Bitcoin has been suffering from low lows in recent weeks, with many investors questioning whether their assets are on the brink of the major bear cycle. However, rare data points related to the US Dollar Strength Index (DXY) suggest that a significant change in market dynamics may be imminent. This Bitcoin purchase signal, which has only appeared in BTC history three times, could point to a bullish reversal despite current bearish sentiment.

To find out more about this topic, check out our recent YouTube videos here.

Bitcoin: This happened three times before

BTC vs DXY The opposite relationship

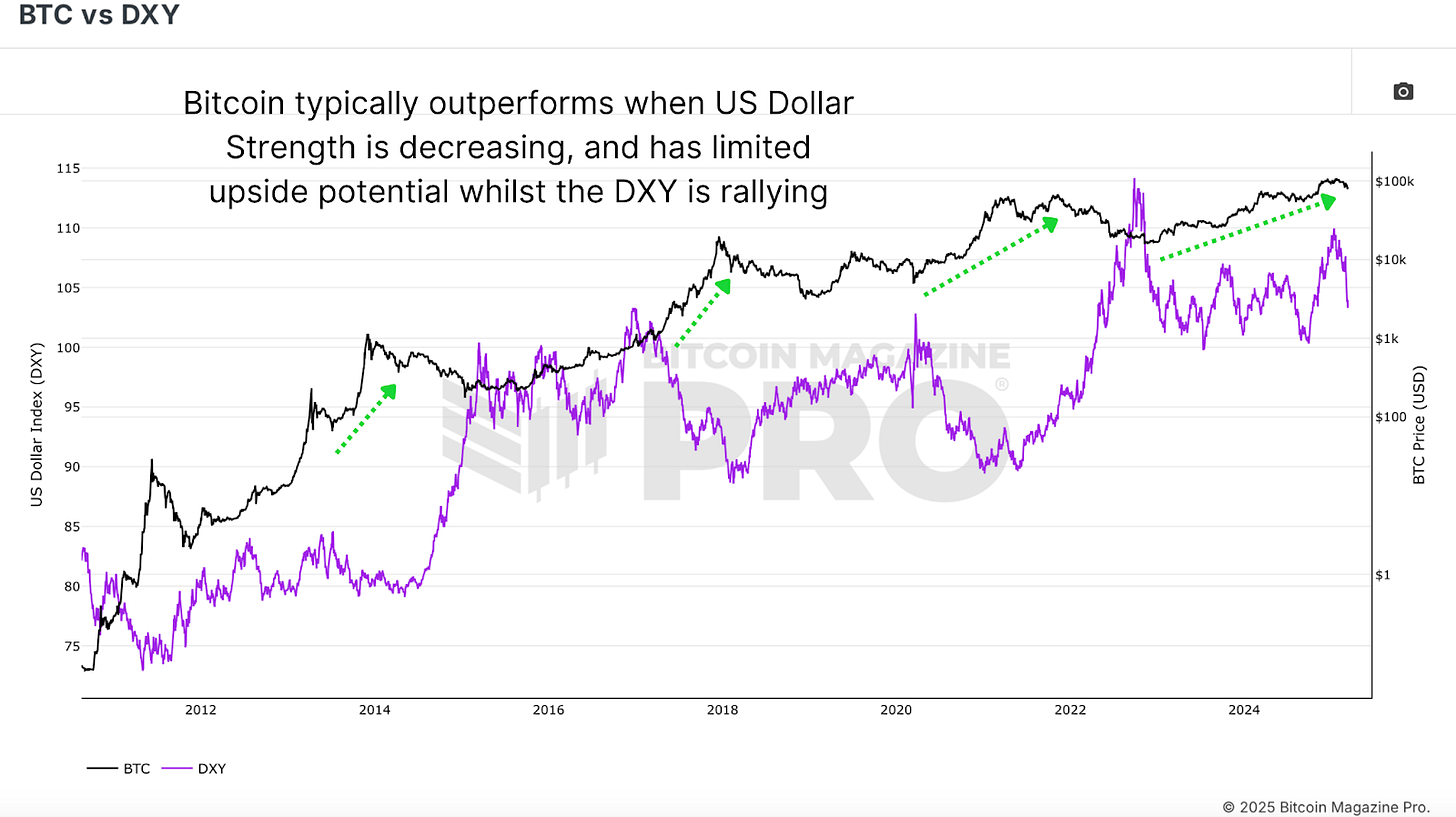

Bitcoin's price action has long been inversely proportional to the US Dollar Strength Index (DXY). Historically, when DXY strengthens, BTC tends to struggle, but DXY declines often create favorable macroeconomic conditions due to the rise in Bitcoin prices.

Despite this historically bullish influence, Bitcoin prices have continued to withdraw, falling below $80,000 recently from over $100,000. However, the past occurrence of this rare DXY retracement suggests that a delayed but meaningful BTC rebound may still be working.

Bitcoin buys the historical outbreak of signals

Currently, DXY is declining sharply, falling by more than 3.4% within a week, with only three observations across Bitcoin trading history.

