3 hours 30 minutes ▪

Four

Takes a few minutes to read ▪

Great news for the crypto world. The SEC has approved a spot ETF for Ethereum. It's been four and a half months since the Bitcoin ETF and cryptocurrency popularity is soaring. These new trackers will bring Ethereum even more attention and value. It remains to be seen whether Bitcoin can keep up the pace or stumble in its tracks.

Bitcoin: Spot ETFs are on the rise!

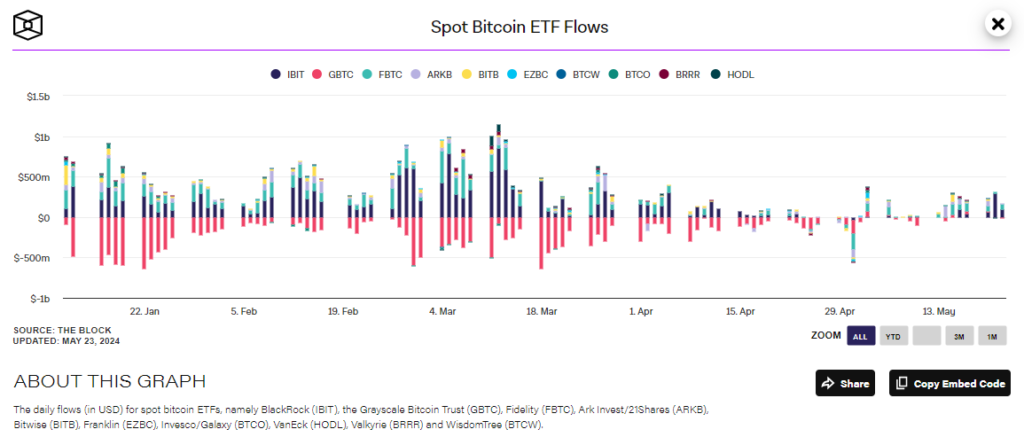

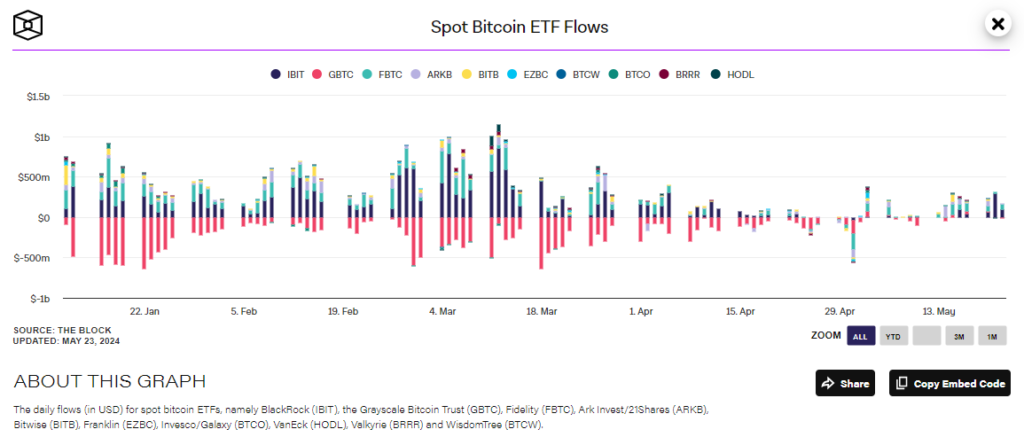

The craze surrounding spot-traded Bitcoin funds in the United States has been on our radar for some time now. In fact, spot ETFs 9th consecutive day of net inflowsphenomenal $107.91 million Thursday alone saw a string of positive inflows, unprecedented since mid-March, when the market saw 10 consecutive days of inflows, according to The Block.

Leading the way, BlackRock's IBIT topped the list with $89 million.It was followed by Fidelity's FBTC with $19 million, while VanEck raised $10 million, according to SoSoValue. Smaller players Ark Invest's 21Shares and Invesco's Galaxy Digital were not far behind, raising $2 million each.

But the grayscale Converted GBTCRecording Net outflow was $14 millionMeanwhile, funds from Bitwise, Valkyrie, Franklin Templeton, WisdomTree and Hashdex remained stable with no inflows or outflows.

Since January, 11 Bitcoin ETFs have amassed over $13.43 billionHowever, overall flows remain well below the peaks reached in March, The Block noted.

The ETF Dance: Bitcoin and Ethereum Take Off

Bitcoin is on a rollercoaster ride! The price has fallen by 2.61% in the past 24 hours.67,642, but analysts remain confident. The U.S. Securities and Exchange Commission added fuel to the fire by approving the 19b-4 form. 8 Ethereum Spot ETFsespecially from companies like BlackRock, Fidelity and Grayscale. But the happy-go-lucky ones have to wait for approval of their S-1 registration statements before they can start trading.

Despite this drop in Bitcoin, some cryptocurrency experts, such as BitQuant, are predicting a sharp rise. According to him: Bitcoin hits $80,000 in May, may peak at $95,000 The following month, he predicts that this “global high” could be reached by the third quarter, followed by an equally dramatic decline.

“Certainly, the $95,000 will continue through June, but the sharp decline from the regional peak also occurs in June, so the overall timeline of the regional peak remains unchanged,” he said undeterred.

Therefore, optimists need not worry too much if Bitcoin's price drops temporarily. SEC approval of Ethereum ETF seen as a strong signalIt is likely to revitalize the cryptocurrency market.

One thing is certain: the ETF dance has only just begun, and spectators are ready to take to the trading and investing floors in 2024.

Make the most of your Cointribune experience with our “Read to Earn” program. Earn points for every article you read and get access to exclusive rewards. Sign up now and start earning rewards.

Click here to join Read to Earn and turn your crypto passion into rewards!

The blockchain and cryptocurrency revolution is underway! And today, with the world economy in its most fragile state, despite all the difficulties, I wonder what I should do.

Disclaimer

The views, thoughts and opinions expressed in this article are those of the author and should not be taken as investment advice. Please conduct your own research before making any investment decisions.