- Solana dominates the NFT sector, outperforming Bitcoin and Ethereum.

- SOL price fell on the back of broader market correction

Solana [SOL] It has gained explosive popularity in the past few days.Despite recording a sharp rise in price during this period, it still lags behind Bitcoin. [BTC] and Ethereum [ETH] In terms of market capitalization.

Solana NFT sector is booming

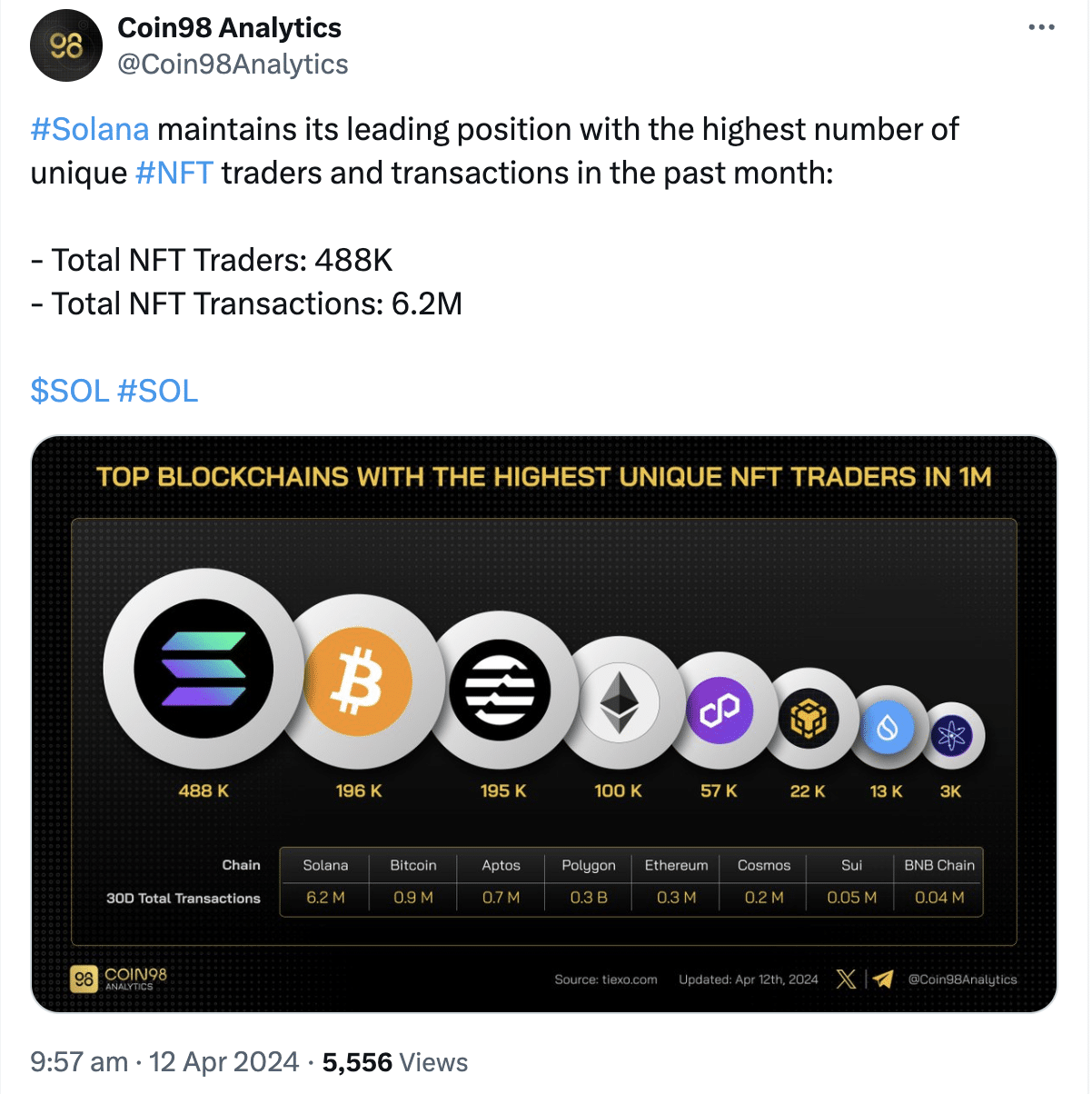

Still, Solana has outperformed both of these networks in the NFT space. In fact, according to recent data, Solana has the highest number of NFT traders at 488,000. Moreover, the total number of his NFT transactions occurring on the Solana network is also very high, with the total amounting to 6.2 million.

