Mantra Price has become a parabolic since 2024, becoming one of the most performant players in the crypto industry.

Mantra (OM) hopes to become the biggest crypto in the real world asset or RWA industry, surged to $9.10 from $0.0158 in January 2024. This surge has shifted its market capitalization from $29 million in January 2024 to $8.45 billion today.

Mantra jumped after launching Mantrachain in 2024. Mantrachain hopes to become the largest layer 1 network for the RWA industry. Last week, the developer launched RWACCELERATOR. This is what we want to fund developers in the industry.

The Mantra also owns a Mantra Zone, a gateway to the chain, where users complete on-chain missions and boost reward allocation. These users receive the regular airdrop. This will help you increase your income, especially as OM prices are rising sharply.

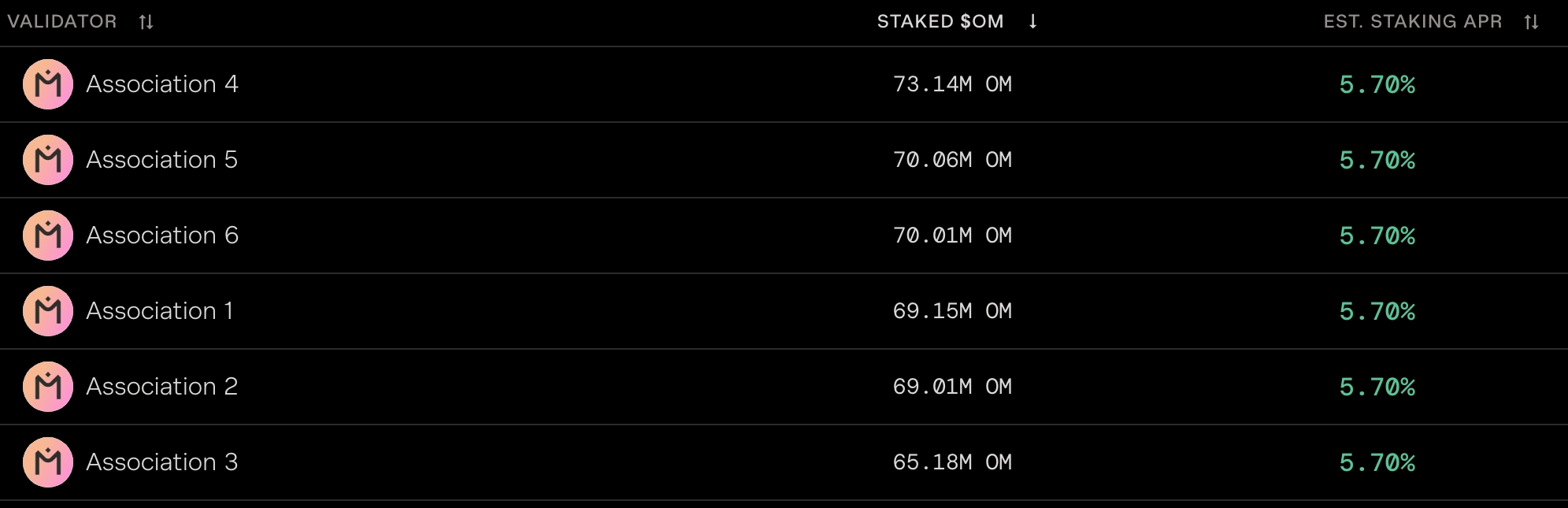

Mantra Price is roving for a stronger and more durable reward than other networks such as Ethereum (ETH) and nearby protocols (near). Most OM validators pay an average staking yield of 5.50%.

