TP ICAP, an intermediary that connects buyers and sellers in wholesale financial, energy and commodity markets, expects the wholesale cryptocurrency market to be increasingly served by traditional brands and providers in 2024.

Duncan Trenholm and Simon Forster, global co-heads of digital assets at TP ICAP, said in an email that the operating model of spot crypto exchanges will continue to change as separation of execution and custody becomes the default for institutional investors. They expect trading activity to continue to shift to traditional regulated exchanges and venues, and that spot crypto volumes that were once dominated by offshore exchanges will start to shift to more regulated providers.

Duncan Trenholm, TP ICAP

“In November, CME overtook Binance to become the top exchange in terms of open interest in Bitcoin futures contracts,” Trenholm and Forster added. “We believe this will be a watershed moment for the broader crypto derivatives market.”

They argued that the biggest opportunity for their business is the continued institutionalization of the crypto space.

“The world's largest banks and asset managers are now actively deploying blockchain technology, including the World Bank, which issued digital bonds with Euroclear's DLT solution, and BlackRock, which has applied for a spot Ethereum ETF,” they added.

Tokenization

Consultancy coalition Greenwich agreed that the pace of adoption of blockchain technology in capital markets has been robust, even as many companies, particularly in the United States, have kept a low profile domestically or focused on other jurisdictions.

The report states: Market structure trends to watch in 2024The Greenwich Union said it was particularly interested to see progress being made towards the tokenization of financial instruments.

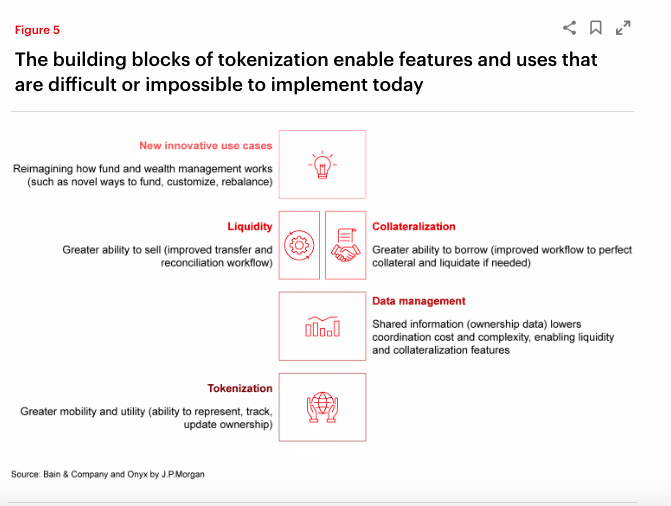

Tokenization and blockchain can increase efficiency by providing standardized processes for multiple participants in the trade lifecycle, enabling automated order processing, settlement, ownership tracking, and data management. Asset ownership and characteristics can be represented as smart contracts encoded in a distributed ledger. Smart contracts can be programmed with automated rules for settlement and corporate actions that update all relevant data for the involved participants.

Coalition Greenwich gave the example of corporate and government bonds, which are issued digitally “on-chain” and make up a small but growing part of the traditional market.

“Traditional financial institutions, often perceived as slow adopters of innovation, are now moving decisively beyond proofs of concept (POCs), pilots and sandboxes into production,” the report added.

According to Coalition Greenwich, these are signs that a major tipping point is coming as tokenization moves beyond real estate, art, venture capital, and private equity.

“As we delve deeper into this transformational journey, the centre of gravity may not ultimately be New York or London,” Coalition Greenwich said. “With US and UK regulators still seeking clarity from potential market participants, the market will be closely watching developments in places like Singapore and Switzerland.”

For example, Project Guardian, an initiative of the Monetary Authority of Singapore, has been partnering with traditional financial institutions to explore tokenization. In 2022, SBI Digital Asset Holdings, the digital asset arm of Japanese financial services company SBI Group, announced it would join Project Guardian to explore institutional trading of tokenized bonds and deposits to improve efficiency and liquidity in wholesale funding markets.

As part of the project, in November 2023, UBS, SBI and DBS launched the world's first live repo using digital bonds natively issued on a public blockchain. The transaction involved automatic and instant settlement of the repo, purchase and redemption of the digital bonds between regulated entities in Japan, Singapore and Switzerland using a regulated digital payment token. The transaction demonstrated benefits such as 24/7 real-time settlement, operational and capital efficiencies, while ensuring compliance and security requirements.

