Key takes

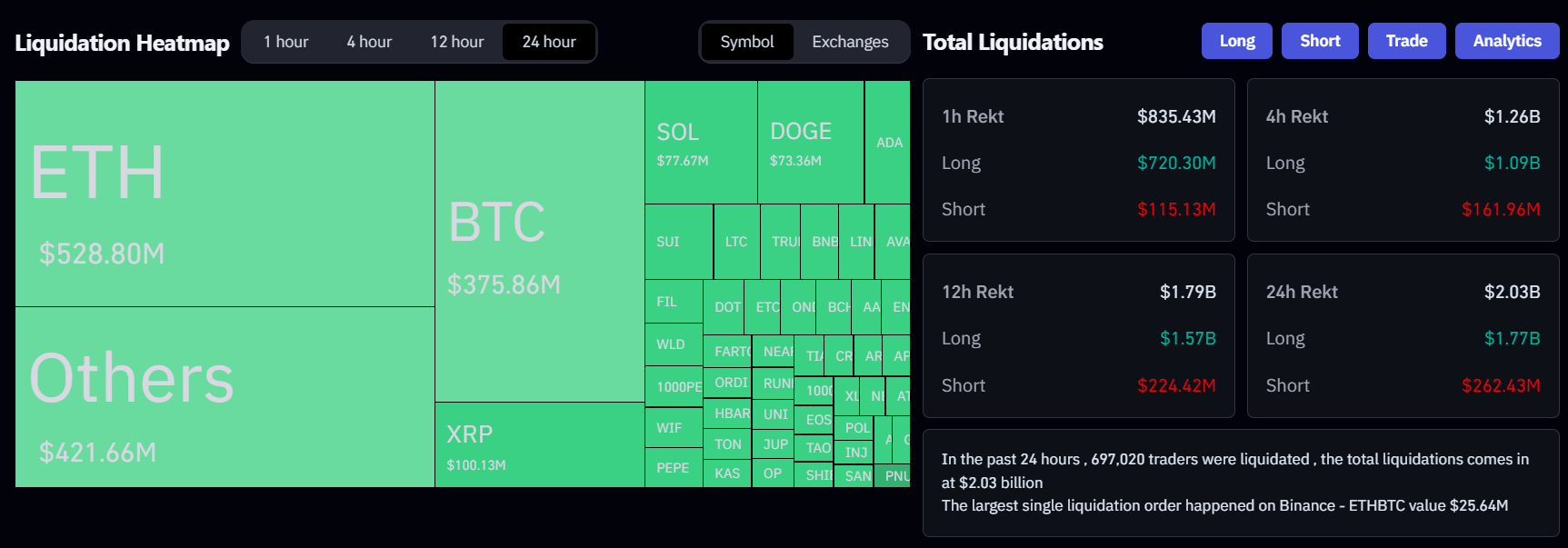

- Crypto Crash has wiped out the $ 2 billion leverage liquidation in the past 24 hours.

- Despite the recent decline, analyst suggests that a decrease in dollars and a decline in US fees can create conditions that are advantageous for the recruitment of bitcoin.

Please share this article

According to Coinglass data, Trump announced new tariffs that caused inflation, and Bitcoin has dropped to $ 2 billion, as Bitcoin has dropped to the lowest level since early January.

Trump announced on Saturday to impose 25 % tariffs on imports from Canada and Mexico and 10 % of Chinese products. This measure, targeting three largest trading partners in the United States, will be taken on Tuesday.

The President has dealt with border security and assembled tares in the crisis of the opioid, especially a more wide strategy for fighting Fentanyl's trafficking.

Economist warns that Trump's new tariffs can increase consumer costs as companies pass additional costs.

White houses claim that these measures will strengthen American production, but experts can worsen inflation and may cause trade disputes that affect all related countries. And it may lead to the confusion of the supply chain.

The announcement of these tariffs has caused the encryption market volatility because investors responded to the fear of increasing inflation pressure.