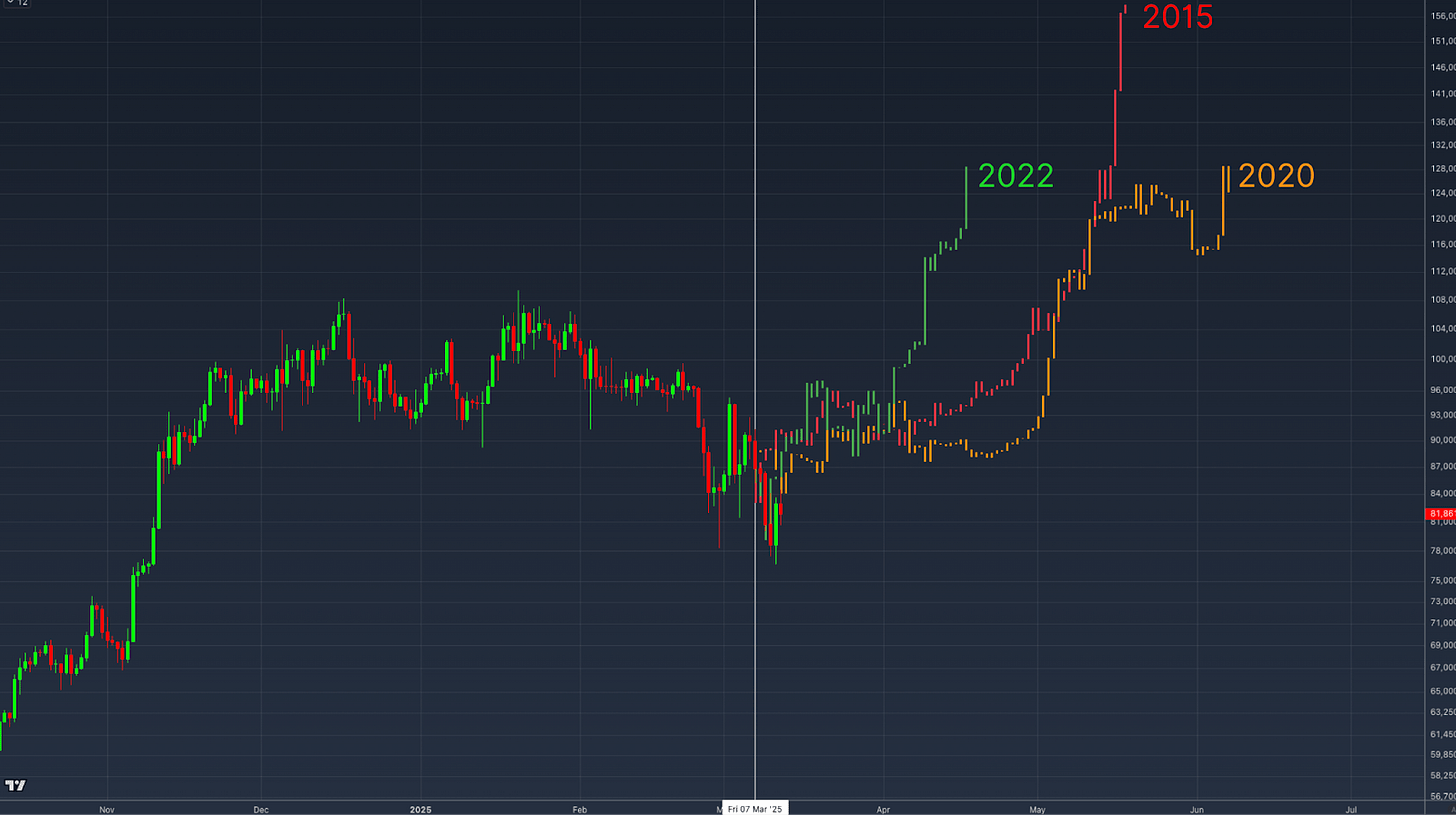

To understand the potential impact of this DXY signal, let's look at three previous instances where this sudden drop in the US dollar strength index occurred.

- Market bottoms since 2015

The first outbreak came after the price of BTC bottomed in 2015. After the horizontal integration period, BTC prices experienced a significant upward surge, increasing by more than 200% within a few months.

The second example occurred in early 2020, following the sharp market collapse caused by the Covid-19 pandemic. Similar to the 2015 case, BTC initially experienced choppy price action before a rapid upward trend emerged, culminating in a few months of rally.

- 2022 Bear Market Recovery

The latest instance took place at the end of Bear Market in 2022. After an initial period of price stabilization, BTC continued to recover, rising to a rather high price, and began its current bull cycle over the next few months.

In both cases, a sharp decline in DXY followed by the integration phase before BTC embarked on a rather bullish ride. Overlaying the price action for these three instances with the current price action gives you an idea of how things can unfold in the near future.