Additionally, US ETF issuer WisdomTree, along with JP Morgan and Apollo, announced a new proof of concept for an institutional use case of tokenization and smart contracts for model portfolio rebalancing as part of Project Guardian.

Simon Forster, TP ICAP

Trenholm and Forster believe the tokenization trend will only accelerate, and as digital assets gain legitimacy and acceptance within traditional financial institutions, they will gain wider trust and be integrated into the mainstream financial system, but they also warn that blockchain interoperability is a major challenge.

“When large institutions launch their own chains while leveraging public chains like Ethereum, this can result in trapped liquidity and a fragmented ecosystem that hampers the efficiency gains that blockchain technology can unlock,” they added. “Advances in blockchain interoperability protocols will be crucial in breaking down existing silos between different blockchains.”

Alternative Investments

According to a report by JP Morgan, tokenization could unlock a $400 billion opportunity in the distribution of alternative investments. Onyx Digital Assets Consulting firm Bain & Company.

Tyrone Lobban, J.P. Morgan

Tyrone Lobban, head of blockchain and Onyx digital assets at JPMorgan Onyx by JPMorgan and one of the report's authors, said blockchain and tokenization could directly address the distribution challenges facing the alternative investment industry for both institutional and retail investors, which could represent a $400 billion annual new revenue opportunity.

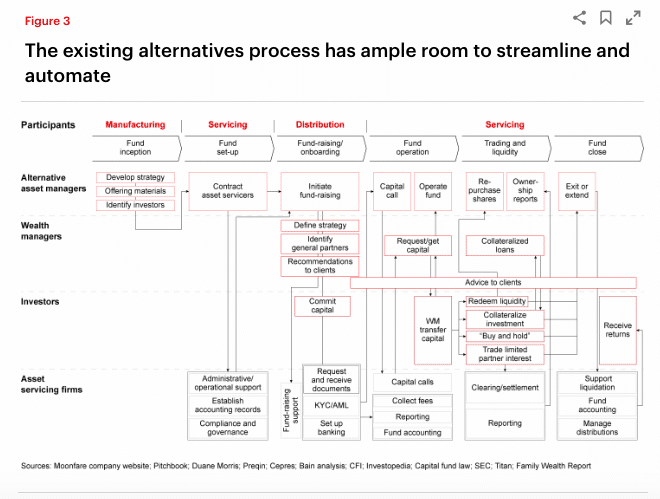

Lobban said the alternative investment industry remains highly manual. Time-consuming, multi-party processes with siloed data and costly reconciliation. Increasing automation using DLT and tokenization will significantly improve investor experience and the introduction of additional functionality will enable wider adoption of alternatives by qualified individuals, creating new revenue streams and cost efficiencies for fund managers and distributors.

The bulk of the $400 billion opportunity will come from increased distribution and assets under management, with companies across the value chain generating new revenues from improved liquidity, while the report said there is a $270 billion opportunity for fund managers.

“By expanding their investor base, fund managers may be able to attract more capital, leading to increased assets under management and revenue from management fees and carry,” the report said. “New revenue streams may arise from secondary trading and partnering with distributors, and cost savings may also be realized through simplified administration.”

Tokenization has the potential to make illiquid investments more liquid for individuals.

“Note that enhanced settlement and improved holding records alone will not create liquidity – a sufficiently strong buyer network is essential,” the report added. “This can come from existing holders or from secondary funds that have the opportunity to purchase small new supply of familiar funds at less than net asset value.”

We may also see the emergence of a new class of market makers providing liquidity to previously illiquid assets.

The technology also offers the potential to introduce new functionality, such as tokenizing underlying investments (such as individual company shares in a private equity fund) to enable partial divestments, programmatic rebalancing of discretionary model portfolios, and automating unpredictable, time-sensitive, and manual capital calls. When a private equity fund makes a capital call, smart contracts can enable the automatic redemption of liquid tokenized investments, using the proceeds to meet the capital call.

“Consider asset managers that build customized alternative portfolios for large institutional investors,” the report added. “These firms can leverage scalable, transparent platforms to streamline manual processes and reinvest in higher-value functions such as manager due diligence.”

Source: Bain & Company

Trenholm and Forster said that on-chain cash, and stablecoins in particular, will increasingly be recognized as one of the most important use cases for cryptocurrencies.

“With increasing industry professionalization and the likely approval of spot-based Bitcoin and Ethereum ETFs in the US, we believe 2024 could be a year of significant change in overall sentiment,” they said.