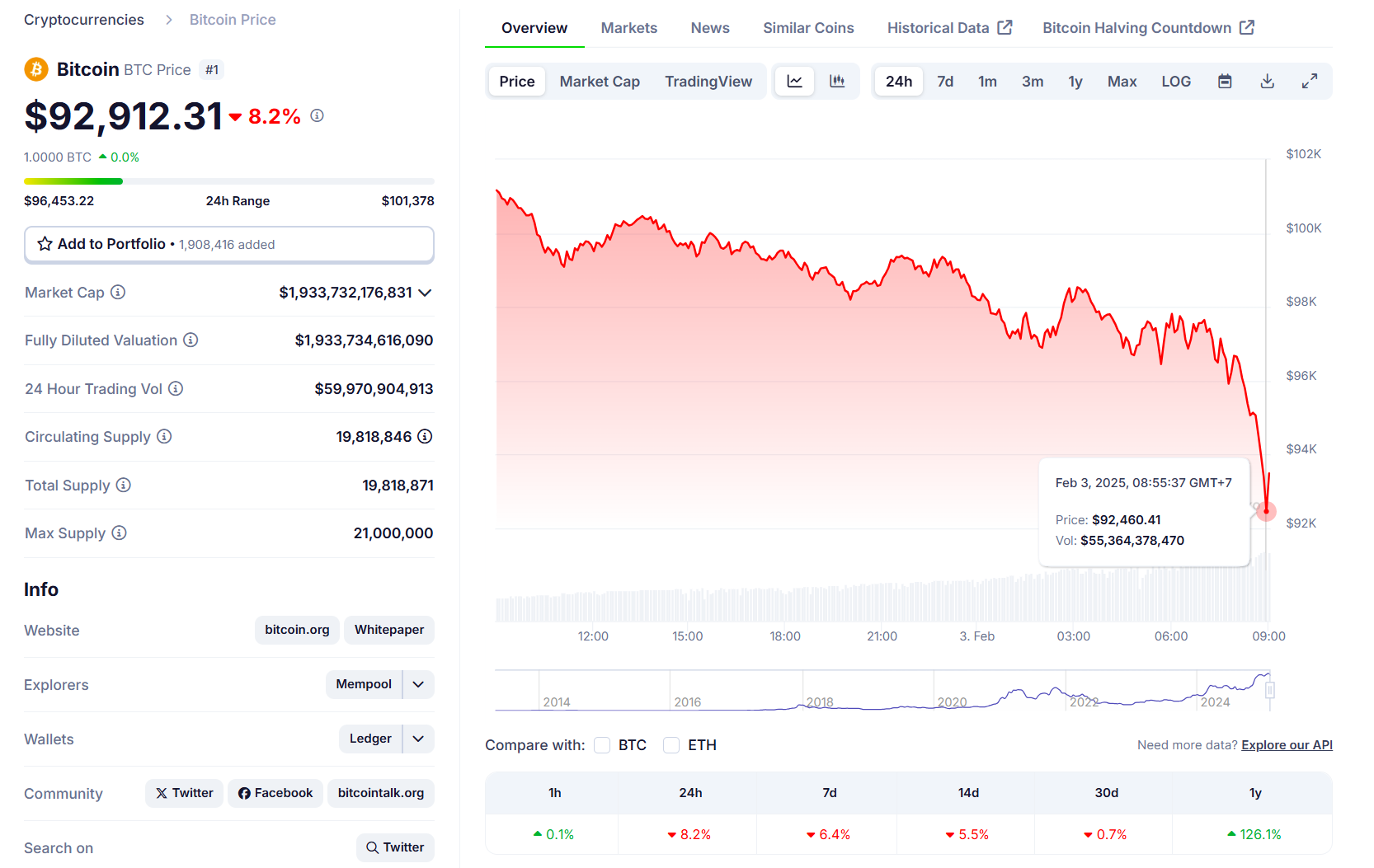

According to coingecko data, bitcoin fell below $ 100,000 on Saturdays and decreased to $ 92,000, but Ethereum has decreased 24 % to $ 2,300.

The turbulence of the market has set up a $ 1.7 billion long position for 24 hours, the Ethereum trader has experienced $ 528 million, and the Bitcoin Trader faces $ 421 million. The coinglass data is shown.

The overall codal market capital reduction is reduced by about 8 %, and most encryption assets have a two -digit loss within one day. XRP and DOGE fell by 30 %, ADA decreased by 35 %, and SOL and BNB decreased by 15 %, respectively.

Trump tariffs will send bitcoin price higher and faster.

Analysts believe that Trump's new tariffs can lead to an increase in bitcoin demand as hedging for inflation. However, continuous market volatility has been paying attention to the fact that in the short term may continue to put pressure downwards.

According to Jeff Park, the head of Alpha Strategies in Bitwise Asset Management, Trump's tariff policy may be inadvertently set the stage of the bitcoin boom.

This is the only thing you need to read about tariffs to understand the 2025 bitcoin. This is definitely my best belief macro trade this year: PLAZA ACCORD 2.0.

Bookmark this and release the financial war to send bitcoin intensely, so please revisit. pic.twitter.com/wxmb36yv8o

-Jeff Park (@DGT10011) February 2, 2025

Park suggests that the implementation of new tariffs can weaken dollars and create conditions that are advantageous for bitcoin growth. This happens when the United States is working on a trifin dilemma. There, the role as a world -class preparatory currency needs to maintain a trade deficit to provide global liquidity.

Customs dollars are considered to be a strategic movement that temporarily weakens the dollar, potentially led to the same multilateral agreement as the Plaza Code 2.0, reduced dollar dominance, and the government is buried beyond the US Treasury. Encourage the diversification of the amount.

Analysts have indicated that a combination of weaker dollars and decreased US fees can create conditions that are advantageous for the use of bitcoin. If customs duties boost inflation and influence both domestic consumers and international trade partners, foreign countries may be facing the collapse of currency and driven citizens on bitcoin as a value alternative.

Park said that both sides of the imbalance of trade call for evacuation to bitcoin and “intensely high” prices.

Please share this article