Investors are starting to feel a healthy amount of cognitive dissonance, the unpleasant feeling you get when two beliefs you hold don't quite match up.

Meanwhile, U.S. markets are surging on the back of AI optimism and potential tax cuts.

And on the other hand, company stock prices are starting to roughly resemble the early days of the dot-com bubble in the late '90s compared to actual profits.

So which belief will prevail in 2025, boom or bust? Let's parse through this contradictory outlook by considering three questions in particular:

Are US stocks overvalued?

This time last year, we said that the economic boom could continue if the Fed lowered interest rates as inflation cooled.

Interest rates did drop, and the market took notice. Through the end of November 2024, the Betterment Core portfolio, which is 90% stocks, had a year-to-date return of approximately 17.6%.

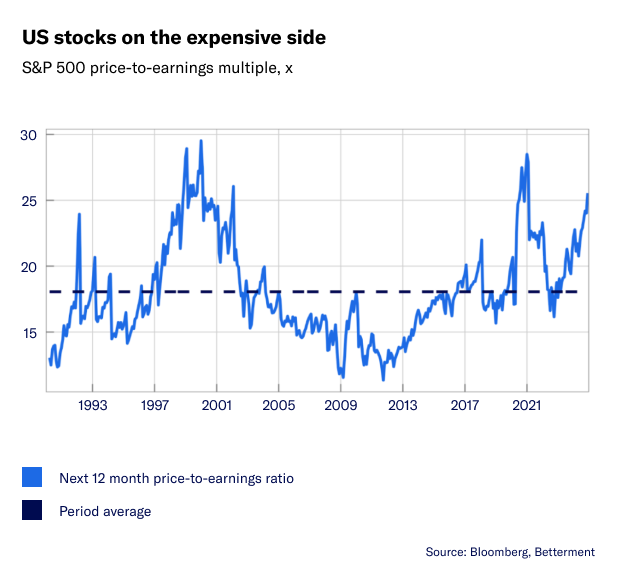

However, such a rally raises speculation of further reversals, swings of the pendulum toward less frothy valuations, and lower portfolio returns. The S&P 500 currently costs about 25 times the price these companies are expected to bring in over the next 12 months. For comparison, this average “price-to-earnings” ratio over the past 35 years has been 18 times.

But from a long-term investor's perspective, these ratios aren't as important as you might think. As long as you keep investing for more than a few years, the overall market valuation can “grow”.

Remember 2021, when tech-heavy risk stocks became pandemic darlings and were blown to the moon? Analysts rightly decried such valuations as unsustainable.

But within a few years, the market hit new all-time highs. Investors who had sold or stayed on the sidelines would have missed out on all of this growth. So if you're tempted to sell “high” now, keep this in mind:

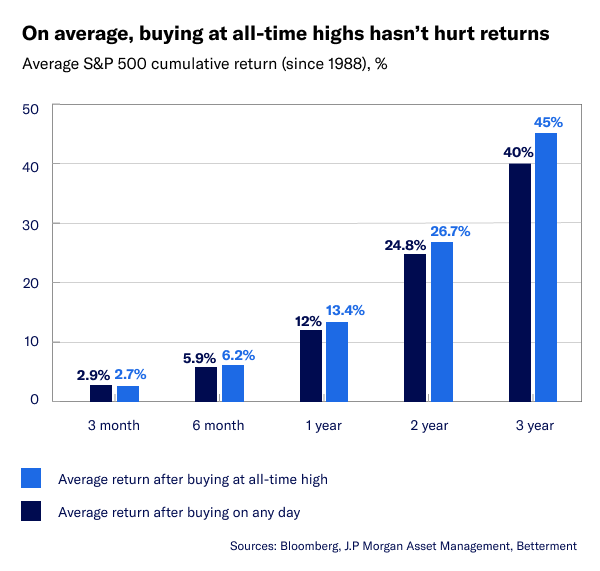

On average, investing at historical highs will not result in lower future returns than investing on any given trading day.

Conversely, if you buy when the market is unprecedented, your average return will be slightly higher in the long run. It is impossible to know exactly when the growth cycle ends.

Will AI work?

A big driver of the bull market is optimism around artificial intelligence and the big tech companies that power it, including Amazon, Google and computer chip maker Nvidia. Stock prices have increased significantly over the past 12 months, and as a result, they represent an increasingly large portion of the U.S. and global stock markets.

However, there is debate about the superior performance of AI and all the fuss about AI in general. While some analysts argue that heavy investments in AI will ultimately not bear fruit, others predict significant increases in productivity and profits.

Alongside the possibility of a revolutionary turnaround, there is once again a worrying feeling that it is mostly hype. In the face of uncertainty, all you can do to lower your risk is hedge and diversify your bets. Our portfolio's equity allocation keeps this in mind, providing significant exposure to Big Tech, while also investing in Europe, Japan and emerging markets. These cheap stocks provide a potential cushion if AI ambitions fall short.

Alongside the possibility of a revolutionary turnaround, there is once again a worrying feeling that it is mostly hype. In the face of uncertainty, all you can do to lower your risk is hedge and diversify your bets. Our portfolio's equity allocation keeps this in mind, providing significant exposure to Big Tech, while also investing in Europe, Japan and emerging markets. These cheap stocks provide a potential cushion if AI ambitions fall short.

Does the market care who is in the White House?

At this point, markets don't know exactly what to make of President-elect Trump's proposed economic policies. While the promise of corporate tax cuts has fueled the recent rally in stocks, it could actually increase inflation. The same goes for tariffs and mass deportations. And rising inflation could cause the recent trend of rate cuts to be paused or reversed. However, the full impact will not be known until more detailed information is available, or until the policy itself is actually implemented.

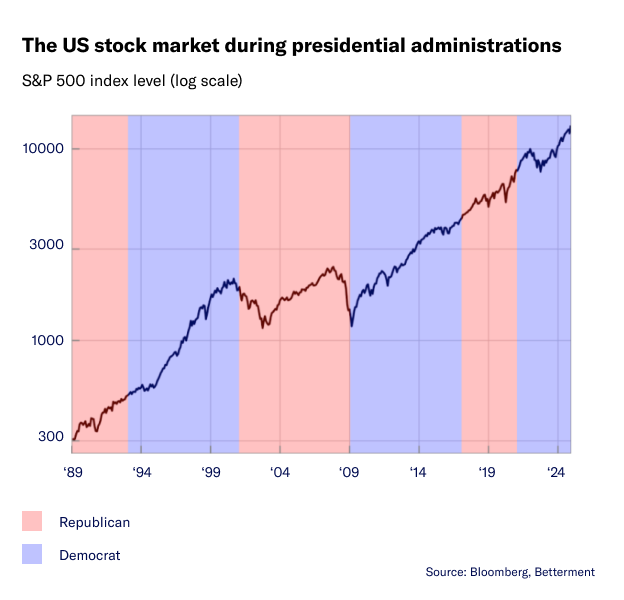

Rather than sit back and wait anxiously, I encourage you to take a look at the chart below. This shows that markets tend to rise over time, regardless of which party is in office. Maintaining a consistent and diversified investment approach is the best way to weather political and economic cycles. Also, maybe it will ease my news consumption a little bit.

So what now?

As always, it's impossible to know exactly how long each growth cycle will last, so consider the mistake of continuing to invest. If you find yourself sitting around with a lot of cash, now might be the time to put it to use in the market. Studies have shown that you can invest in a lump sum and have the potential for higher returns. Or you can sprinkle them into your portfolio over time. Most importantly, no matter how the market goes in 2025, it's a good idea to zoom out and remind yourself that you're in the market for the long haul.