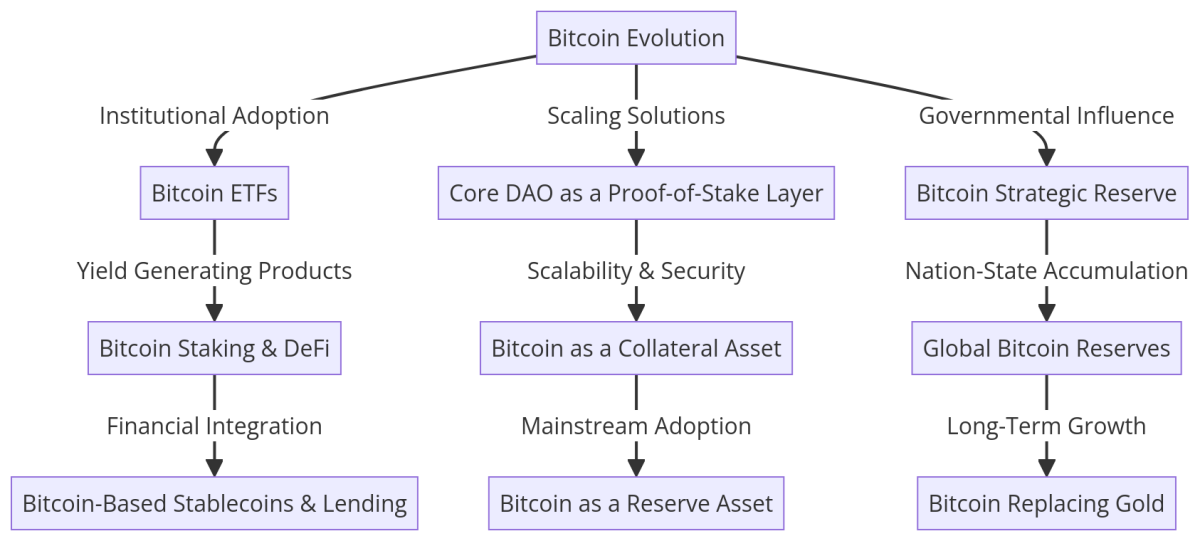

The evolution of Bitcoin from an obscure digital currency to a global financial force is nothing but extraordinary. As Bitcoin enters a new era, institutions, governments and developers are working to reach their full potential. Matt Crosby, lead market analyst at Bitcoin Magazine Pro, sat down with Rich Rines, a contributor to Core Dao, to discuss the growth stages of Bitcoin, the rise of Bitcoin Defi, and its potential as a global reserve asset I did. Check out the full interview here: The Future of Bitcoin – Feature Rich Candles

Evolution and institutional adoption of Bitcoin

Richline has been in the Bitcoin sector since 2013, witnessing firsthand the conversion of experimental technology into globally recognized financial products.

“By the 2017 cycle, I was pretty determined that this was what I was going to spend the rest of my career.”

The conversation delves into Bitcoin's role in the facility's portfolio, with spot Bitcoin ETFs already surpassing the $41 billion inflow. Rines believes that the institutionalization of Bitcoin will continue to reform global finance.

“Every asset manager in the world can now use ETFs to buy Bitcoin, which is fundamentally changing the market.”

What is Coa Dao?

Core DAO is an innovative blockchain ecosystem designed to enhance the capabilities of Bitcoin through proof stakes (POS) mechanisms. Unlike traditional Bitcoin scaling solutions, Core DAO leverages a decentralized POS structure to improve scalability, programmerity, and interoperability while maintaining Bitcoin security and decentralization.

At its heart, Core Dao acts as an a Layer 1 blockchain for Bitcointhat is, it expands the functionality of Bitcoin without changing the base layer. This allows for a variety of Defi applications, smart contracts and staking opportunities for Bitcoin holders.

“Core is the main Bitcoin scaling solution, and the way you think about it is actually a layer of Bitcoin proof.”

