Bitcoin (BTC) is struggling to hold on to $63,000 as the 2024 Bitcoin halving approaches, and the price is expected to fall further in what is being called a “correction.”

Cryptocurrency analyst Michael Van de Poppe told X that the current stock decline is a “pre-halving peak” and that there is still time for Bitcoin to hit a new all-time high. Ta.

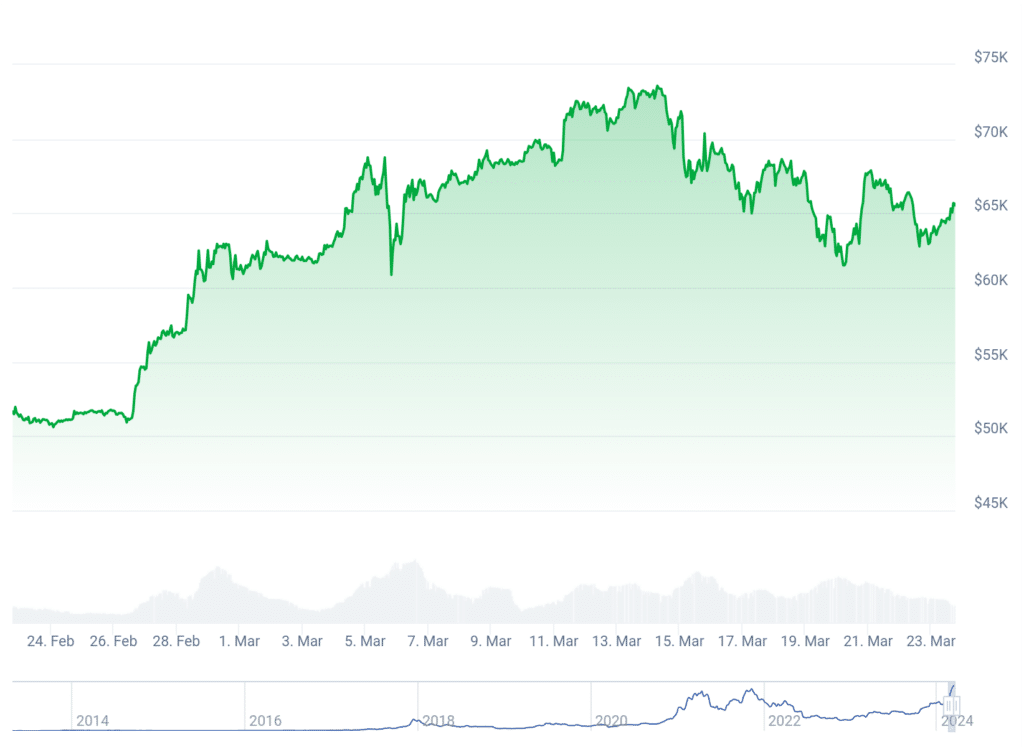

Bitcoin prices have fallen nearly 2.6% over the past week and 4% over the past two weeks. Van de Poppe said this could be due to an upcoming halving event.

He said that like in other cycles, Bitcoin has yet to reach its pre-halving peak, and we won't see any big “spectacle” coming from Bitcoin until it reaches $70,300. He added that it might be possible.

Bitcoin halving is an automatic process that reduces miners' rewards by half. Halving occurs every four years or after his 210,000 blocks of Bitcoin have been mined. The next halving event he is scheduled to take place in April 2024.

Van de Poppe compared Bitcoin's price movements to the 2016-2017 cycle and suggested that history is repeating itself and Bitcoin will experience a significant upward trend.

“My main argument is that we are experiencing pre-halving hype and will continue to have a long, massive bull market.”

At the time of writing, Bitcoin was trading at $65,537, up 3.2% in the past 24 hours, according to CoinGecko. As mentioned above, the current price represents a decline of 2.6% in his 7 days.

However, you will see a 26% improvement over 30 days.

Pseudonymous analyst Recto Capital suggests that the correction ahead of this year’s Bitcoin halving has already begun. Bitcoin pre-halving retrace typically occurs 14-28 days before the halving event.

This year's price decline is similar to the 20% correction before the 2020 halving and the 40% decline before the 2016 halving, according to Recto Capital.

He added that the correction will last about 77 days, but the decline may be smaller than in previous cycles.

The current downtrend presents a good opportunity for investors to buy Bitcoin before the upcoming halving event, and if history repeats itself, the bullish trend is likely to continue after that.