Source:X

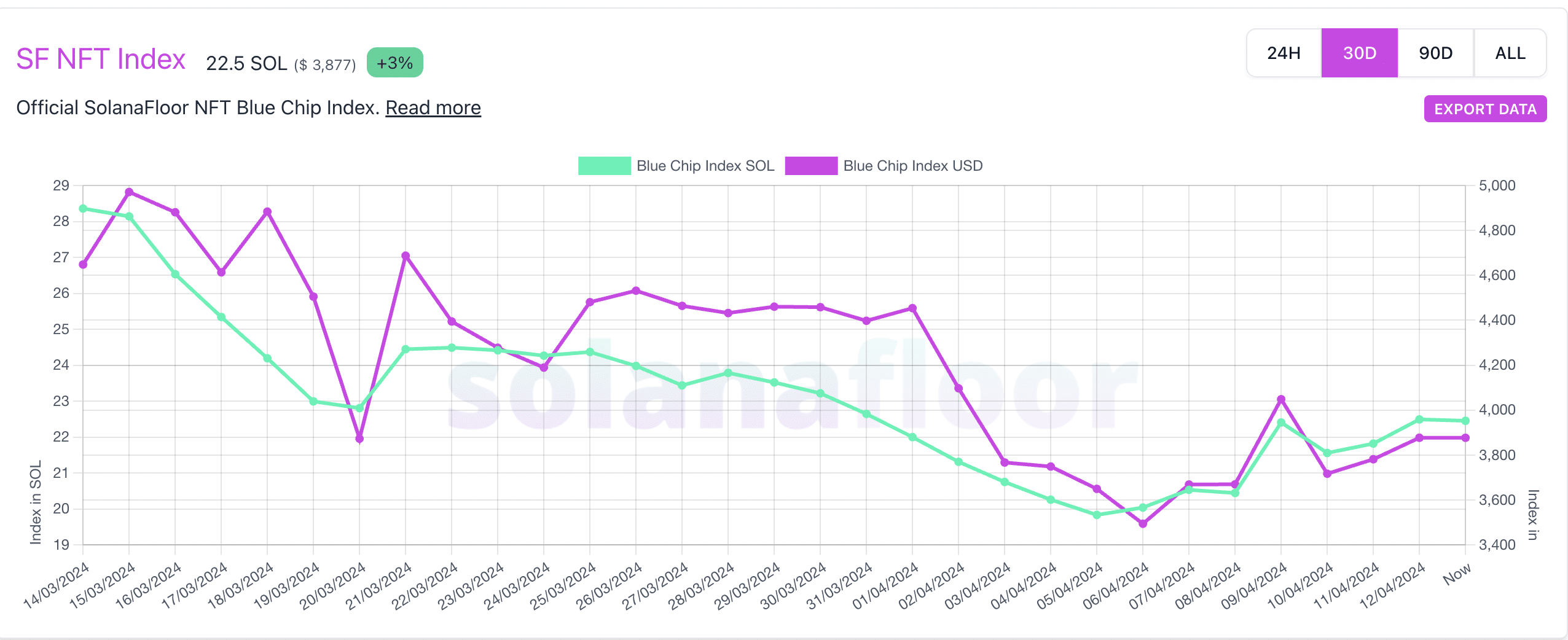

Surprisingly, the Solana NFT index declined, showing that the popular blue chip Solana NFT is not the traction of the network.

Source: Solana Floor

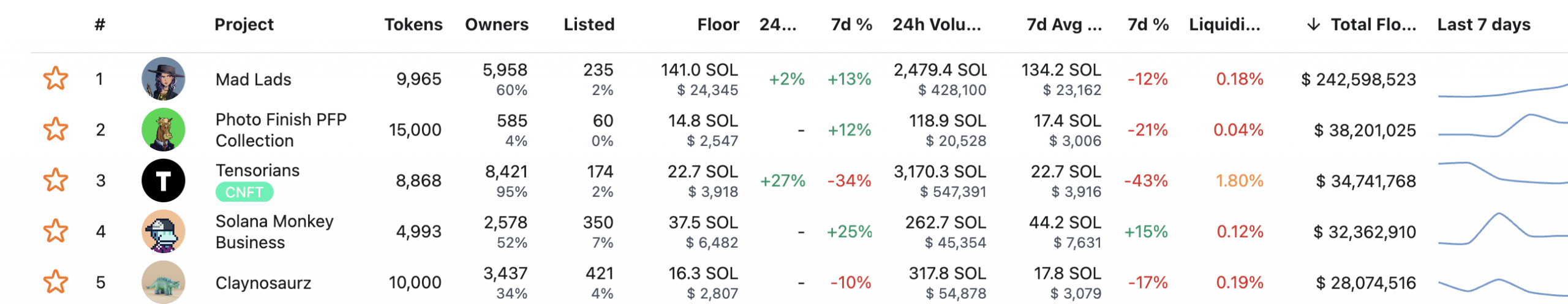

Popular NFT projects such as Mad Lads and Solana Monkey Business all noted lower minimum prices over the past week. It remains to be seen whether interest in these NFT collections will rise again or if other new collections will displace the existing leaders.

