Ripple CEO Brad Garlinghouse appeared on “Mornings with Maria” to comment on the cryptocurrency market, claiming that it will double in size by the end of 2024.

Former President Donald Trump may have succeeded in winning the hearts of cryptocurrency supporters last week by promising to embrace the burgeoning digital asset market if re-elected, but his credibility within the industry dates back to 2017, according to one former regulator.

Speaking at the Crypto Policy Summit in Washington DC on Wednesday, former Commodity Futures Trading Commission (CFTC) Chairman Chris Giancarlo said that President Trump already holds the title of “America's first crypto president,” a title he has held since his first year in office, when his administration approved the launch of bitcoin futures contracts at the CFTC.

“Not only has Trump declared he's 'good enough' about cryptocurrency, but he's also rightly calling himself America's 'first crypto president,'” Giancarlo said. “That's because regulated bitcoin futures trading was launched during Trump's first year in office.”

New court documents reveal SEC Chairman Gensler believed Ethereum was a security for at least a year

“The enduring success of a regulated futures market helped ensure that bitcoin, the world's first digital commodity, was priced in U.S. dollars,” he continued, calling it a significant achievement for the future of digital assets.

Giancarlo said cryptocurrency was not a political issue in 2017 when he and other CFTC commissioners were “united in support of regulatory reform.”

The Trump Administration has approved the launch of Bitcoin futures contracts at the CFTC. (James Devaney/GC Images | istock / Getty Images)

Seven years later, cryptocurrencies are poised to become a political issue in a presidential election for the first time after President Trump said at an event in Florida last week that if elected, he would end the “hostility” the industry has faced from regulators and Democratic lawmakers under the Biden administration.

Trump urged the crowd to vote for him if they liked cryptocurrency “in any form,” and even suggested he might start accepting campaign contributions in it.

His comments sparked excitement in the X cryptocurrency community, with some key industry figures voicing their support for him, leading some in the media to speculate that the former president had secured the industry's vote in November.

Determined to make its voice heard in the election, the crypto industry has raised more than $100 million through so-called Super PACs, with major crypto companies such as Ripple and Coinbase making significant donations. With six months to go until November, individual donations to pro-crypto candidates such as Massachusetts Senate candidate John Deaton and Ohio Senate candidate Bernie Moreno have also increased.

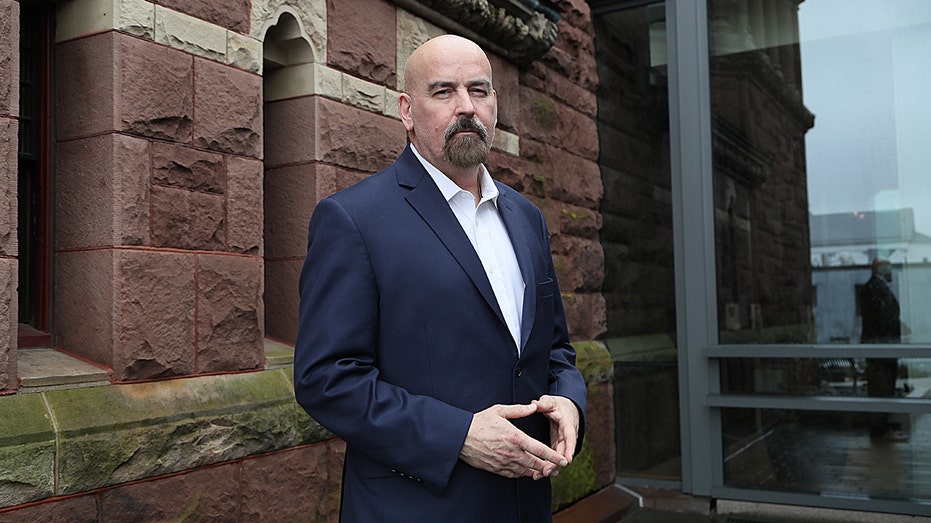

John Deaton, Republican candidate for the Senate in Massachusetts. (Suzanne Kreiter/The Boston Globe via Getty Images/Getty Images)

Crypto Industry Fights Back Against Government Crackdown

Meanwhile, since taking office, President Biden has often angered vocal crypto enthusiasts thanks to SEC Chairman Gary Gensler, who has brought numerous enforcement actions against some of the industry's largest companies, and Massachusetts Democratic Senator Elizabeth Warren, who has advocated for building an “anti-crypto army.”

Senator Elizabeth Warren (D-Massachusetts) spoke at a hearing of the Senate Banking, Housing and Urban Affairs Committee in Washington, DC on March 7. (Al Drago/Bloomberg via Getty Images/Getty Images)

Under the Biden administration, the SEC and CFTC are at odds over who should have jurisdiction over the $2 trillion cryptocurrency industry, while Congress struggles to pass a bipartisan bill to settle the issue. Meanwhile, the industry is trying to get clarity from various courts, who are also divided on whether digital assets should be regulated as commodities or securities.

The result has been growing hostility from cryptocurrency participants who see the federal government as trying to stifle their way of life.

Prominent crypto billionaires such as Cardano and Ethereum founder Charles Hoskinson took to social media in response to Trump's comments, saying that a Biden victory in November would further hurt the crypto industry.

Coinbase enters traditional payments market with $15 million in NBA ad spend

In contrast, Giancarlo said the Trump administration's approval of Bitcoin futures contracts has helped bolster the dollar's status as a reserve currency and strengthen its power. He noted that Bitcoin, which currently trades at over $60,000, recently overtook the Swiss franc to become the world's 13th largest currency, and that cryptocurrencies “are not going away.”

Bitcoin futures also aided in the January launch of 10 spot Bitcoin ETFs (exchange-traded funds) that track the daily price of the world's largest digital currency. The launch was hailed as a landmark moment for the industry, as it was finally legitimized by Wall Street giants such as BlackRock and Fidelity, allowing these firms to offer clients exposure to the cryptocurrency in a highly regulated ETF format.

Trump's critics say his sudden “180-degree turn” on cryptocurrencies (in June 2021, Trump said Bitcoin was “like a scam” that threatened the dominance of the dollar) was nothing more than a clever ploy to garner votes from enthusiasts who feel alienated and attacked by the current administration.

Some crypto industry insiders said they felt the same way under the regulatory oversight of SEC Chairman Jay Clayton during the Trump administration, who brought 56 crypto-related enforcement actions during his four-year term. By contrast, Gary Gensler has brought more than 90 enforcement actions since taking over as chairman in April 2021.

Click here to get FOX Business on the go

Giancarlo, who worked under both Democratic and Republican administrations during his tenure at the CFTC, is no stranger to political maneuvering, but he points out that the Trump administration's establishment of a “groundbreaking regulatory regime for virtual currencies” by establishing the Bitcoin futures system is “proof that U.S. regulators can successfully regulate virtual currencies if they are willing to do so.”