Analyst and trader Kevin Svenson is bullish on Bitcoin (BTC) as the leading crypto asset breaks out of a bullish reversal structure.

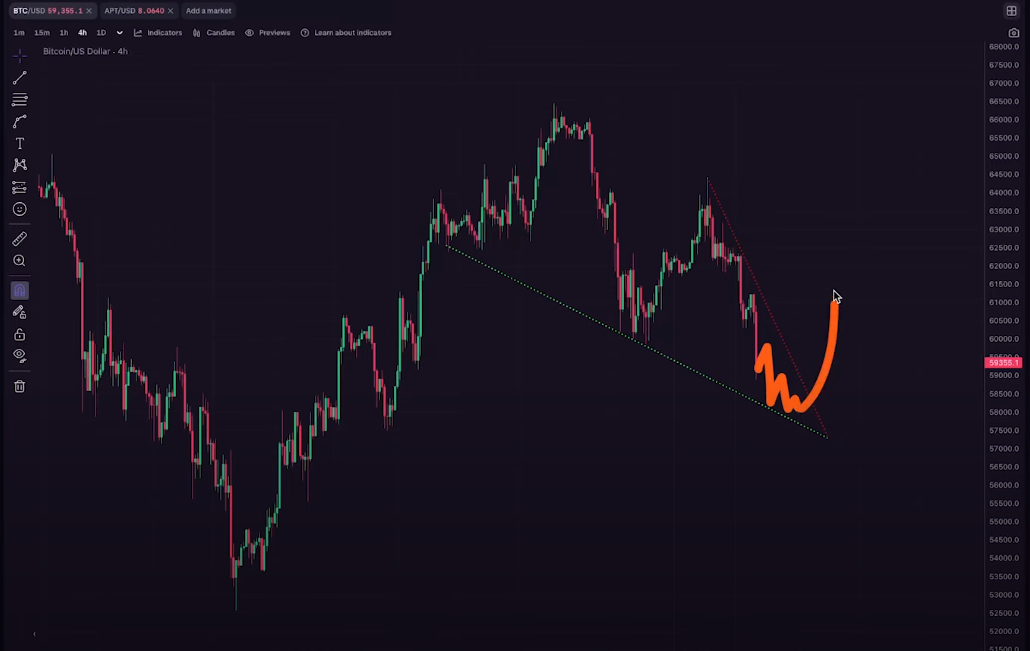

In a video update, Svensson told his 79,800 YouTube subscribers that Bitcoin appears to be forming a descending wedge pattern on the four-hour chart.

The descending wedge formation is a bullish reversal pattern, suggesting an upward trend as seller momentum declines.

According to Svensson, the completion of the descending wedge pattern could indicate a local bottom for Bitcoin.

“As long as the stock market remains stable, I think Bitcoin should be close to completing this pattern. Maybe it will fall further. But theoretically, if this was a known low, If we extrapolate the falling wedge, Bitcoin could have a pretty good recovery and a pretty good rebound to recover from this range.”

At the time of this writing, Bitcoin is trading at $62,718, indicating that BTC has broken out of its descending wedge pattern.

However, a crypto analyst and trader says that Bitcoin needs to continue lowering its lows on the daily time frame to maintain any chance of a sustained recovery. According to Svensson, a break through a key level will trigger a new downside event.

“So the lowest price I would like to see Bitcoin fall is around $57,000. It still has a chance of hitting that trend line, but if we break below that, it means things are a little bit risky. That means it will likely give us room to get back to where all these wicks were and drive prices down to deep lows again before rebounding.”

Looking at the trader's chart, he appears to be indicating that Bitcoin will see a recovery after trading above $62,000 with a target price just below $90,000.

Never miss a beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me ×Facebook and Telegram

Surf the Daily Hoddle Mix

Disclaimer: The opinions expressed on The Daily Hodl do not constitute investment advice. Investors should perform due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that transfers and transactions are made at your own risk and you are responsible for any losses you may incur. The Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets. The Daily Hodl is also not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3