Solana (SOL) is gaining bullish momentum as Zeus Network plans to connect Solana to the Bitcoin blockchain.

SOL has risen 4% in the past 24 hours and is trading at $129.9 at the time of writing. The market capitalization of this asset exceeded his $58 billion, and the daily train traffic amounted to his $4.1 billion.

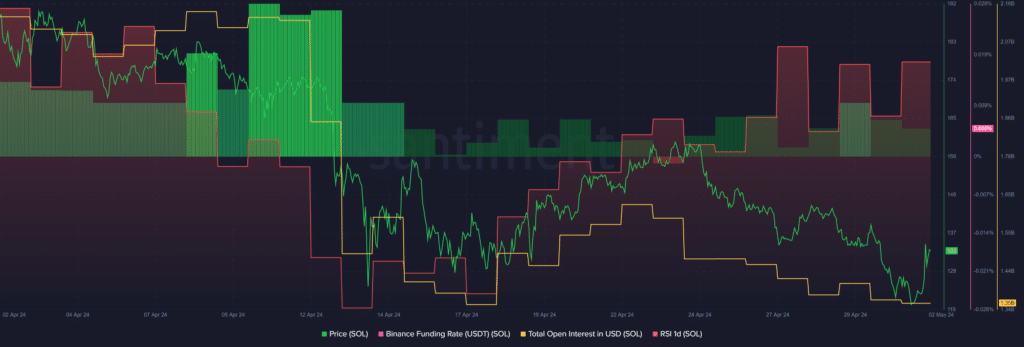

According to data provided by Santiment, total SOL open interest has consistently declined over the past 10 days, dropping from $1.63 billion on April 22 to $1.35 billion at the time of reporting.

A decrease in open interest may indicate decreased price volatility and liquidations.

Moreover, the ratio of long and short trading positions on Binance has been halved since April 29, as SOL price continues its downward trend, according to market intelligence platform data. This indicates that more trading contracts are betting on rising prices.

According to Santiment, the SOL Relative Strength Index (RSI) jumped from 43 to 50 in the past 24 hours. This indicator shows that the market is bearish, so the asset is neither undervalued nor overvalued at this price range.

For SOL to stay in the bullish zone, the RSI needs to stay below the 50 mark. An RSI above 50 can indicate high price volatility and even whale manipulation.

The bullish sentiment on SOL is that Zeus Network has the potential to make Solana, with assets leveraging ZPL (Zeus Program Library) and a so-called permissionless communication layer, “a Layer 2 solution for all blockchains.” It was born after the announcement.

In simple terms, users will be able to convert assets such as BTC into ZPL assets, such as zBTC, and access the Solana ecosystem, according to the announcement.