(May 6): The euro zone economy is awaiting a resounding vote of confidence from its own consumers for the long-awaited economic recovery to finally take shape.

With employment at record levels, wages soaring and inflation nowhere near 2%, the conditions are ripe for people to get out and spend. Business surveys are showing some hope, and on the ground, Frankfurt retail entrepreneur Kaveh Nemati believes it's only a matter of time before shoppers return.

“You have to stay positive and optimistic; anything else means giving up,” Nemati says. Nemati runs a small boutique in the city's Nordend district and is the president of the local trade association. “At some point, consumers will have to say, 'I've saved money long enough.' And once the first domino falls, the others will follow.”

An economic recovery in 2024 represents the eurozone's best chance to end years of turmoil, from the pandemic to the ensuing cost of living crisis. And as manufacturing continues to slump, policymakers are looking to household spending to boost growth.

The evidence so far suggests that that didn't really happen in the first quarter. While last week's figures showed the region has emerged from recession and all four of the eurozone's biggest economies grew faster than expected, both Germany and Italy remain struggling with weak domestic demand and spending The situation was mixed.

But French households are actually spending more, and there are some recent signs that a consumer-led rebound may be materializing.

Activity in the euro zone's services sector reached an 11-month high in April, according to S&P Global's Business Survey, and rising orders suggest the momentum can be sustained.

Dutch retail giant Ahold Delhaize NV, which owns supermarket chain Albert Heijn BV, reported positive sales volumes for Ahold Delhaize's various brands in February for the first time in more than two years. was optimistic about the outlook for European consumer demand.

“We are at an inflection point,” said Antonio Esparza, chief European economist at Santander CIB, citing rising wages, falling inflation and the prospect of lower interest rates from the European Central Bank (ECB) as drivers of demand. After the second half.

From his desk in Boadilla del Monte, a town just west of Madrid, Mr. Esparza is closely watching what such a recovery would look like.

“Job creation is stronger and real disposable income is growing faster in Spain than in other countries,” he said. “At the same time, Spain's population is growing significantly. That is very important for consumption. More people visiting means more people spending money.”

Economist survey target bloomberg Spain's consumer spending is expected to grow twice as fast as the euro zone and roughly on par with the United States, which is contributing to a significant economic acceleration.

If such an effect were to be replicated across the region, it would correspond to the economic recovery long awaited and predicted by ECB officials, who have consistently overestimated the recovery in consumer spending. Their latest forecast, as of March, may still be too optimistic.

Santander's Esparza expects a rise of just 0.7% this year, compared with the median economist forecast of 1%. Both rates are lower than the 1.2% expected by central bank staff.

