The Crypto community is divided into the future of StableCoins, and some are expecting growth, while others are worried about regulation hurdles in 2025.

StableCoins is everywhere. The wealthy companies and VCs regard them as silver bullets for companies suffering from outdated payment systems. In countries with high inflation such as Brazil, Mexico, and Colombia, ordinary users are becoming more and more stable to save money and fund overseas families. One clear thing is that StableCoins stops here.

And the number itself tells itself. StableCoins, according to the data from the blockchain forensic company's chain dissolution, is now about 70 % of the indirect share of indirect flows from local exchange in Brazil to global exchanges.

“Brazil's high -level stubcoin activity, as well as general interest in digital products and services, is a major cipher player that announced that it was officially announced in Brazil in May 2024, especially in circles. I am attracting interest.

Chain analysis

Nubank, the largest Brazilian digital bank in Latin America, is also following this trend. With more than 85 million customers in Brazil and more than 6 million customers in Mexico and Colombia, this bank provides a 4 % return to users who own USD Coin (USDC), a Circle published StableCoin. I am doing it. According to NuBank, “50 % of new NuBank Crypto users chose USDC as the first digital assets”, so we started providing yields on StableCoins.

Large -scale venture capital companies are also betting on stubcoin, hoping that SMEs will change the way to handle payments. Haseb Qureshi, a DRAGONFLY CAPITAL management partner, says that StableCoins will be more like an instant settlement 24 hours a day, unlike a bank approaching holidays.

City's Wealth Strategist has recorded a record of $ 5.5 trillion in the first quarter of 2024, saying that it could “strengthen US dollars' rule,” stating that it could strengthen US dollars. I'm looking at the big potential.

MARC Boiron, the CEO of Polygon Labs, sees the great potential of StableCoins, but emphasizes that their growth is not just the market size.

“The persuasive power is how the foundation is in harmony,” said Boir ON in commentary. He pointed out that the framework of regulations, such as the European crypto assets, provide clearness, supporting conventional financial institutions in a stable space.

“The clarity of the regulations is functioning as a catalyst, not a barrier. Since the frameworks such as MICA provide a clear guidelines, conventional financial institutions and Fintech companies are more confident. You can approach. “

Mark Boylon

Nobody shares Boiron's optimism about StableCoins. For PAOLO ARDOINO, Tether CEO, Mica's regulations, the largest Stullecoin publisher with market capitalization, seem to be exaggerated in a modest way. He argues that the demands of StableCoin publishers to maintain at least 60 % of cash deposits can bring a serious risk to banks.

Ardoino compared Circle's USDC in 2023 with the collapsed Silicon Valley Bank, which failed after the bank operation when he was stuck in Silicon Valley Bank, where billions of dollars USDC reserves collapsed. did.

“I don't want to expose 300 million people who hold USDT, because 60 % of European banks must maintain 60 % of cash deposits.”

Paoro Aldino

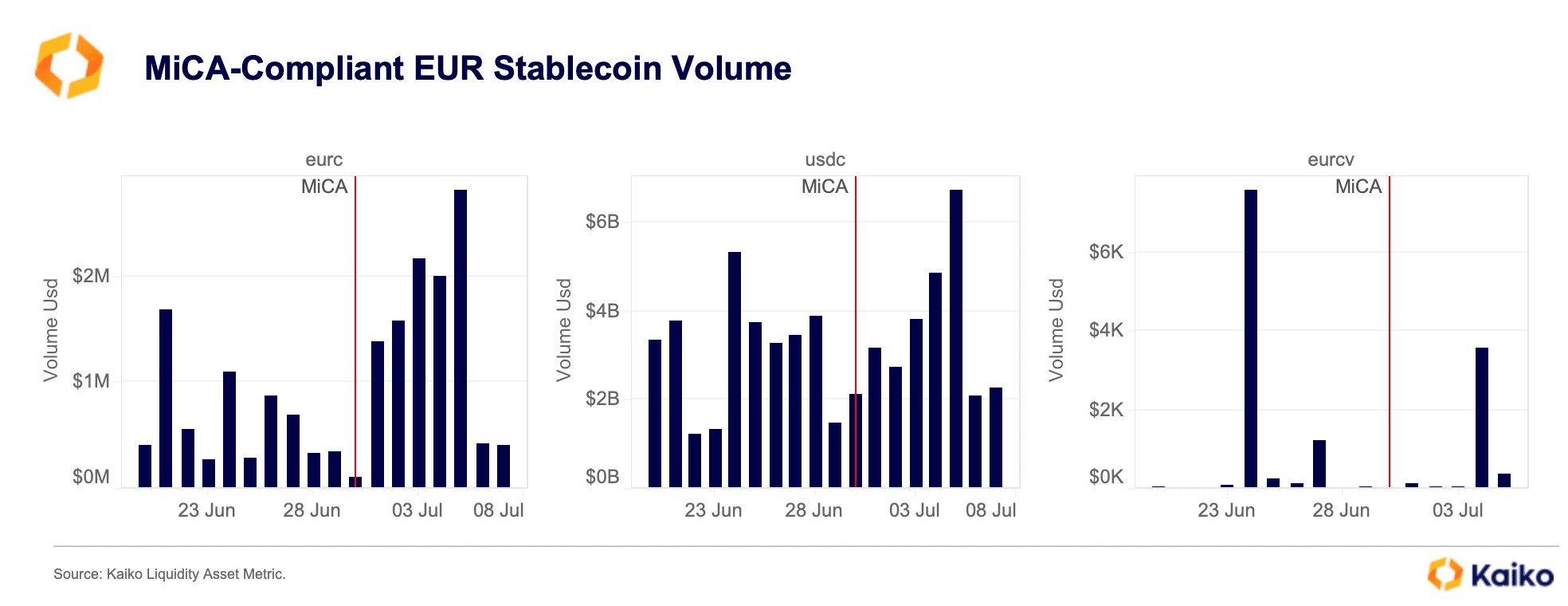

Analysts at the French blockchain company KAIKO pointed out that European regulations do not affect all StableCoin publishers.

So far, only one company has benefited from harsh rules. The circle has been watching the largest jumping in daily transactions since MICA was enforced by the Euro -livened StableCoin EUROC and USDC.

It may still be too early to get a conclusion. But one thing is clear. I want to find a way to realize a “$ 1 trillion opportunity”. Pantera Capital, a California venture capital company, also focuses that these assets are now more than 50 % of blockchain trading and have increased from only 3 % in 2020.

Unknown is that how or where the breakthrough comes, especially even the largest stubcoin companies are already regulating.