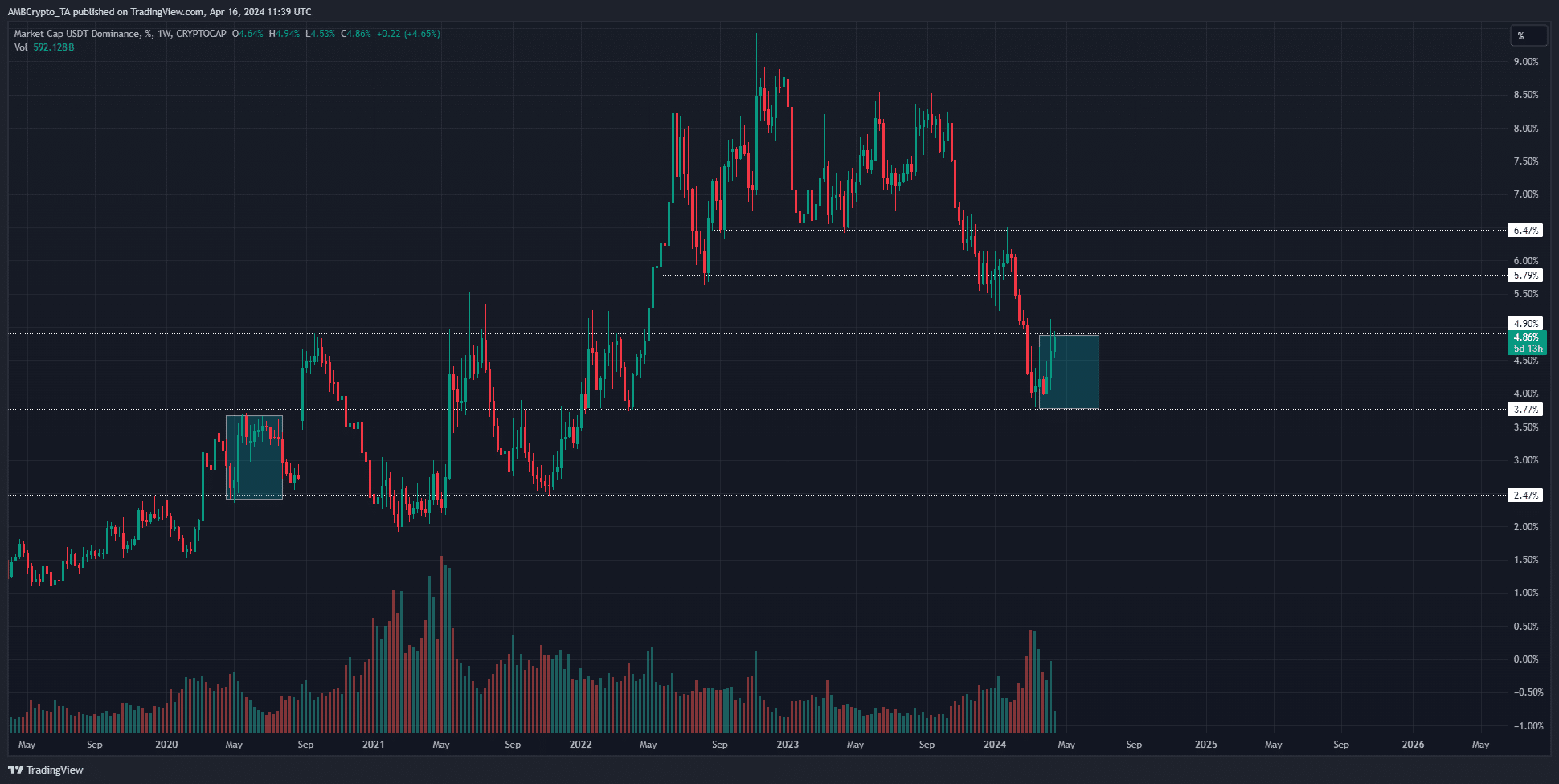

The Tether (USDT) dominance chart showed that crypto market participants were increasingly converting their assets to USDT in April.

A rise in USDT dominance means stablecoins will account for more of the crypto market capitalization. This happens when more USDT is minted.

What's even more interesting to us is that this also happens when traders and investors decide the market is risky and move into stablecoin holdings.

In other words, the market has seen an increase in selling pressure resulting from large supply and relative lack of demand. The bullish sentiment in late March swayed in April and has slumped over the past 10 days.

Uncertainty surrounding whether miners will part with some of their BTC holdings likely contributed to the weak demand.

Will tethered dominance be similar to the 2020 halving?

Source: USDT.D on TradingView

AMBCrypto investigated the USDT dominance chart. USDT.D rose from May 4th to May 18th. After that, it remained flat at 3.47% until July 20, eight weeks later.

The current chart also saw a significant increase from 4% to 4.88%. If parallels play out, crypto prices could remain range-bound for the next 1-2 months.

Source: ETH/BTC on TradingView

However, some argue that their dominance is growing. This comes from the ETH/BTC chart. Founder of Into the Cryptoverse, benjamin cowenit was observed that ETH/BTC lost the HTF support level at X.

read bitcoin [BTC] Price prediction for 2024-2025

The last time this happened was in July 2019. It started rising in September 2019. During that two-month period, both Bitcoin's dominance and Tether's dominance rose. Together they emphasized the capitulation of altcoins.

The same thing could happen within the next two months, and investors should prepare for it.

![Want to know if Bitcoin will rise? Watch Tether [USDT] performance](https://decentralizedrebel.com/wp-content/uploads/2024/04/Bitcoin-Featured-Image-1000x600.webp.webp)