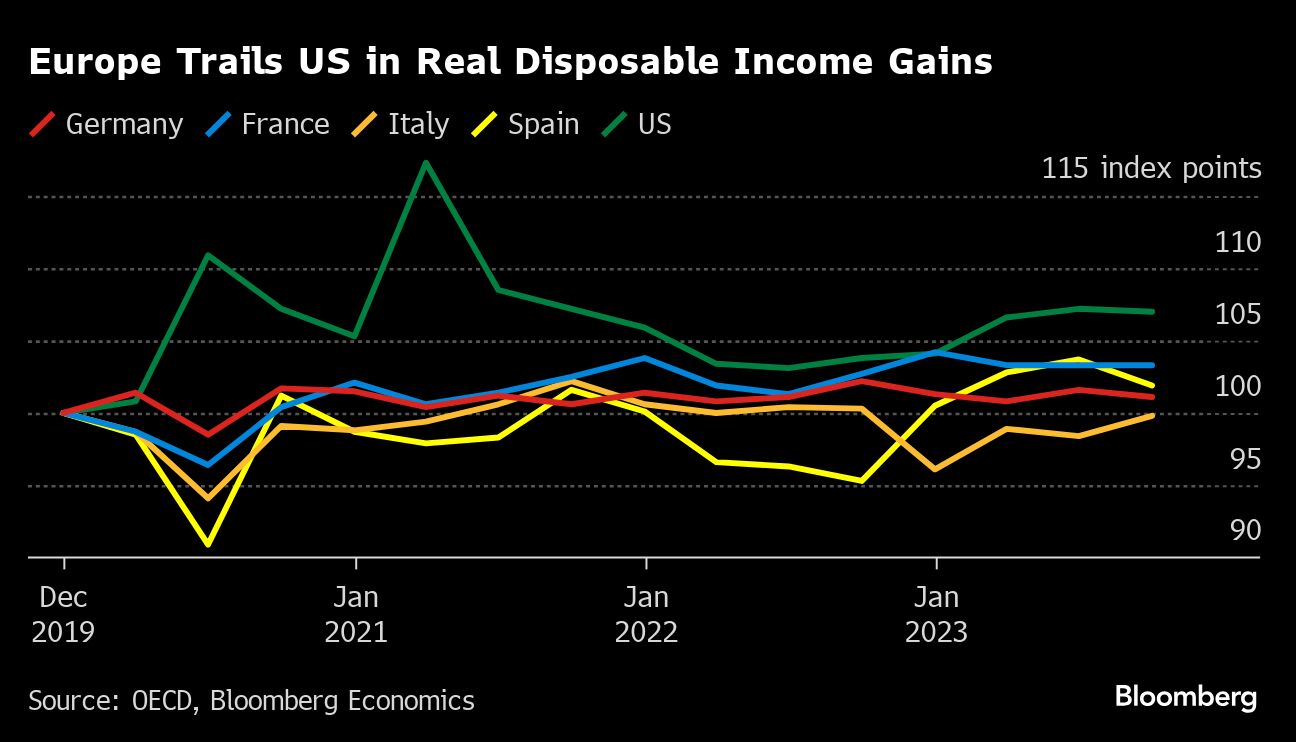

Trying to understand the region's fickle consumer psychology has long been a key obsession for the ECB. President Christine Lagarde recently cited household behavior as the biggest difference between the European and U.S. economies, highlighting Washington's generous pandemic stimulus checks and diminished concerns about the crises in the Middle East and Ukraine.

“It's finances, it's energy, and it's the American consumer's natural tendency to spend with confidence rather than save too much,” she said. CNBC.

