Trump's strategic crypto sanctuary announcement could lead to a more sustainable rally at the top altcoins, along with a decline in leverage from the February liquidation, with the ADA likely to see the biggest pump.

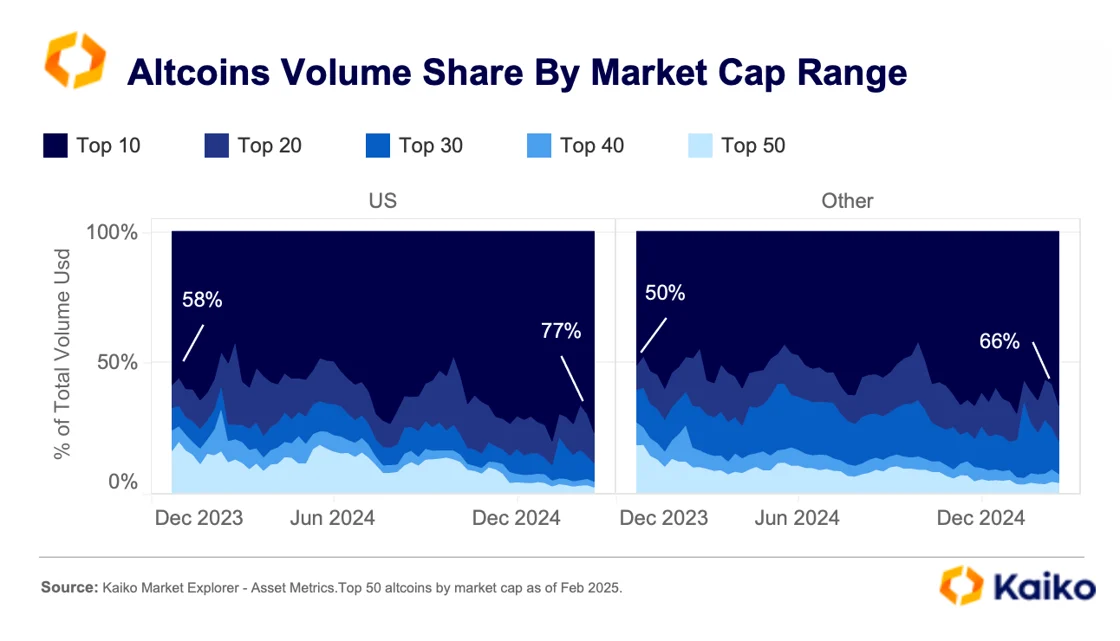

President Trump announced the establishment of the reserve on Sunday, naming Ripple (XRP), Solana (Sol) and Cardano (ADA) as part of his initial choice before adding Bitcoin (BTC) and Ethereum (ETH). According to Kaiko's research, including selected Altcoins in the US strategic reserve could accelerate capital turnover in the Altcoin market. The top 10 Altcoins currently account for 77% of Altcoin trading volume on US platforms, up from 58% a year ago.

Increased capital concentration on ALT coins can significantly increase prices. The reason for this is that Altcoins has less liquid than Bitcoin. This means that slight changes in supply and demand can have a greater impact. In particular, ADA can now see even greater price movements as they delay other assets to strategic reserves.

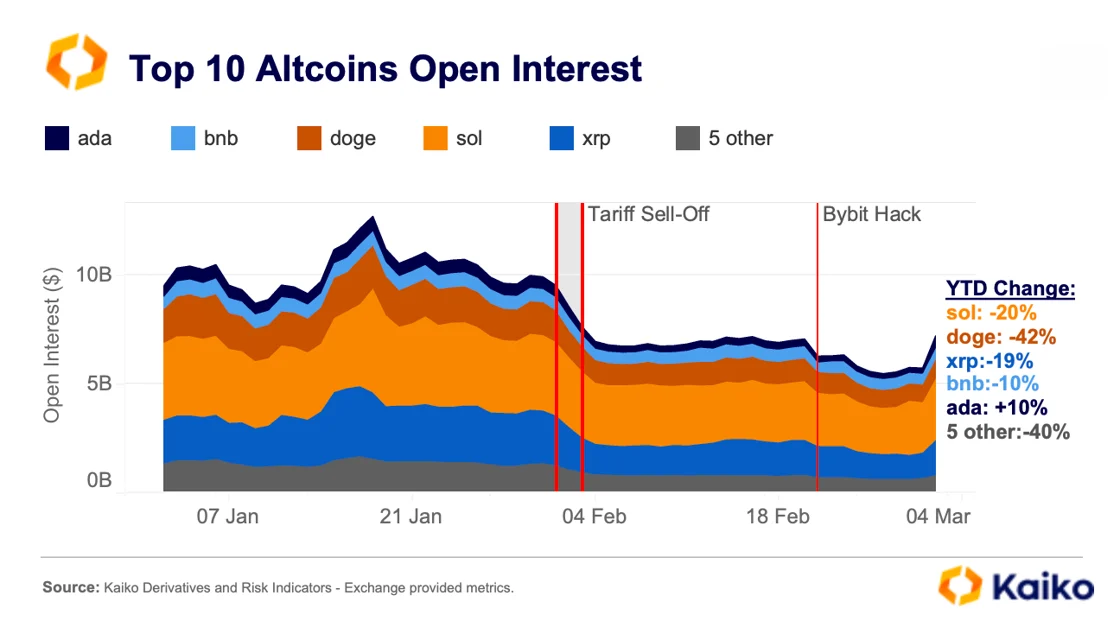

The signs are already obvious. Following the preliminary announcement, market volatility has skyrocketed, especially among altcoins. Within the first 24 hours of news, inherent volatility spiked the large altcoins, surged beyond the ADA's incredible 600%. Tokens have seen the strongest capital inflow since its announcement, with its open profits increasing 10% annually to $554 million.

Additionally, Kaiko noted that the recession in February caused several waves of liquidation, reducing leverage across the top 10 Altcoins. Combined, these two factors suggest that there is a concentrated flow of capital to the upper altcoins (which is likely to increase prices), but reduced leverage means that ALT pumps will become less volatile and sustainable in the future.