Key takeout

- Historical patterns indicate that the peak of the cryptography cycle is not yet here.

- Stablecoins increasingly serve as a bridge between treasonable currency and the crypto market, making up the majority of crypto trading pairs.

Please share this article

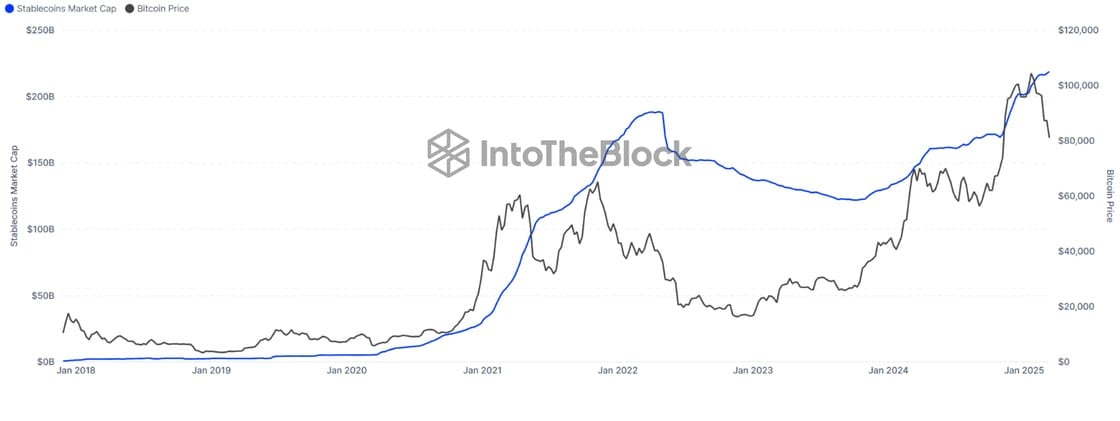

Stablecoin's total supply reaches $219 billion and continues to climb, suggesting that Crypto Bull Run is not finished yet, Intotheblock said Friday statement.

According to Crypto Analytics Firm, historical data shows that the previous peak, $187 billion, recorded in April 2022, reaches a normal peak at highs in the market cycle, just before the market begins to decline.

Stablecoin supply is higher and is increasing than ever before, which suggests that the market has not yet reached its peak and is still in its growth stage.

After falling below $77,000 earlier this week, Bitcoin rose above $85,000 on Friday morning, TradingView data shows. At the time of pressing, Bitcoin was trading at around $84,700, an increase of 4.5% over the past 24 hours.