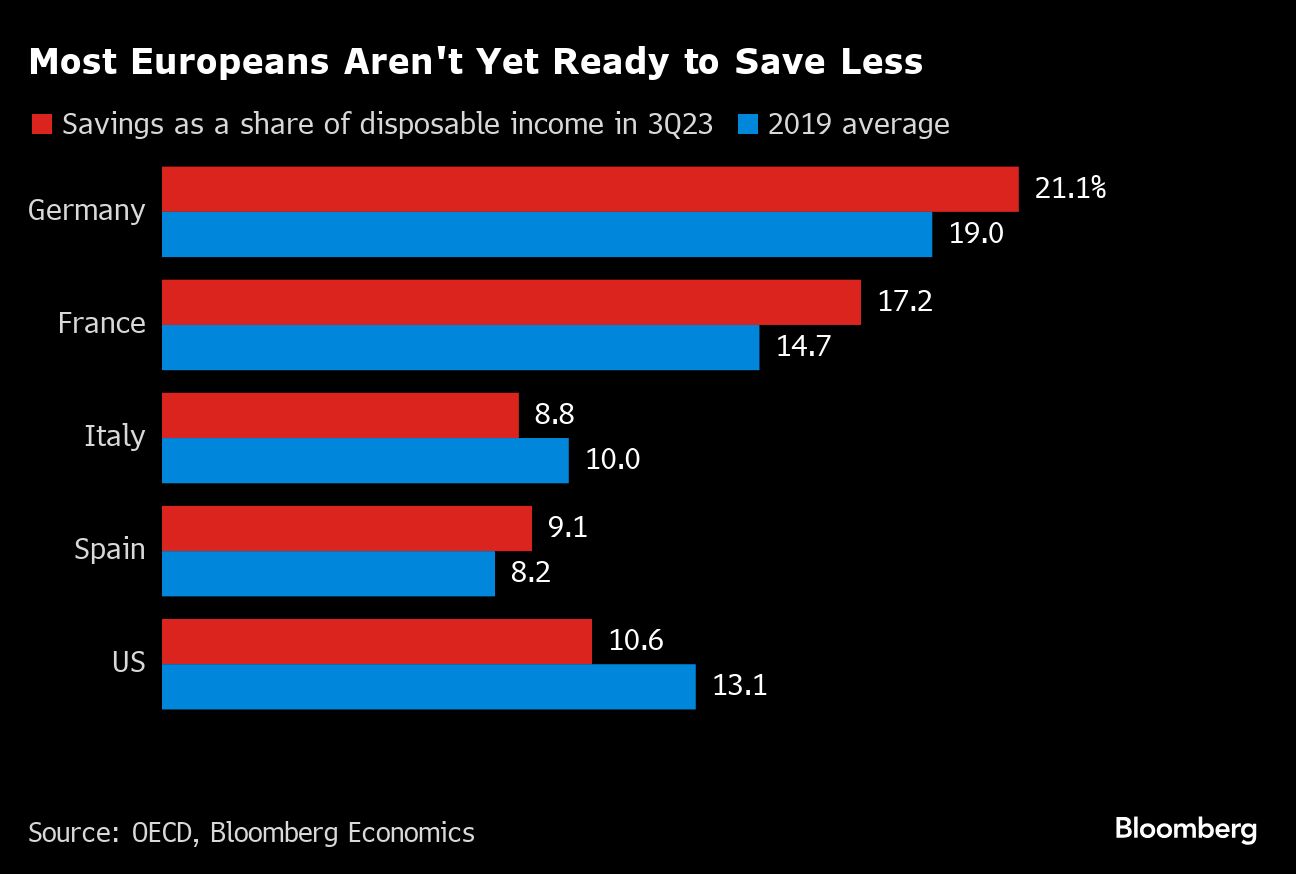

In Germany, Europe's largest economy, the strength of consumption will make the biggest difference. Households in the region are among the most cautious in the region, unsettled by the impact of the Ukraine war on the country's cheap gas business model and the political indecision of a finicky government.

But even there, things are starting to brighten. Clemens Fuerst, Director of the IFO Institute, said: bloomberg television Last month, it said household spending could drive growth in the second quarter. “It seems like what we've been waiting for is just around the corner, in a way,” he said.

On Friday, Deutsche Bank economists upgraded their forecasts for 2024, saying consumer spending should rebound more strongly than originally expected, predicting growth of 0.3% instead of a 0.2% contraction.

What can fuel and sustain such spending is whether people can reliably perceive that their economic context is less volatile.

“There is nothing in the data to support a significant increase in consumption,” said Rolf Buerkl, head of consumer environment at NIM, which conducts consumer confidence surveys in countries including Germany. “But there is a strong psychological factor that is often underestimated: uncertainty. It is just as important for consumer spending as it is for business investment.”

The prospect of making money again through simple savings after years of negative interest rates is also weighing on consumer demand. Total deposits have grown at a slower pace than usual since inflation began to rise, but deposits offering longer terms and higher interest rates have increased nearly 10 times in Germany and significantly in other countries.

The ECB's readiness to cut borrowing costs could remove some of the incentive to save and accelerate spending. Policymakers have signaled they intend to cut interest rates by a quarter of a percentage point in June, but Lagarde has so far avoided hinting at further easing beyond that.

Back in Frankfurt, we can't expect another shopping boom anytime soon. Walking down Bergerstrasse, the city's longest shopping street, Nemati pointed to a soon-to-close home accessories store.

In addition, boutiques are trying to lure customers with deep discounts. Some locations have shortened their business hours, leaving too many counters open for a while.

“We have long expected business to return to pre-pandemic conditions, but we are increasingly convinced that this is not the case,” he said. “But hope remains.”