Tether has seen a massive surge in activity on the chain over the past few weeks.

Market Intelligence Platform's Santiment says that on-chain data related to Tether (USDT) is the key in this direction.

In particular, analysts on on-chain and social metric monitoring platforms believe the surge in USDT volumes indicates a shift in trader dynamics that appears to be hit by available opportunities.

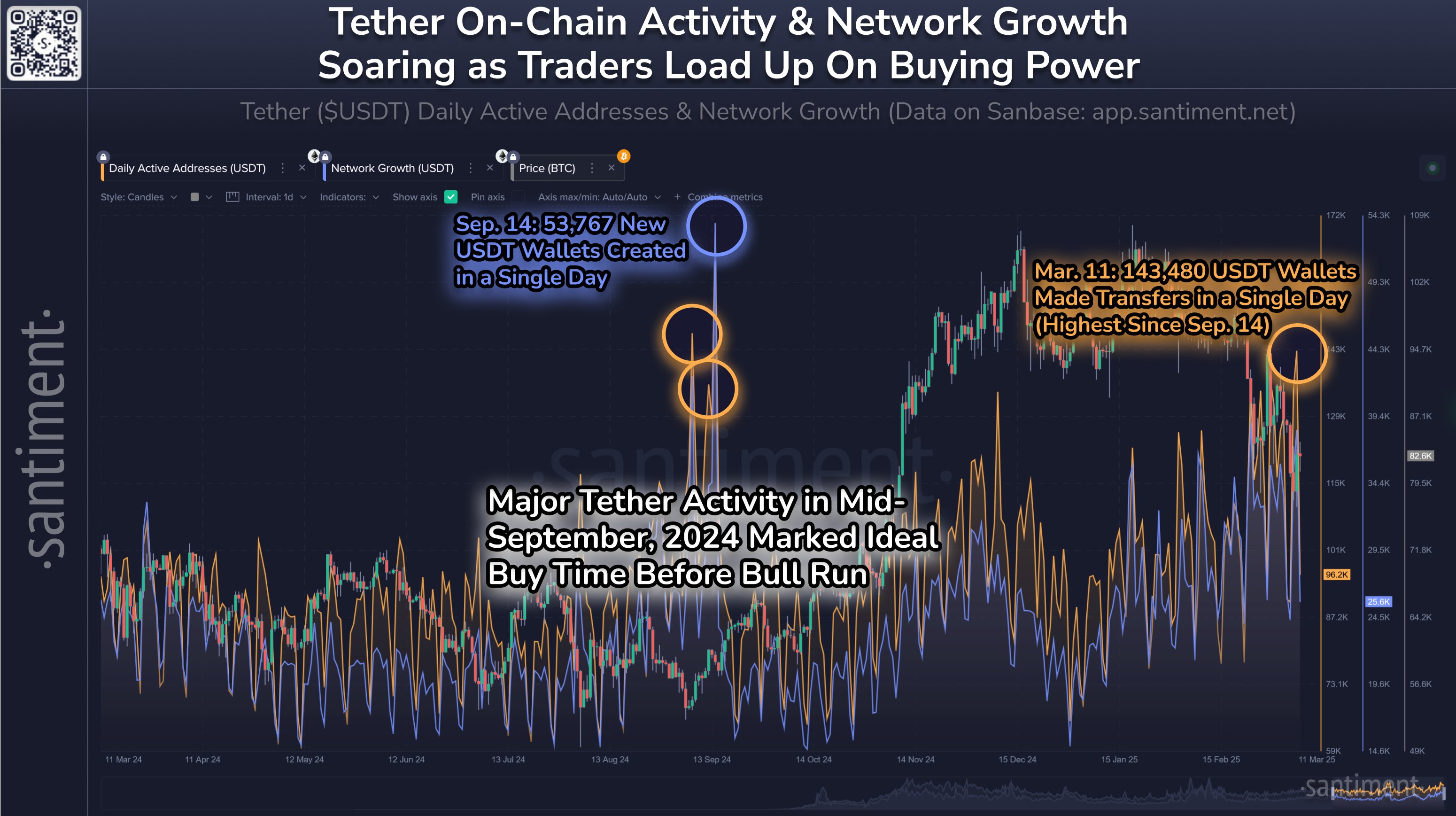

In the market, major price drops often result in traders retreating to the top stubcoins and using accumulated purchasing power to gather on Bitcoins (BTC) and other top coins when opportunities arise. Data Santiment collated shows that recorded six months' height for the number of wallets USDT transfers in one day.

“Activities on the tether chain are rising rapidly, with over 143k wallets moving yesterday alone (6 months high). As $USDT and other Stablecoin activities skyrocket during price drops, traders are preparing to buy,” it says in X.

Analysts say rising purchasing pressures have often helped the crypto market recover. This is mainly because stub coins such as USDT and USDC (USDC) are useful during the sale. Traders were worried that potential dumps often cashed out and acquired ridiculous things as assets in their potential reservoirs. When sentiment is reversed, these offer the opportunity to scoop up profitable deals.

Tether's chain activity has skyrocketed as BTC and Altcoins experience significant losses amid wider risk-off sentiment. Santiment said daily active address counts and network growth over the past week in mid-September mirrors tether activities in mid-September.

For example, on September 14th, Tether created 53,767 new wallets in one day. The overall surge coincided with “ideal purchase time before the Bull Run,” which saw Bitcoin reach an all-time high of over $109,000.

Can the 143,480 USDT wallet, which was undertaken for the transfer on March 11, 2025, portend a similar scenario?