Stay informed with free updates

Just sign up for uk inflation myFT Digest — delivered straight to your inbox.

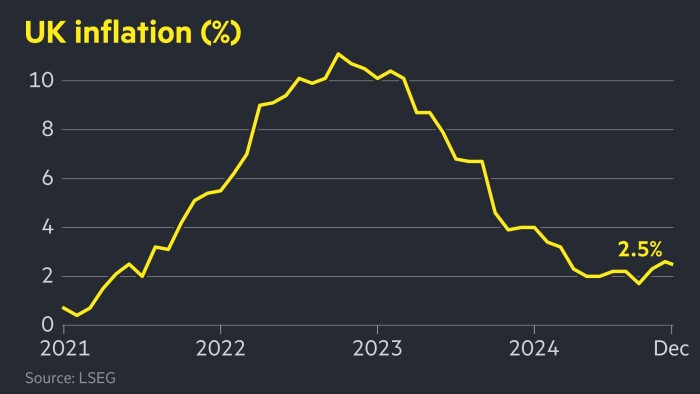

British inflation unexpectedly slowed to 2.5% in December, easing pressure on Chancellor Rachel Reeves and paving the way for the Bank of England to cut interest rates.

The Consumer Price Index figure was lower than November's 2.6%, dragged down by restaurant and hotel prices. Analysts last month expected inflation to remain stable.

The data will provide some relief to Mr Reeves, who is battling rising borrowing costs amid fears the UK economy could enter a period of stagflation with slowing growth and persistent price pressures. .

Recent rises in the UK government's borrowing costs, which hit a 16-year high last week, threaten to blow a hole in the chancellor's promise to balance everyday spending and tax revenues in 2029.

“We still have work to do to help families across the country pay their bills,” Reeves said Wednesday, stressing that he would “fight every day” to achieve growth and improve living standards.

“After a tough start to the year, this morning's inflation report should bring some relief to Reeves,” said Zara Noakes, an analyst at JPMorgan Asset Management.

He added that rising inflation could have “triggered further instability in the gold market.”

The report from the Office for National Statistics comes as the BoE's Monetary Policy Committee prepares to hold its first meeting of 2025 next month.

Traders had priced in a 75% chance of a 15 percentage point cut in February after the data was released, compared with about 60% ahead of time, according to swap market indicators.

Tomasz Wiladek, chief European economist at T. Rowe Price, said the latest data was a “clear green light for a further round of rate cuts.”

The BoE estimates that the economy will stagnate in the final quarter of 2024. Business surveys point to declines in confidence and employment, which could curb inflationary pressures.

Data on Wednesday showed that services inflation, which is closely watched by the Bank of England as an indicator of potential price pressures, sharply slowed to 4.4% from 5% previously.

This was also 4.9% below economists' expectations.

Core inflation, which excludes food and energy, fell to 3.2% from 3.5%.

Following the release of the statistics, the pound fell 0.2% to $1.219.

Liberal Democrat Treasury spokeswoman Daisy Cooper said on Wednesday that while the unexpected drop in inflation “brings a glimmer of hope, the reality is that the UK economy remains stuck in a quagmire.”

He added that growth was “nowhere to be seen” after the government's “detrimental” increases to Employer National Insurance.

Mel Stride, the Conservative shadow chancellor, welcomed the cuts but warned there were “continued challenges” as the rise in national insurance contributions for employers was “still severe” and likely to lead to higher prices. did.

Additional reporting by Ian Smith