Source: Solana Floor

How is SOL doing?

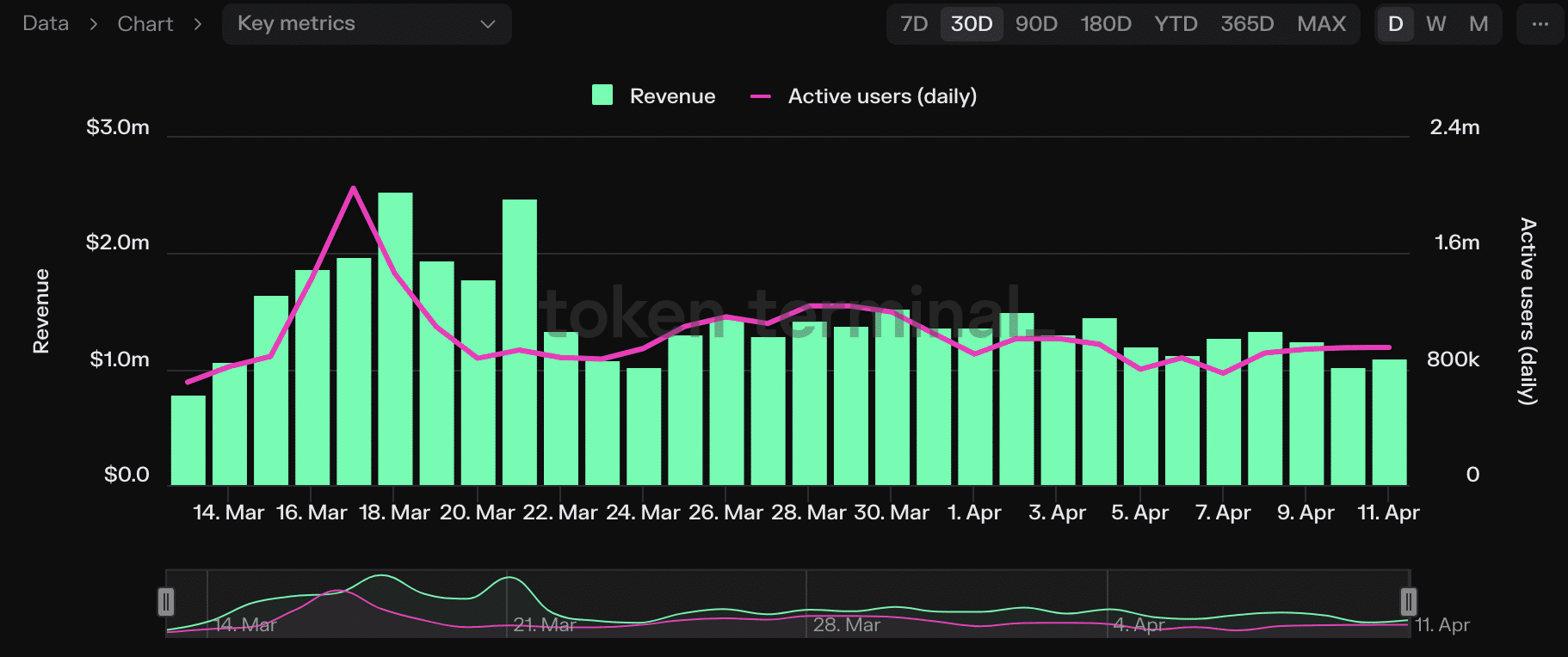

While the blue-chip collection on the Solana network is currently facing challenges, the network as a whole is on track. Analysis of Token Terminal data by AMBCrypto reveals that Solana's active user count has increased by 27.9% over the past month.

Additionally, the revenue generated by Solana also increased by a significant 391% during this period.

Source: Token Terminal

The positive performance of the Solana protocol was matched by the positive price movement of SOL. Over the past month, SOL's price has increased by 12.16%. However, after March 15th, SOL began to move sideways due to a significant price increase. During this period, it traded between $210 and $161.

Realistic or not, the SOL market cap in BTC terms is:

However, at the time of writing, SOL had fallen to $154 on the price chart. Not because of any project-specific updates or anything, but because Bitcoin crashed by 5%, taking the rest of the market with it. In fact, thanks to the market-wide correction, SOL has lost more than 10% of its value. Indicators such as Chaikin Money Flow also highlighted the arrival of bearishness.