By protecting 75% of Bitcoin hashrateCore DAO ensures that Bitcoin security principles remain intact, while providing greater functionality to developers and users. The over-ecosystem is increasing Over 150 projectsCore Dao paves the way for the next phase of Bitcoin's financial expansion.

Core: Bitcoin Proof Layer & Defi Extension

One of the biggest challenges facing Bitcoin is scalability. High fees and slower transactions on the Bitcoin network will become a strong payment layer, but limit the utility of daily transactions. This is where Core Dao appears.

“Bitcoin doesn't have the scalability, it's too expensive. All of these things that make it a great payment layer are why we need a core-like solution to extend those capabilities. ”

Core DAO acts as a Bitcoin proof range layer, allowing users to generate yields without third-party risk. It provides an ecosystem that allows Bitcoin holders to participate in Defi applications without compromising security.

“Bitcoin is a great collateral asset, so we intend to see Bitcoin's defi dwarf etherium debt within the next three years.”

Bitcoin as a strategic reserve asset

The government and sovereign wealth funds are beginning to view Bitcoin as a strategic reserve asset rather than as a currency. The possibility of US Bitcoin strategy preparation, and wider global adoption at the nation-state level, could create a new financial paradigm.

“People are talking about building a strategic Bitcoin reserve for the first time.”

The idea of replacing Bitcoin as a major repository of value is becoming more specific. Rines argues that the rarity and decentralization of Bitcoin will make it a better alternative to gold.

“I think within the next 10 years, Bitcoin will become a global reserve asset instead of gold.”

Bitcoin Privacy: The Last Frontier

Bitcoin is often welcomed as a decentralized and censor-resistant asset, but privacy remains an important issue. Unlike cash transactions, Bitcoin's public ledger exposes all transactions that have access to the blockchain.

Rines believes improving Bitcoin privacy will be an important step in evolution.

“I've been hoping for a private Bitcoin transaction for a very long time. I'm pretty bearish on what's going on in the base layer, but there's a possibility in the scaling solution.”

Solutions like Coinjoin and Lightning Network offer privacy improvements, but full-scale anonymity remains elusive. Core is investigating innovations that could enable sensitive transactions without sacrificing Bitcoin's security and transparency.

“At Core we work with teams that may potentially have sensitive transactions, which can tell you that the transaction is happening, but not the amount or the counterpart involved. ”

As governments continue to increase surveillance over digital financial activities, the need for enhanced privacy capabilities in Bitcoin will only grow. Bitcoin's privacy future through two-tier solutions, whether upgrades to native protocols, remains a critical area of development.

The future of Bitcoin: The trillion dollar market in production

As the interview progresses, Rines outlines the economic framework of Bitcoin has expanded beyond speculation to productive financial products. He predicts that within 10 years, Bitcoin will lead a market capitalization of $10 trillion, with Defi applications becoming a significant part of its economic ecosystem.

“The Bitcoin debt market is a trillion dollar opportunity and we're just starting out.”

His perspective is consistent with the broader industry trends in which Bitcoin is used not only as a store of value but also as an aggressive financial asset within a decentralized network.

Rich Line Roadmap for the Future of Bitcoin

Final thoughts

The conversation between Matt Crosby and Rich Lines offers an engaging glimpse into the future of Bitcoin. With institutional adoption accelerating, the definition of Bitcoin expanding, and Bitcoin is recognized as a strategic reserve, it is clear that Bitcoin's best year ahead.

As Line says:

“Building on Bitcoin is one of the most exciting opportunities in the world. There's a trillion dollar market waiting for the lock to be unlocked.”

The key points are clear for investors, developers and policy makers. Bitcoin is no longer just a speculative asset, it is the foundation of a new financial system.

Check it out for more detailed Bitcoin analysis and advanced features such as live charts, personalized indicator alerts and detailed industry reports. Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.