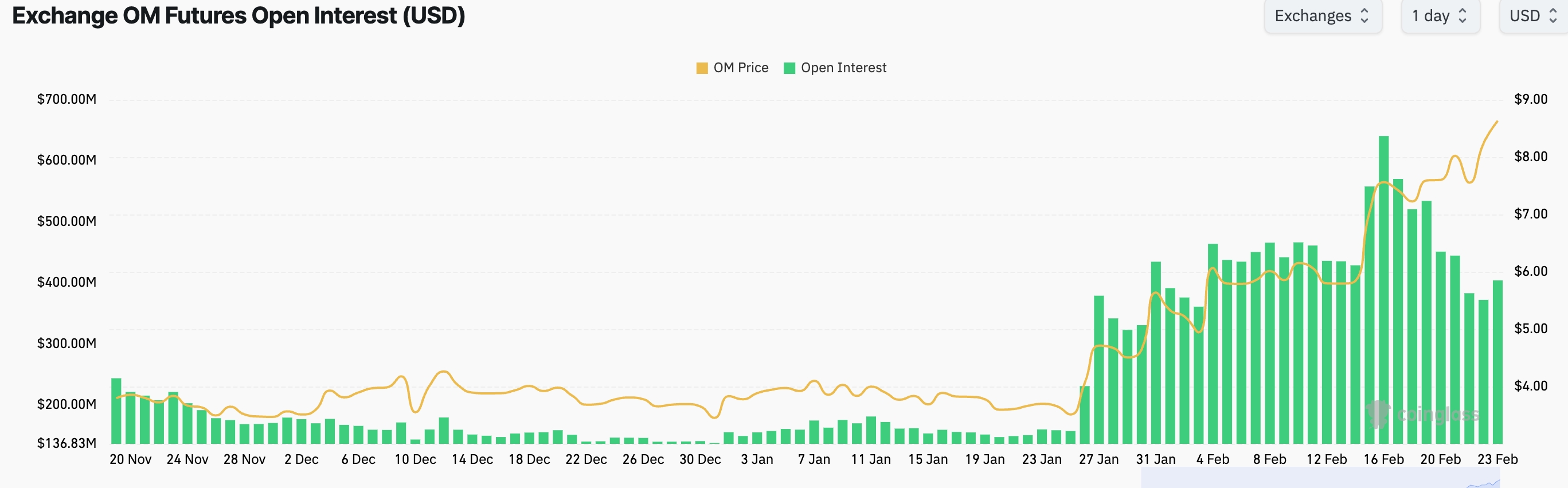

There are several reasons why OM prices are quickly reversed. First, there is a continuing difference between mantras and open interest in futures.

As shown below, Coinglass data shows futures interest peaked at $640 million earlier this month, falling to $404 million. The difference is a sign that futures market investors are cutting bets on coins.

Mantra Price Technique refers to retreat

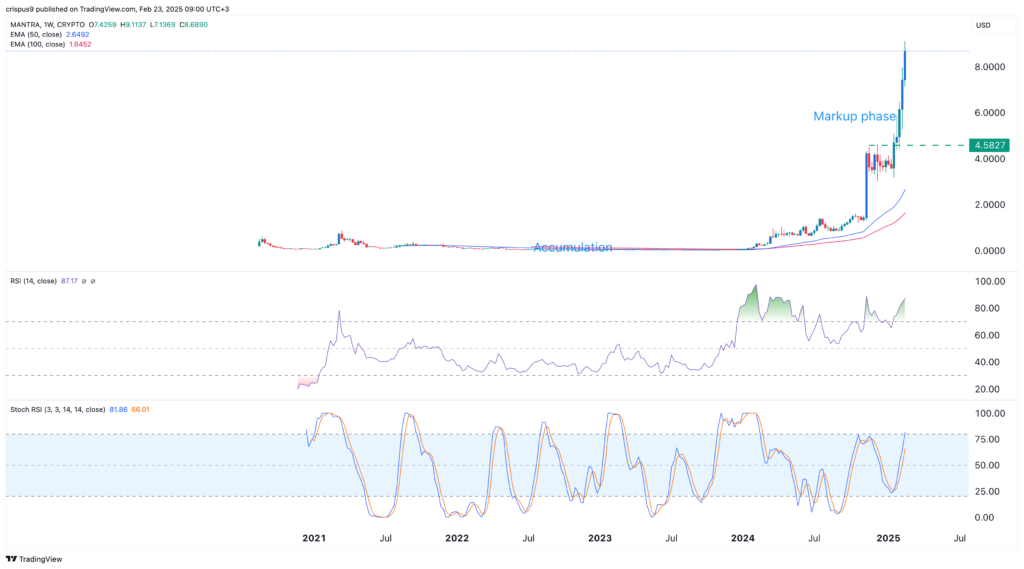

Second, OM prices may be retreated due to the concept of mean return. This is the concept that states that assets always return to the historical average.

For example, the 50-week moving average is $2.65, while the 100-day average is $1.64. In this case, the average rotation concept suggests that prices return to these averages over time.

Third, the mantra price is still in the markup phase of the Wyckoff method. The chart above shows that it remains in the integration phase between 2020 and 2024. This integration was part of the accumulation.

It then entered the markup phase in 2024 and is currently underway. This phase is usually followed by a distribution followed by a markdown in which the assets recede.

Fourth, there are indications that mantra tokens are being acquired in excess. The relative strength index moved to an extreme excess point at 87, but the stochastic RSI approaches the level of acquired. These are signs that momentum may begin to fade.

So, at least up to the next major support level, the mantra price could drop on December 9th with the best swing.

Mantra: From defi to tokenized assets

Started in 2020 by John Patrick Marin, Will Corkin and Rodrigo Quan Miranda, the project initially highlighted community-driven governance and cross-chain interoperability, gaining traction as Mantra Dao I did.

Originally built on Polkadot's substrate framework, Mantra has expanded to multiple blockchain networks, including Ethereum and Binance Smart Chains. It offers users the opportunity to wager om tokens, earn yields and participate in the lending and borrowing market.

Recently, the Mantra has pivoted towards regulated financial services and protected Abu Dhabi's Virtual Asset Service Provider (VASP) licenses. This move places it as a leader in real asset tokenization, bridging the gap between traditional finance (Tradfi) and Defi.

By integrating RWAs in real estate and financial products, Mantra is a pioneering compliant, scalable blockchain solutions.