- Solana took advantage of Bitcoin's rally to overtake Ethereum.

- Can ETH recover as momentum shifts?

It is loosely referred to as the “Ethereum killer.” Solana [SOL] has shown great resilience during this bullish cycle. It earned this title not only by its market capitalization, but also by consistently ranking among the top weekly gainers. Ethereum [ETH] It remains flat.

In this cycle, SOL is growing as BTC reaches key psychological levels and attracts investors looking to move capital to reduce risk. This is an advantage that ETH once held.

SOL leads ETH

Even though ETH's market cap is $300 billion, significantly higher than SOL's $81 billion, recent trends show that SOL's market cap has increased by more than 5%, while ETH's market cap has increased by 3%. is shown to be decreasing.

This trend is particularly noteworthy because it coincides with the following periods: Bitcoin's It recently soared to nearly $70,000, a 16.67% gain in just 10 days.

Typically, when markets heat up, liquidity flocks to high-cap altcoins as risk-averse investors seek to redistribute profits.

ETH then experiences a significant rally as BTC reaches a market high. However, unlike previous cycles, SOL appears to be in control this time.

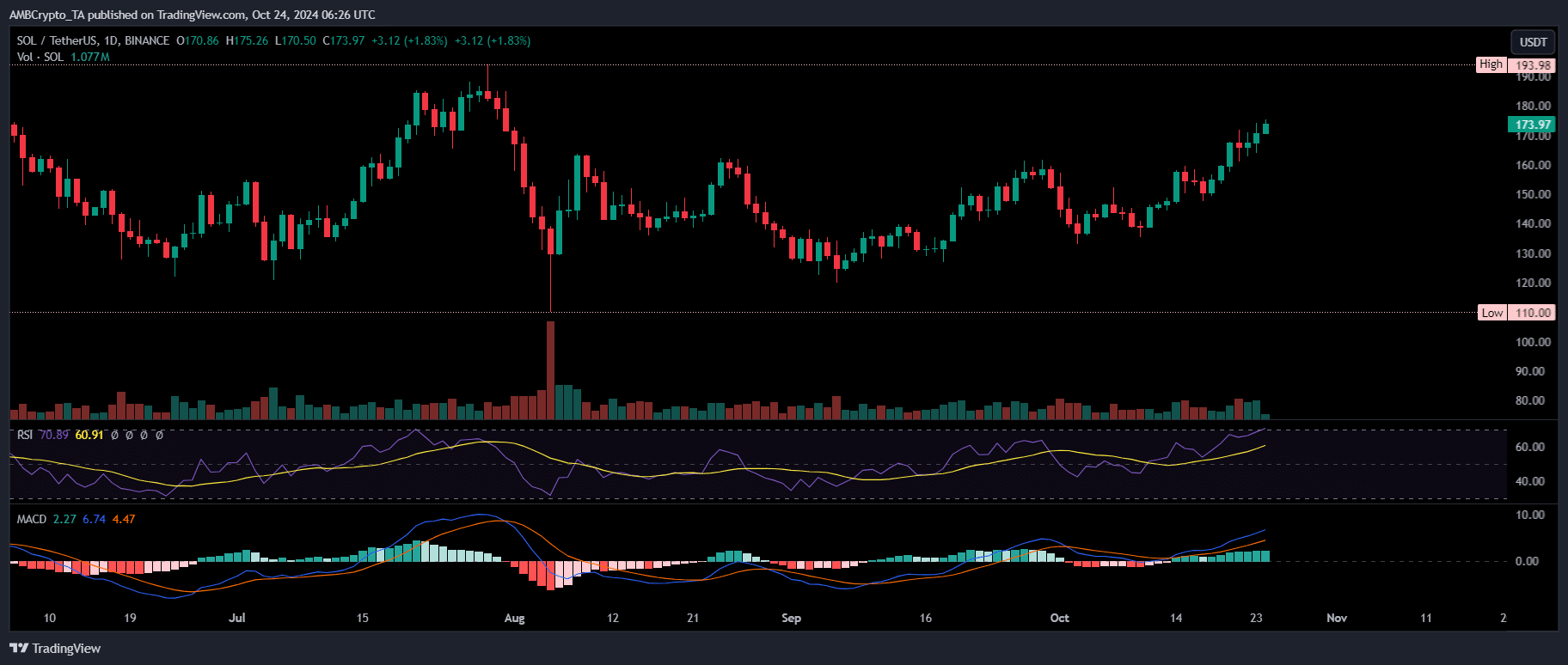

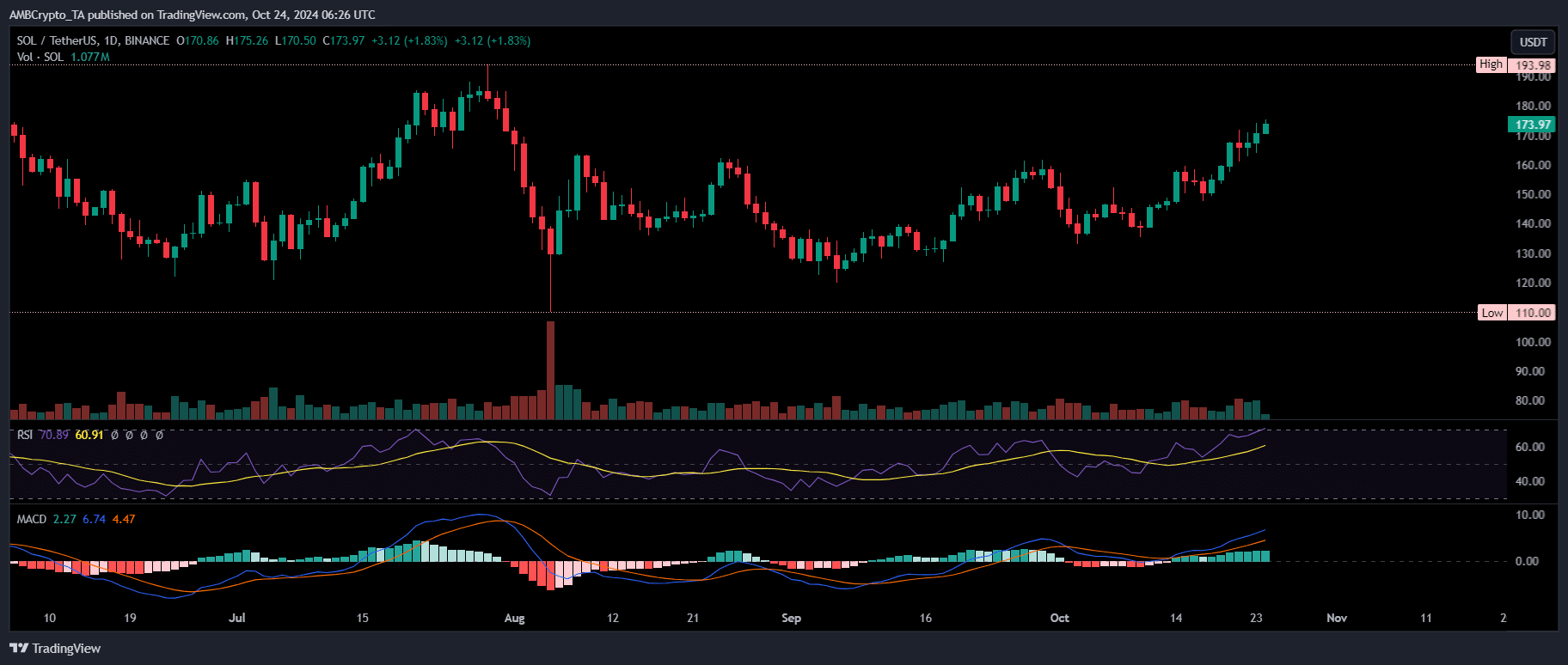

Source: TradingView

Just four days ago, when BTC's price surpassed its four-month-old slump and faced resistance, SOL posted a daily gain of 4%, hitting its highest price in the past week and marking an important turning point. I did.

