According to a Chainalysis report on October 17, North America has once again claimed the top spot as the world's most important cryptocurrency market due to increased institutional investor activity in the United States.

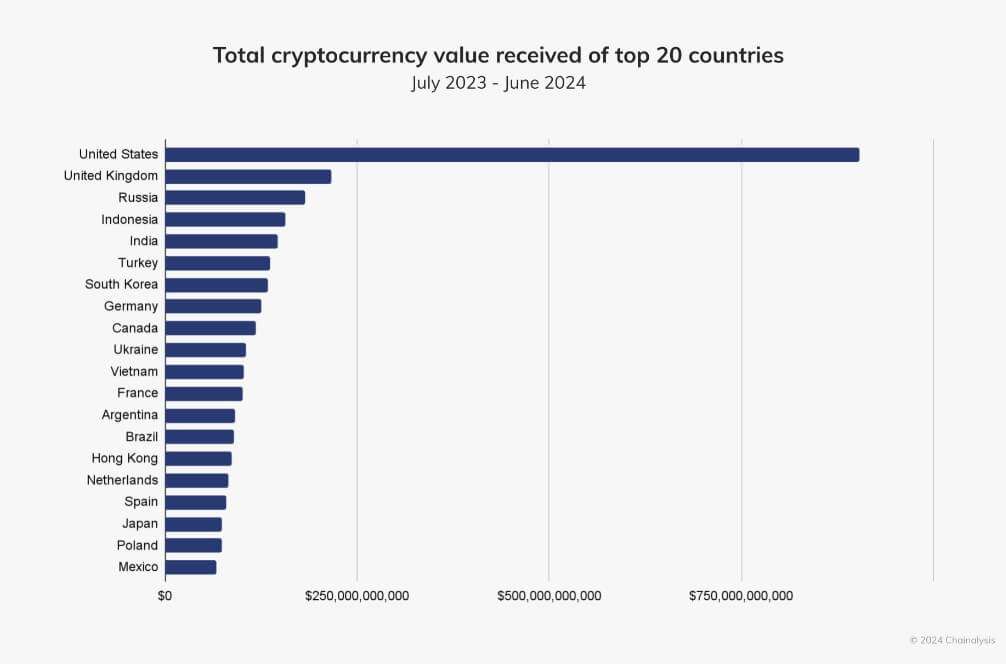

From July 2023 to June 2024, $1.3 trillion of on-chain value will be created in North America, representing 22.5% of the global total. Chainalysis believes this advantage is due to increased institutional investor activity, particularly in the US, where large transactions of over $1 million account for 70% of crypto remittances in the region. .

While the United States leads the North American cryptocurrency industry, Canada follows, with on-chain value of $119 billion over the same period.

US advantage

The United States remains a dominant player in the North American cryptocurrency market, thanks in large part to significant institutional investment around spot Bitcoin and Ethereum exchange-traded funds (ETFs).

But this leadership is not without its challenges. Chainalysis notes that the U.S. market is more volatile than global markets.

The report states:

“In recent quarters, the US has shown sensitivity to both bull and bear markets. When crypto prices rise, the US market shows greater growth than the global market, and vice versa when the crypto market falls. applies.”

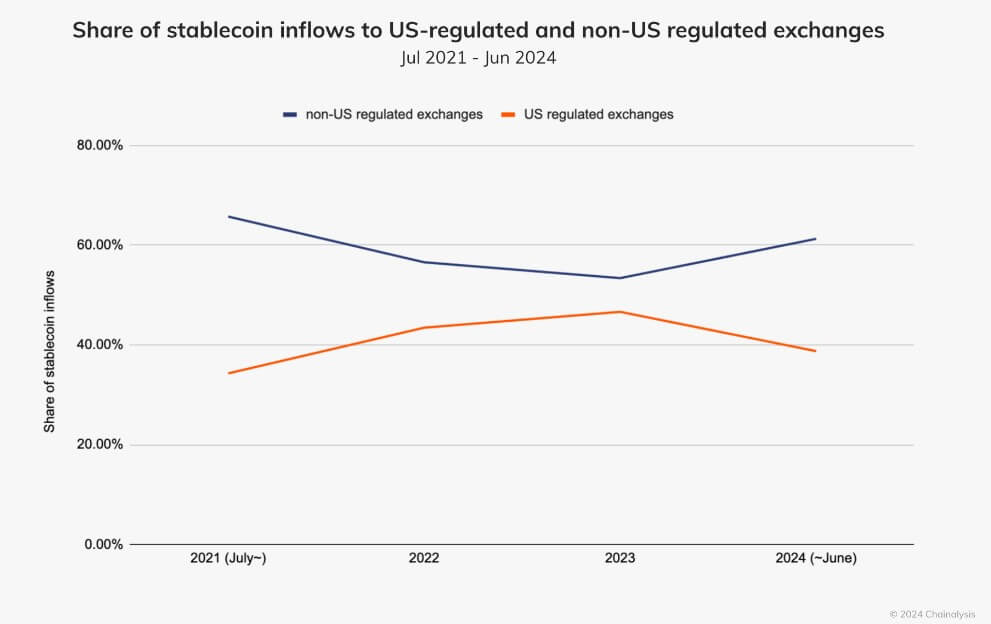

Although cryptocurrencies are becoming more popular in the United States, the amount of stablecoins held on exchanges is rapidly decreasing. The share of stablecoin trading on US-regulated exchanges has fallen from around 50% in 2023 to less than 40% in 2024.

Chainalysis reported that this decline may be related to regulatory uncertainty surrounding these digital assets in the United States. Circle, the issuer of the USDC stablecoin, noted that regulatory uncertainty in the US has led stablecoin projects to seek more favorable environments in Europe and the UAE.

Stablecoin usage is increasing outside the US

In contrast, stablecoin trading is rapidly increasing outside the US, accounting for more than 60% of trading in non-US markets by 2024.

This trend is particularly strong in developing markets, where stablecoins allow users to access US dollars without relying on traditional banking systems. Circle confirmed this change, reporting that as of late 2022, 45% of US dollar bills in circulation will be held overseas.

The increased use of stablecoins outside the United States reflects a broader trend. Global markets are increasingly viewing USD-backed stablecoins as both a store of value and a more affordable method of transaction.

Tether CEO Paolo Ardoino also emphasized the importance of USDT in providing stability amid economic uncertainty in inflation-hit countries like Argentina.