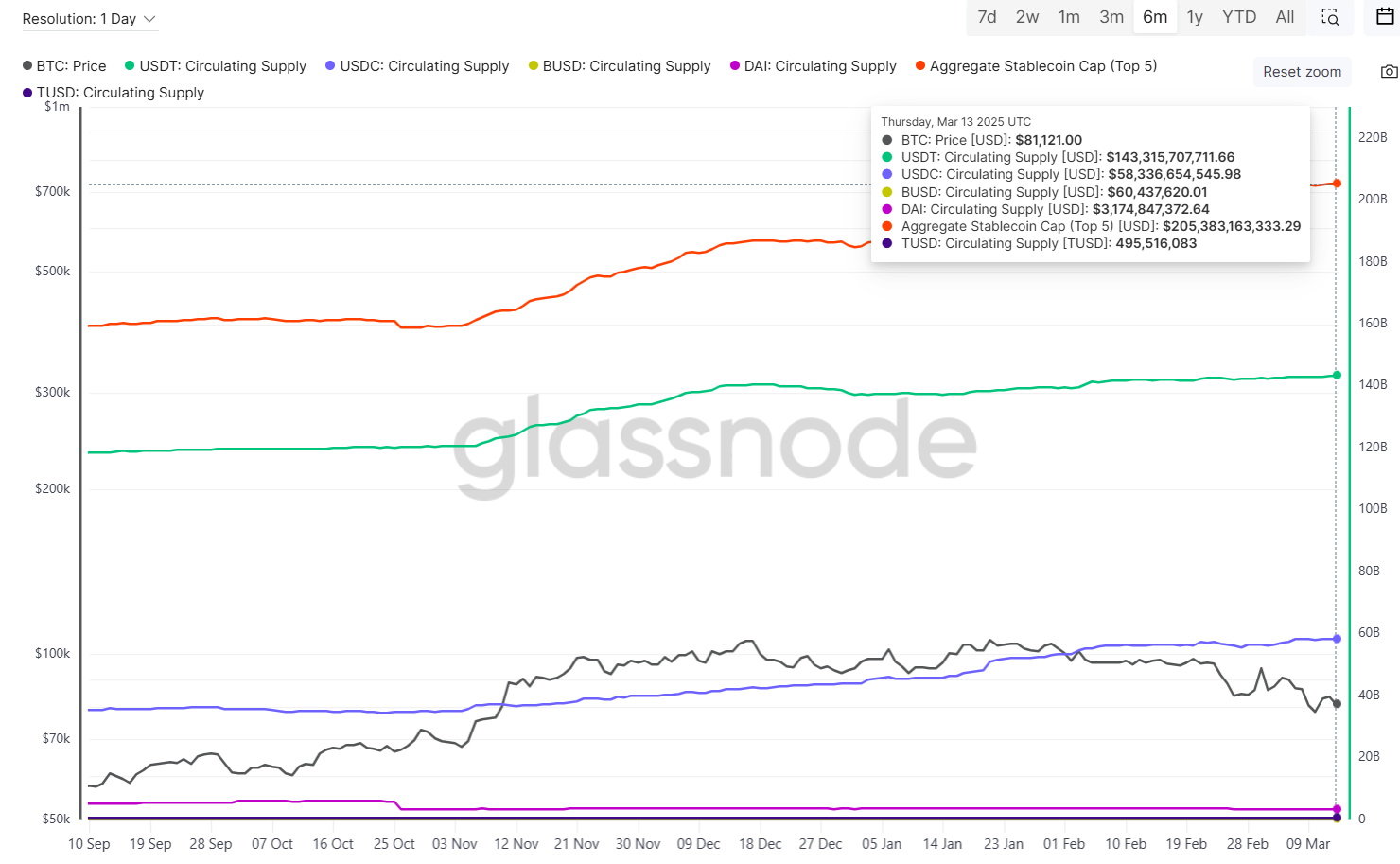

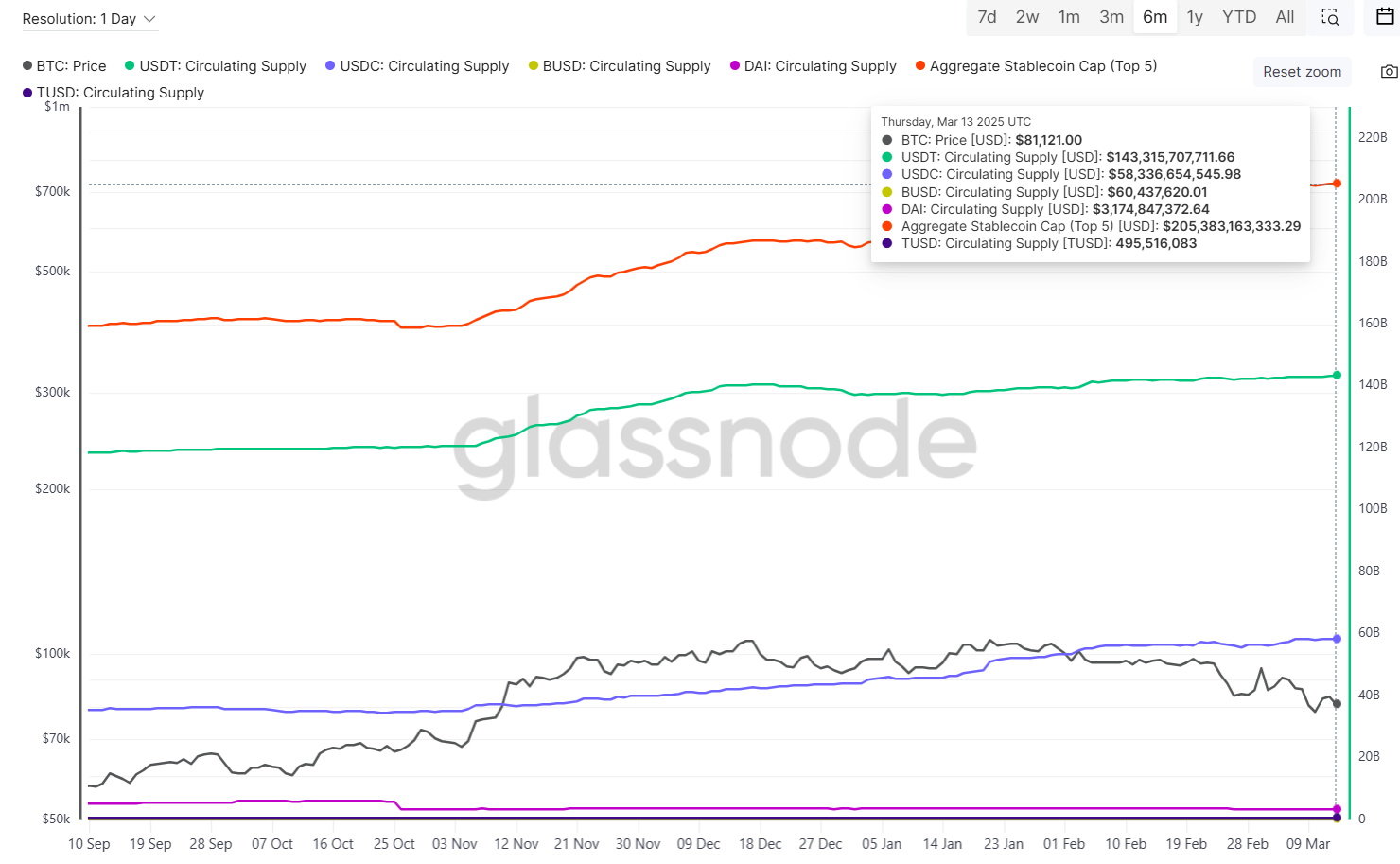

The recent revival of Bitcoin coincides with an increase in market capitalization of major stubcoins, including USDT, USDC, BUSD and DAI. Their total market capitalization increased from around $204 billion to over $20.5 billion from March 10th to 14th, according to GlassNode data.

Stablecoins act as a bridge between Fiat currency and the crypto market, accounting for the majority of crypto trading pairs and market liquidity. The rise in market capitalization indicates the adoption of higher stubcoins and its widening role as a medium prioritized for crypto trading.

The increase in supply is likely to reflect the overall market movement of assets in stablecoins in preparation for trading, suggesting market activity expected in the coming weeks.

The total market capitalization of the five major stubcoins has increased by more than 28% since November 5, 2024, US Election Day.

Please share this article