- Toncoin has an average of 500,000 new holders every day.

- Holders have struggled to maintain profitability while growing.

ton coin [TON] It has shown impressive growth since its launch, and there are signs suggesting it could eventually surpass Ethereum. [ETH] In terms of number of holders.

The latest data reveals that the number of Toncoin holders is steadily increasing, suggesting that the number of Toncoin holders could overtake Ethereum by the end of the year. However, while the number of holders has soared, profitability has shown a declining trend, indicating a mixed outlook for the asset.

Toncoin holders increase rapidly

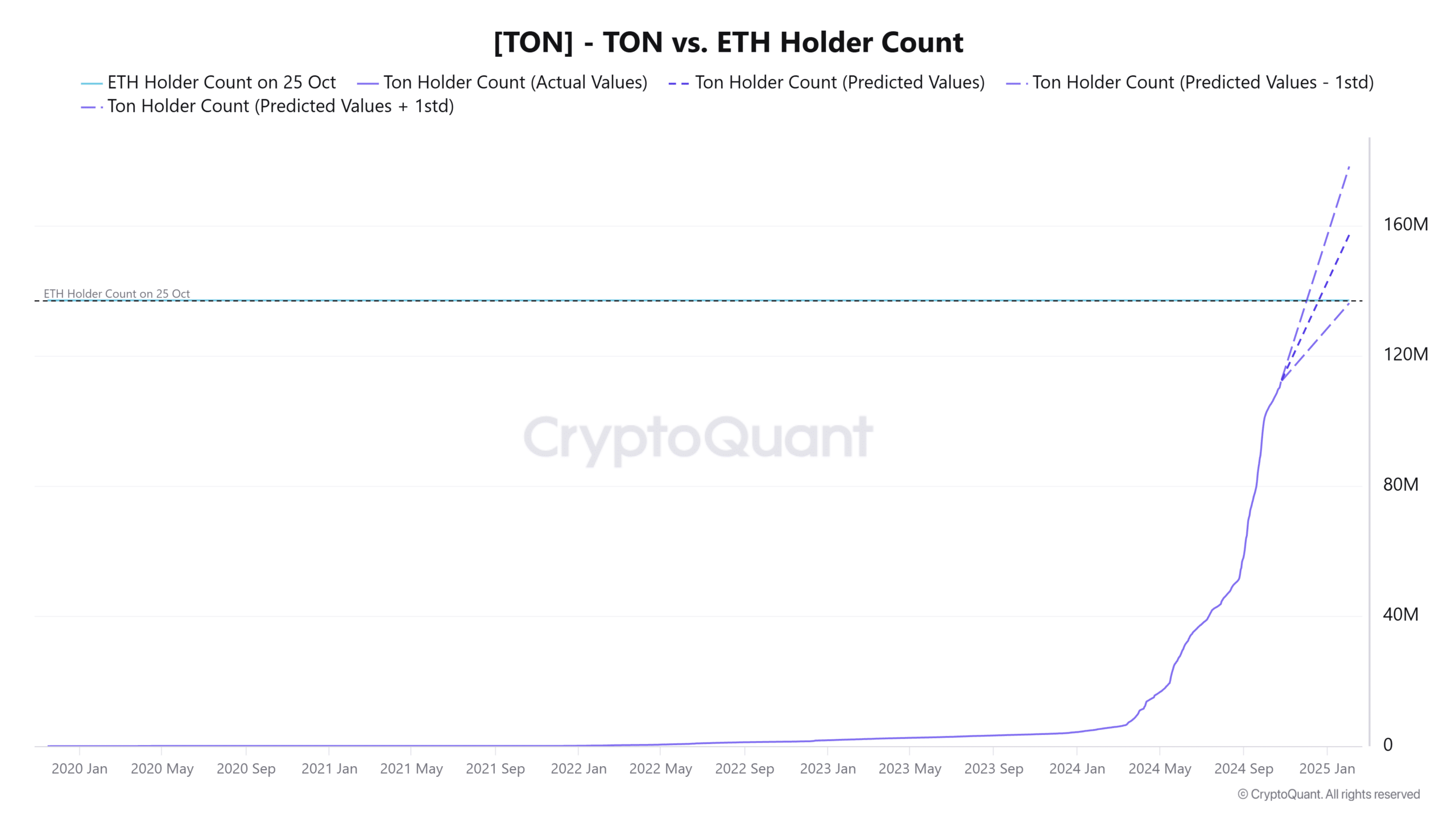

According to CryptoQuant, Toncoin’s holder base has increased significantly. From March 15th to October 17th, the number of TON holders jumped from about 7.12 million to about 108 million.

This growth rate is significantly higher than that of Ethereum, which has remained stable at around 137 million holders. According to our analysis, TON is currently adding around 500,000 holders every day.

Source: CryptoQuant

If this situation continues, Toncoin may surpass the number of holders of Ethereum by December. Even if rates slow, this milestone is expected to be achieved within the next year, indicating that TON could soon have more holders than ETH.

Assessing the profitability of Toncoin holders

A rapid increase in the number of holders does not necessarily lead to high profitability for all Toncoin investors. An analysis of IntoTheBlock's global In/Out of the Money chart shows that many Toncoin holders are currently experiencing losses.