Equity Market correlation

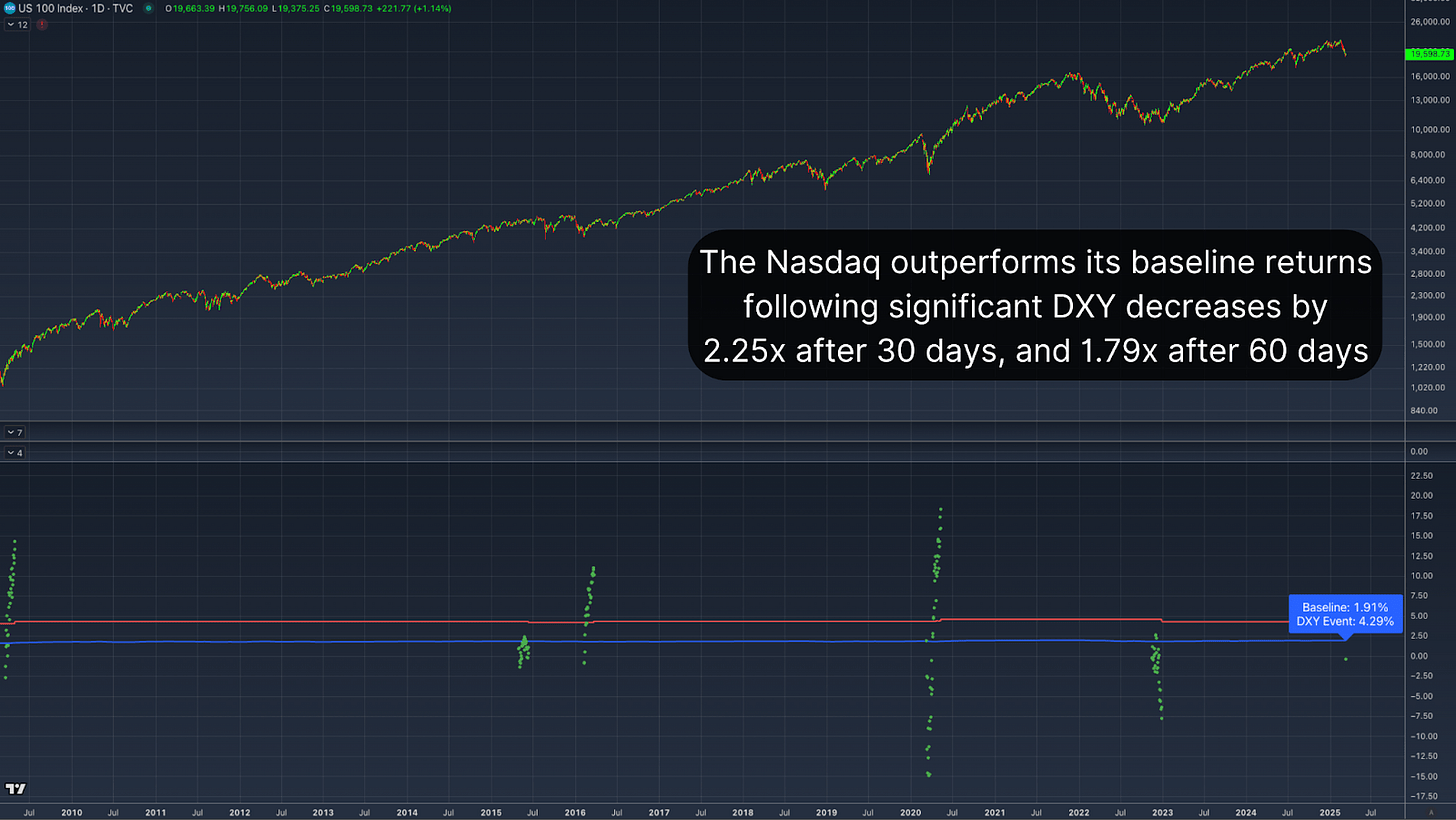

Interestingly, this pattern is not limited to Bitcoin. Similar relationships are observed in traditional markets, particularly in the Nasdaq and the S&P 500. With DXY being boosted sharply, the stock market has historically surpassed its baseline returns.

NASDAQ's record-high 30-day revenue after similar DXY decline was 4.29%, far surpassing the standard 30-day return of 1.91%. Extending the window to 60 days will increase the average NASDAQ revenue by nearly 7%, almost double the typical performance of 3.88%. This correlation suggests that Bitcoin's performance following a keen DXY retracement is consistent with historic broader market trends, reinforcing the debate of delayed but inevitable positive responses.

Conclusion

The current decline in the US dollar strength index represents a rare and historically bullish Bitcoin purchase signal. Although BTC's immediate price action remains weak, the historic precedent suggests that periods of integration are likely to continue and significant gatherings. A broader macroeconomic environment is favored for BTC, particularly when reinforced by observing the same responses at indexes such as the Nasdaq and S&P 500.

Be ahead of Bitcoin price action with Bitcoin Magazine Pro, explore live data, charts, indicators and in-depth research.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.