The stock market is facing a tough mix of macro factors after Nvidia's earnings beat expectations again.

-

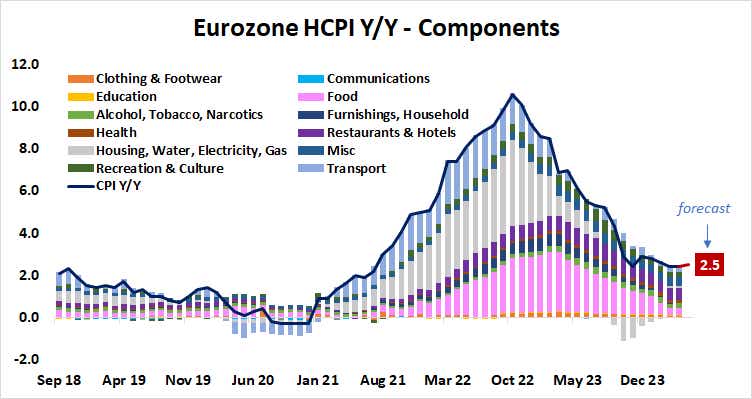

If euro zone consumer price inflation falls short of expectations, the euro could weaken.

-

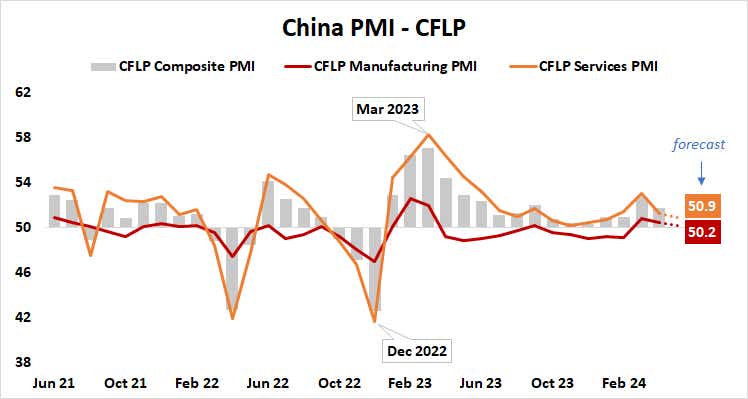

Weak PMI data could hit proxies for the Chinese currency such as the Australian dollar.

-

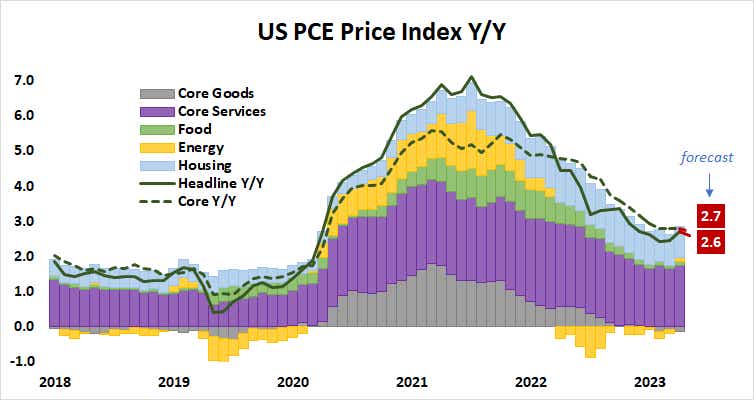

US PCE inflation data may be hard to stomach for stock markets.

The mood on Wall Street was gloomy despite another unexpected profit gain. NVIDIA NVDA is a poster child for the frenzy of speculation about the burgeoning field of artificial intelligence. The chipmaker posted earnings of $6.12 a share on sales of $26.04 billion, beating expectations of $5.60 a share on revenue of $24.6 billion.

The stock price soared, closing the day up 9.32%. But the jubilation was not widespread across the market as selling came out in force at the opening bell and quickly filled the gains following Nvidia's overnight earnings release, sending major stock indexes sharply lower for the rest of the day.

The benchmark S&P 500 fell 0.8%, its biggest one-day drop in three weeks. The tech-heavy Nasdaq lost 0.48%, while the small-cap Russell 2000 lost 1.69%. The blue-chip Dow Jones Industrial Average lost 1.58%.

Meanwhile, upbeat U.S. Purchasing Managers' Index (PMI) data prompted a reassessment of a hawkish view of Federal Reserve policy, as growth in economic activity in the services and manufacturing sectors unexpectedly accelerated to the fastest pace in a year, according to S&P Global data.

Treasury bonds fell across all maturities as yields soared following the results, while the U.S. dollar surged against major currencies. Gold and silver prices plummeted. Federal funds rate futures have lowered expectations for a 2024 rate cut to just 27 basis points (bps), down from a record 41 bps recorded a week earlier following closely watched U.S. inflation data for April.

Here are some macro waypoints that could shape price action next week:

Eurozone Consumer Price Index (CPI) Data

Headline inflation in the euro area hit a four-month low of 2.4% in March and is expected to remain at that level in April before rising slightly to 2.5% year-on-year in May.

Key PMI data this month suggests pricing power is weakening even as the recovery in economic activity gathers momentum, while Citigroup analysts have warned that data results have been weaker than expected since early March. This could lead to a weaker result, which could increase expectations of a rate cut from the European Central Bank (ECB), hurting the euro.

China Purchasing Managers' Index (PMI) Data

China's official PMI data is expected to show a slowdown in economic activity growth in the world's second-largest economy for a second straight month, and here too, Citigroup's research warned the data outcome would be worse than its baseline forecast.

A disappointing PMI could weigh on cyclical assets such as the Australian dollar in China. Meanwhile, Chinese stocks have become somewhat out of step with the macroeconomic trend since mid-April after Beijing required the investment arms of sovereign wealth funds to buy Chinese shares.

U.S. Personal Consumption Expenditures (PCE) Price Index

The Fed's key inflation gauge is expected to signal a resumption of disinflation in April. A key measure of price increases excluding food and energy that is important to Fed policymakers is seen falling to 2.7% year-on-year after remaining stubbornly at 2.8% for the past three months.

This coincides with the seemingly market-friendly results for the analog CPI data, but it's not clear that the expected results will cause investors much joy. Core CPI appears to have hit a three-year low last month, but the near-term trend remains a concern for Fed officials.

The April report showed that the three-month annualized growth rates of headline and core CPI accelerated, suggesting that policymakers are probably not close to being confident enough to cut rates. Moreover, the Cleveland Federal Reserve Bank's inflation trend model is now pointing to an increase in headline and core PCE after underperforming all year.

Overall, it's a warning that the report won't do much to reframe a dovish stance on monetary policy — a fact that may be hard to stomach for stock markets on the final day of a one-week embargo by Fed officials ahead of the June 13 Federal Open Market Committee meeting.

Ilya Spivak, The TastyLive Global Head of Macro has 15 years of experience in trading strategies and specialises in identifying thematic moves in currencies, commodities, interest rates and equities. Macro Money and co-organizers over time, Monday-Thursday. @Ilyaspivak

Daily live programming, market news and commentaryVisit Delicious Live Or YouTube Channel Delicious Live (For options traders) tastyliveTrends For stocks, futures, forex and macro.

Trade with a better broker, Open a TastyTrade account As of today, tastylive, Inc. and tastytrade, Inc. are separate, affiliated companies.