Approximately 75.43 million addresses, representing 80.70% of total holders, are currently classified as “out of the money.”

Conversely, only about 13.16 million addresses, or 14% of holders, are “In the Money” (profitable), and the remaining 5.22% are at break-even point.

By comparison, Ethereum's indicators show a better outlook regarding profitability. Currently, more than 67% of Ethereum holders are “in the money” and 29% are “out of the money,” and recent data shows that ETH is becoming more profitable for holders. It has become a valuable asset.

Toncoin’s current market position

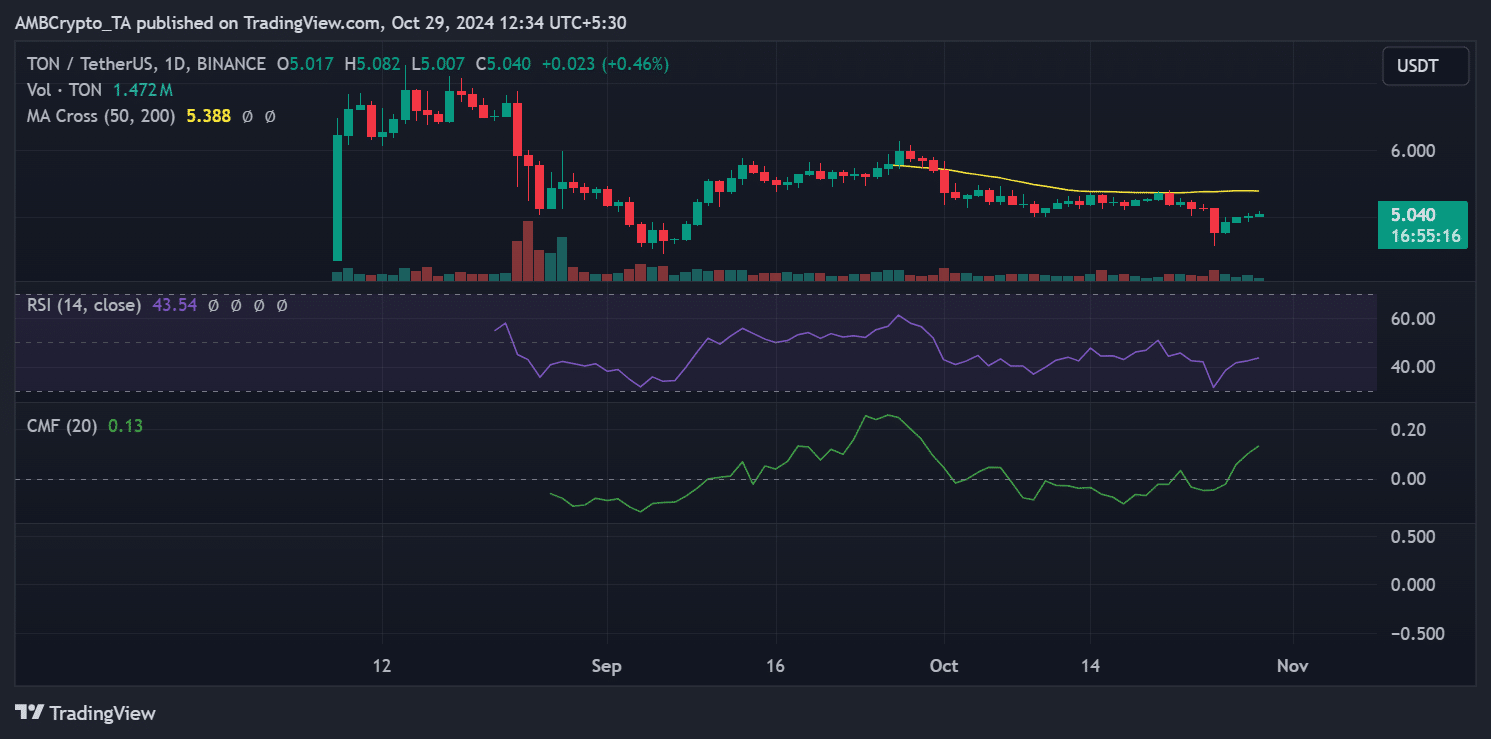

Toncoin is trading around $5.04, up slightly on the day but still below its 50-day moving average of $5.388. This places TON in a medium-term bearish trend.

The Relative Strength Index (RSI) was at 43.54, suggesting neutral to slightly oversold conditions, which could indicate room for upside if buying interest increases.

Source: TradingView

The Chaikin Money Flow (CMF) indicator is 0.13, reflecting positive money flow and indicating some accumulation within the market. To enter a bullish trend, TON needs to rise above the 50-day moving average.

If the upward momentum fails, TON may continue to consolidate near the current price or test the lower support level near $4.90.

Is your portfolio green? Check out Toncoin Profit Calculator

Overall, Toncoin's increase in holders is noteworthy, but its profitability remains a concern. The company's market performance in the coming weeks will largely depend on whether it can overcome these technical resistance levels and continue to attract investor interest.