The next day, BTC experienced a 2% decline and established $70,000 as a new local high. In response, ETH reflected this move, dropping nearly 3% and continuing its retracement.

Conversely, SOL bulls effectively blocked a similar decline. In fact, SOL has been surging since breaking through the $160 resistance level, achieving this milestone on its fourth attempt after three previous failures.

Currently trading at $173, SOL could be due for a correction as the RSI indicates overbought conditions. 83% of price movements in the past two weeks have been in an upward trend; tendency A reversal may be imminent.

Could this bring investor attention back to ETH?

A trend reversal may be coming soon, but be careful

Previously, report AMBCrypto emphasized that the current decline in ETH is a strategic move by traders aiming to wipe out weak hands.

This decline could set the stage for an impending breakout, attracting new buyers and encouraging continued whale accumulation, pushing ETH above $2,700.

However, ETH's rebound in this cycle is closely related to SOL. ETH may be poised for a short-term reversal as it has reached support, but whether a breakout is achieved depends on closely monitoring SOL across various indicators.

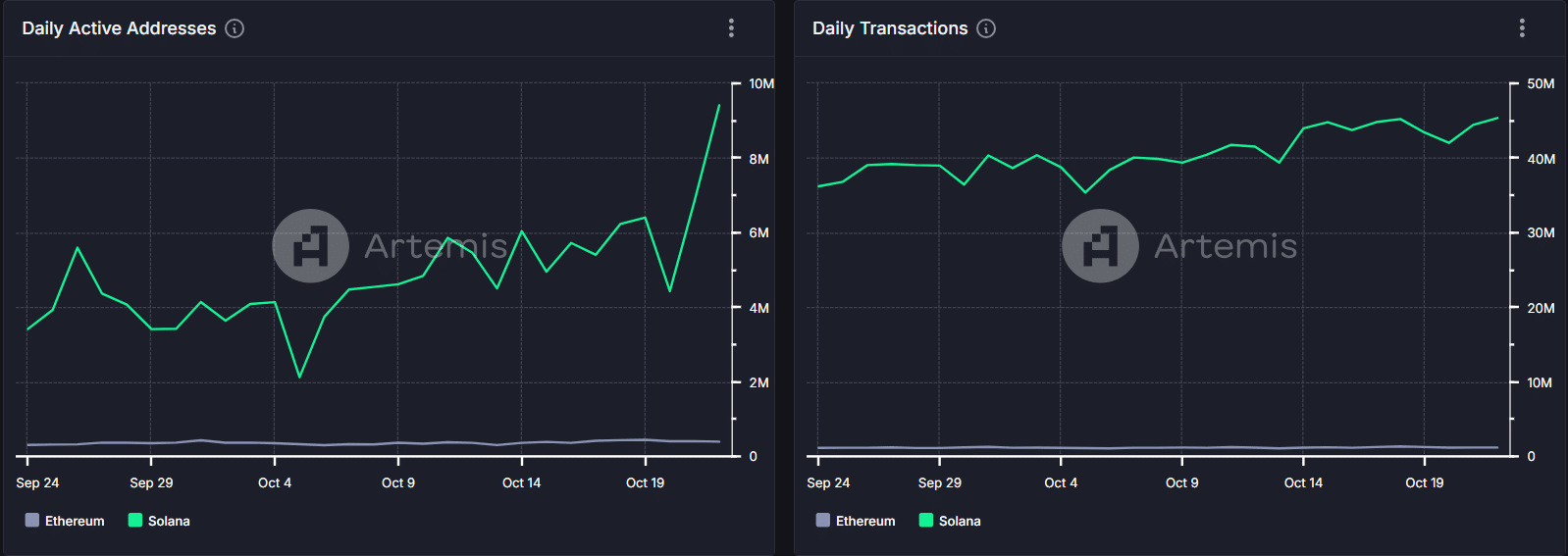

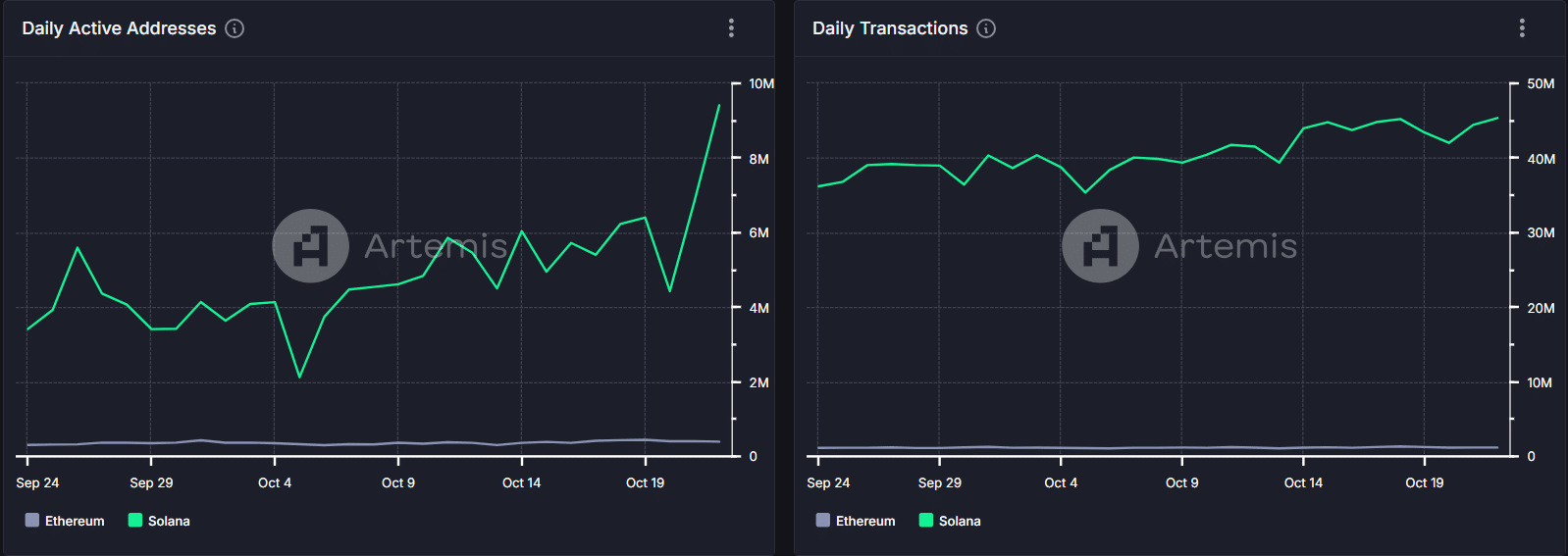

Source: Artemis Terminal

Over the past month, Solana has seen a 175% increase in daily active addresses, while Ethereum has seen only a modest double-digit increase.

This surge in activity is no coincidence. Solana has established a strategic position over ETH by leveraging its high throughput to enable faster and more affordable transactions.

So far, this strategy has worked. SOL has effectively capitalized on the rising cost of ETH, generating impressive momentum in this cycle and attracting significant interest from BTC investors.

read solana's book [SOL] Price prediction for 2024-2025

In other words, the overall outlook for SOL looks much brighter than ETH, establishing itself as a leading altcoin in the long term.

Although a correction could push SOL below $170, it still has momentum above ETH and could easily challenge ETH’s path to $2.7,000.